Our investigations

At Which?, our experts dig deep into complex issues using rigorous testing, large-scale surveys and undercover research to reveal where consumers are being put at risk, misled or left out of pocket.

When we unearth serious problems, we don’t just report them. We challenge companies, expose failures and push for changes that better protect people from harm, confusion and unfair treatment.

On this page, we highlight some of our recent investigations uncovering where consumers are being put at risk or treated unfairly. You can also watch our video below to learn more:

Tackling the biggest issues affecting consumers today

We’ve been challenging manufacturers’ claims for decades. In the very first edition of Which? magazine, published in 1957, our experts were already testing everyday products to uncover hidden problems. Early investigations examined electric kettles for safety, sunglasses for how effectively they reduced glare and aspirin for quality, setting the foundations for the independent, evidence-based work we still do today.

Our extensive research and investigations continue to expose problems across products and services people rely on, from dangerous goods and misleading pricing to poor customer service and weak regulation. We highlight where urgent action is needed to hold businesses to account and to put the power back in the hands of consumers.

Over the years, we’ve uncovered counterfeit cosmetics on online marketplaces, dangerous baby sleeping bags, illegal and potentially unsafe ‘energy-saving’ plugs, plus misleading sales claims by major hotel chains. We’ve also exposed the scale of the fake review industry, inconsistent and misleading origin labelling on supermarket food, and filmed car hire firms using pressure tactics to rip off customers, showing how consumers can be misled or exploited when choosing products and services.

Here are some of the recent ways we've held companies to account on behalf of consumers:

Balloons sold on AliExpress, Debenhams and eBay

At a glance: Which? testing found illegal levels of carcinogenic chemicals in balloons sold on major online marketplaces.

In the past 10 years, more than 100 balloon brands have been recalled or flagged in official product safety alerts.

Despite a decade of warnings, Which? found that AliExpress, Debenhams, eBay, The Range (Wilko) and Shein have been allowing the sale of carcinogenic balloons on their platforms.

Which? bought 21 packs of latex balloons from seven online marketplaces and put them through British Standard tests to find out about the levels of carcinogenic chemicals they contained.

In total, eight of the 21 balloons contained concentrations of potentially carcinogenic chemicals far above the UK’s permitted limit – meaning that they were being sold illegally. One balloon from AliExpress contained more than six times the legally permitted level of nitrosamines (chemicals that are probable carcinogens).

Read more: dangerous balloons found for sale on online marketplaces.

Planning for your 'digital death'

At a glance: Our research shows most people are unprepared for what happens to their digital lives after death, leaving families struggling to access online accounts.

Independent Which? research found that most people have no plan for what happens to their photos, emails and online accounts when they die, leaving loved ones locked out of important and sentimental digital assets.

In a 2024 survey of Which? members, just 18% had recorded how someone could access their accounts, and only 3% had included any digital provisions in their will.

Around 6% of members said that they had tried to access a loved one’s digital assets in the previous three years, most commonly email, photos and Facebook accounts. Many reported problems such as blocked access, complex processes and unhelpful customer service.

Our experts have investigated how major tech companies handle data after death, exposing how confusing, inconsistent and restrictive many platform policies are for grieving families. We’ve also set out clear guidance on how people can plan ahead and called for clearer rules and better support to help loved ones access important digital memories.

Read more: what happens to your data when you die?

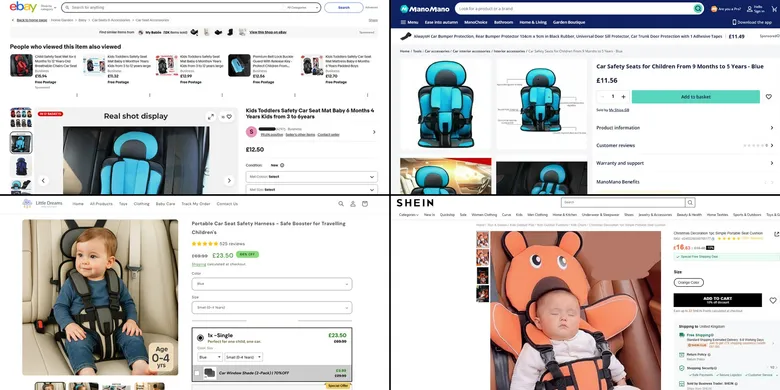

The return of the 'killer car seats'

At a glance: Our experts uncovered dangerous fabric car seats being sold online, raising serious concerns about child safety and weak enforcement.

Our experts first exposed the sale of flimsy fabric children’s car seats in 2014. Although these products were taken down at the time, towards the end of 2025, we found more than a dozen new examples being sold across several well-known online marketplaces.

Not only that, but one of these car seats was spotted at a car seat checking and fitting event. This is particularly concerning, as it shows that parents are buying and using these products in their vehicles, believing them to be safe.

Without tougher secondary regulations, we believe online marketplaces will continue to put lives at risk by failing to prevent the sale of unsafe and illegal products.

Read more: return of 'killer car seats' – fabric seats spotted at checking event.

Music tickets are sold at inflated prices

At a glance: Our pricing investigation found fans being charged vastly inflated prices for event tickets on unauthorised resale sites.

Our investigation found tickets for popular music and sports events being listed on unauthorised resale sites, including StubHub International and Viagogo, at hugely inflated prices, even when tickets were still available at face value from official sellers.

We saw tickets for some events being advertised for up to eight times their original price. In one case, tickets for a gig costing around £60 face value were listed for as much as £480 on a resale site, despite official tickets still being on sale.

Following our investigation, Which? is calling for a cap on resale ticket prices and tougher enforcement to stop fans being ripped off and ensure tickets are sold fairly and transparently.

Read more: tickets for popular music and sports events listed for inflated prices on Stubhub and Viagogo.

Home insurance policies are missing vital cover

At a glance: Our in-depth research covering home insurance policies shows most lack standard accidental damage cover.

Which? research found that most home insurance policies don't include accidental damage cover as standard, despite many consumers assuming they're protected. Our analysis of 78 policies from 35 providers showed that only 28% of buildings insurance policies and 27% of contents policies include accidental damage cover automatically.

This gap between cover and consumer expectations risks leaving households facing costly repairs. In a nationally representative survey, nearly three in 10 people believed their insurance would cover anything that wasn’t their fault, while accidental damage accounted for almost one in five recent home insurance claims.

At Which?, we've raised serious concerns about poor transparency and confusing sales practices in the insurance market. We have called for stronger action to ensure insurers clearly explain what is and isn’t covered, and have used our statutory powers to push for a fundamental reset in how insurance companies treat their customers.

Read more: three quarters of home insurance policies don't cover accidents in the home as standard.

A Which? subscription unlocks access to all our product tests, reviews and recommendations online, plus a host of other perks. You can join Which? today.