The latest scam alerts from Which?

Find out about the latest scams trending this month. Come across a scam? Let us know by using our scam sharer tool.

Join almost half a million Scam Alert subscribers and get free weekly updates on the scams you need to be aware of. In just five years, Which? Scam Alerts has helped subscribers to avoid almost £5.5m in scam losses.

28 January

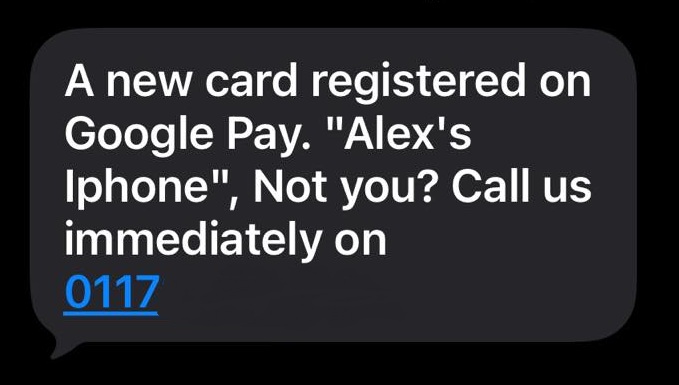

New card scam text

A text from a random mobile number tells you that someone else's card has been registered on your Google Play account.

It then gives you a number to call if you didn't do this. Calling this number will lead to a scammer asking you questions to try and gather personal and financial information.

Recipients of this scam text have also reported the text saying that a new card had been added to their Apple Pay account or Apple Wallet.

Scam texts can be reported by forwarding them to 7726.

27 January

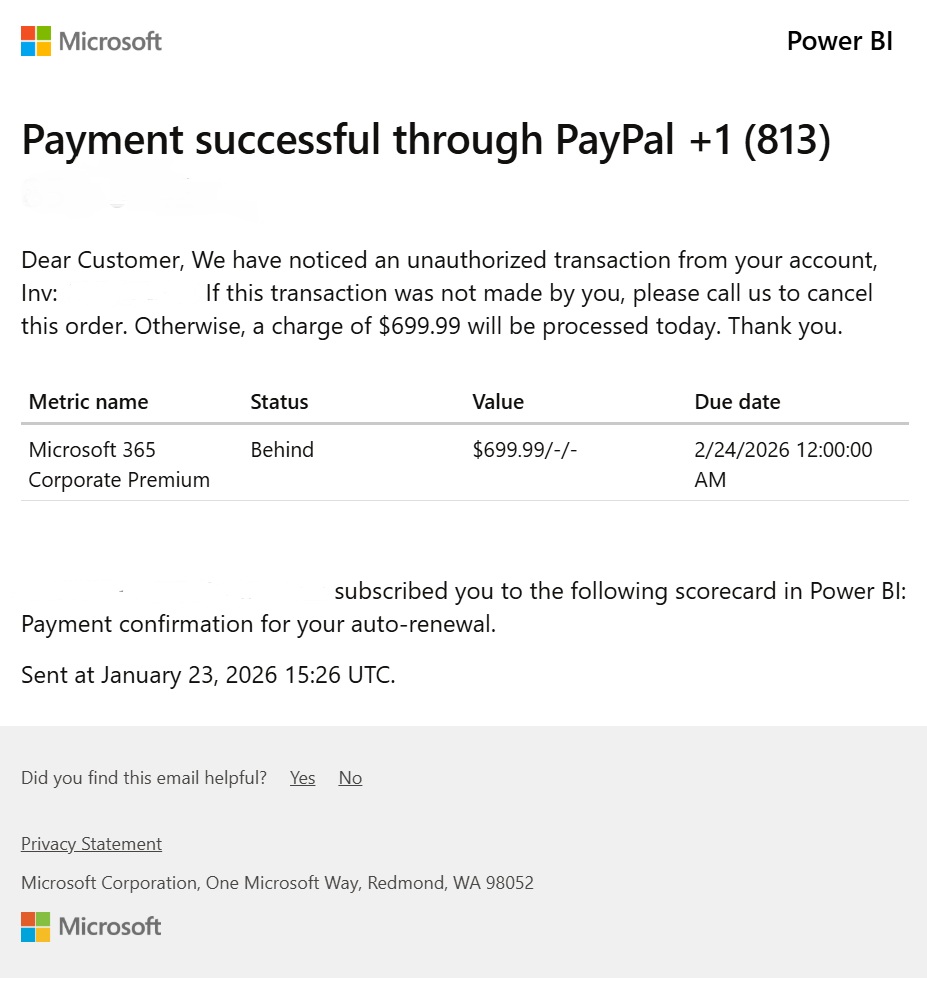

Microsoft 'Power Bi' scam

A scam email impersonating Microsoft sent from 'no-reply-powerbi@microsoft.com,' tells you that an authorised transaction has been made on your account.

It gives you an international number to call if you didn't make this.

Calling this number will put you through a fraudster who will ask you questions in an attempt to elicit your personal and financial details.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

21 January

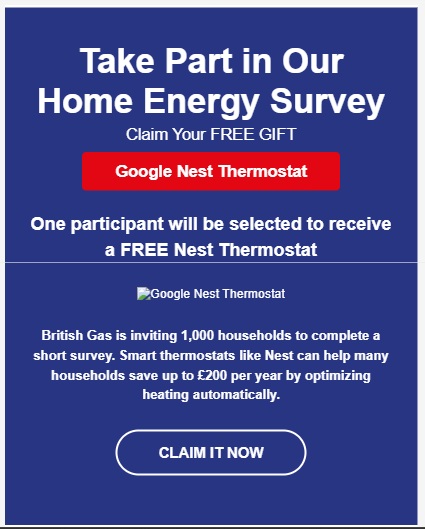

British Gas scam email

An email which claims to be from British Gas tells you that you have the opportunity to receive a Google Nest thermostat.

It goes on to say that in order to receive the thermostat, you need to follow a link to complete a short survey.

This link will lead to a dodgy site which will steal your personal data as you enter it in and use this to scam you now or in the future.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

Dodgy websites can be reported to the National Cyber Security Centre.

19 January

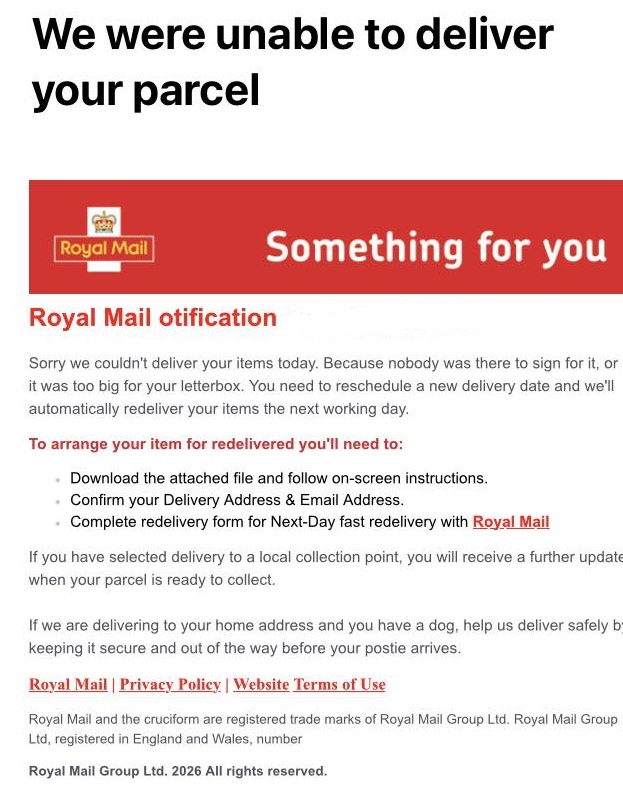

Royal Mail impersonation scam

A dodgy email claiming to be from Royal Mail tells you that you've missed a delivery.

It goes on to say that you need to reschedule the delivery by downloading an attachment on the email and 'following on-screen instructions.'

This could lead to malware being downloaded to your device, which can steal your personal information. It could also phish for your personal and financial info by asking you to fill in personal details to reschedule the delivery before stealing them.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

14 January

Royal Bank of Scotland scam email

A dodgy email claiming to be from the Royal Bank of Scotland tells you that a new direct debit has been set up on your account.

It goes on to detail where this direct debit will be sent to and how much it is.

The email also gives you a number to call if you didn't authorise this payment, which will put you straight through to a scammer who will try to get you to reveal personal information.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

12 January

EE points scam

A scam text claiming to be from mobile operator EE tells you that you have thousands of 'EE Points' which, once redeemed, offer 'exciting rewards.'

The message includes a link to redeem these points, which leads to a copycat EE website waiting to grab your personal data. The message also says that the points are about to expire in an attempt to get you to act quickly.

Which? has previously warned of these text messages, which EE confirmed were fraudulent.

Scam texts can be reported by forwarding them to 7726.

Dodgy websites can be reported to the National Cyber Security Centre.

5 January

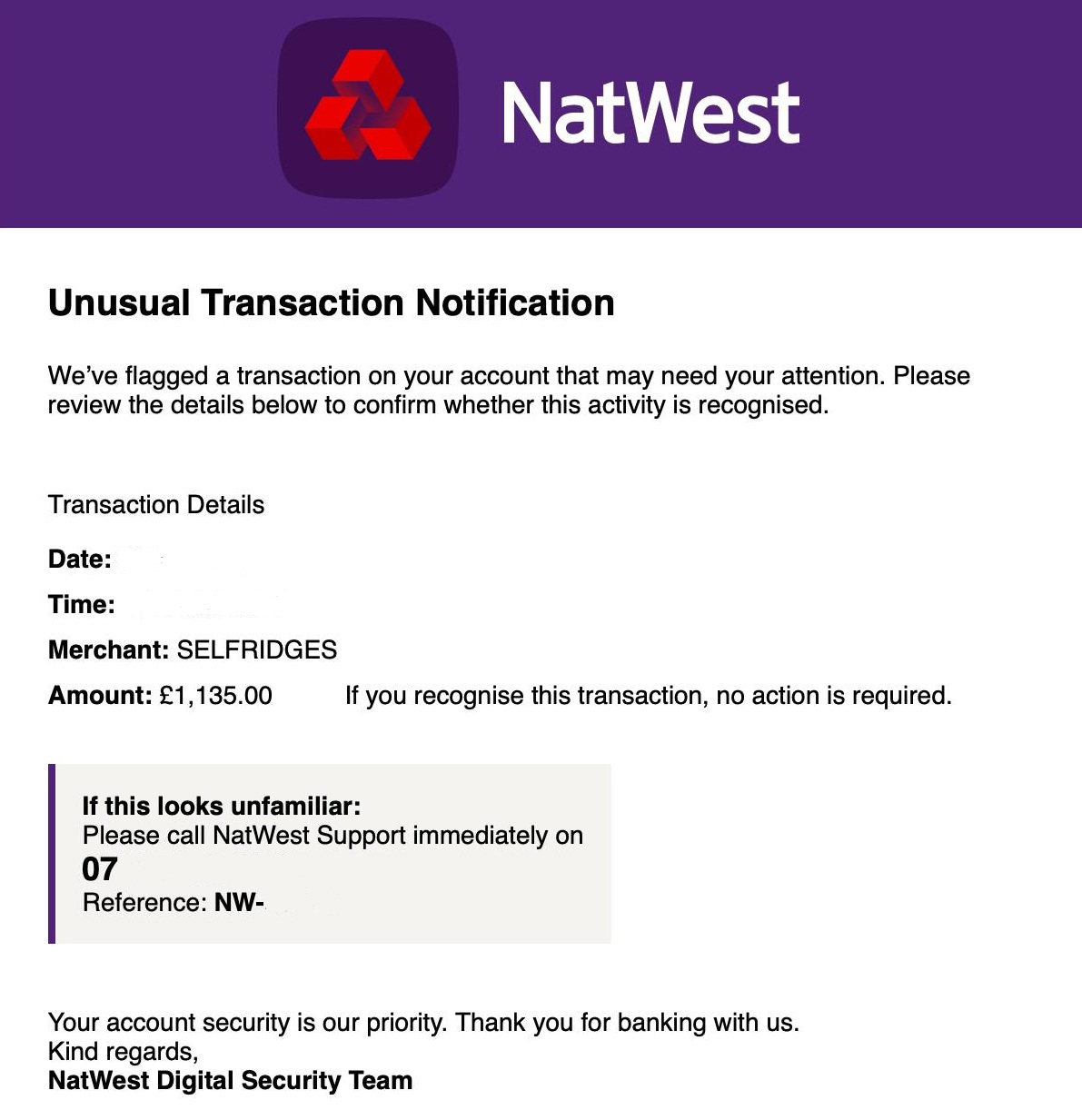

NatWest scam email

A scam email which claims to be from NatWest tells you that there's been an 'unusual transaction' on your account.

The email goes on to list the amount spent and where it was spent in order to get you to panic and act quickly.

It also provides a mobile number for you to call if the transaction is unfamiliar, which is not linked to NatWest. Calling this number will likely connect you with a scammer intent on manipulating you into revealing your personal and financial information.

You can see your recent bank transactions by logging into online banking. If there is anything you're unsure about, call your bank using the number on the back of your bank card.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

29 December

Wise impersonation email

Scam emails pretending to be from online bank Wise tell you that some features on your Wise account have been restricted and use accurate branding to appear legitimate.

The emails include a link to 'complete your account review,' claiming that you need to do this to be able to send and receive money using your Wise account.

One of the giveaways that this is a scam email is that it is sent from a random email address, containing random numbers and letters. Hovering over the links also reveals that they don't lead to the official Wise website.

If you are a Wise customer and receive this email, log in to your account by independently visiting the official Wise web address and verifying the information that way.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

Dodgy websites can be reported to the National Cyber Security Centre.

22 December

Most reported purchase scams

Purchase scams are when you buy a product online and receive nothing in return or something that isn't as described.

Lloyds Bank has revealed the top five most reported purchase scams in 2025, according to its customer data as:

- Vehicle and vehicle accessories

- Ticket scams

- Clothes and accessories

- Personal items (e.g. perfume, hair extensions)

- Driving lessons and tests

The bank also predicts that ticket scams will be big in 2026 and found that more than 70% of purchase scams happen on Meta-owned platforms.

To report scam ads or posts on Facebook or Instagram, select the three dots in the top right corner and press report.

17 December

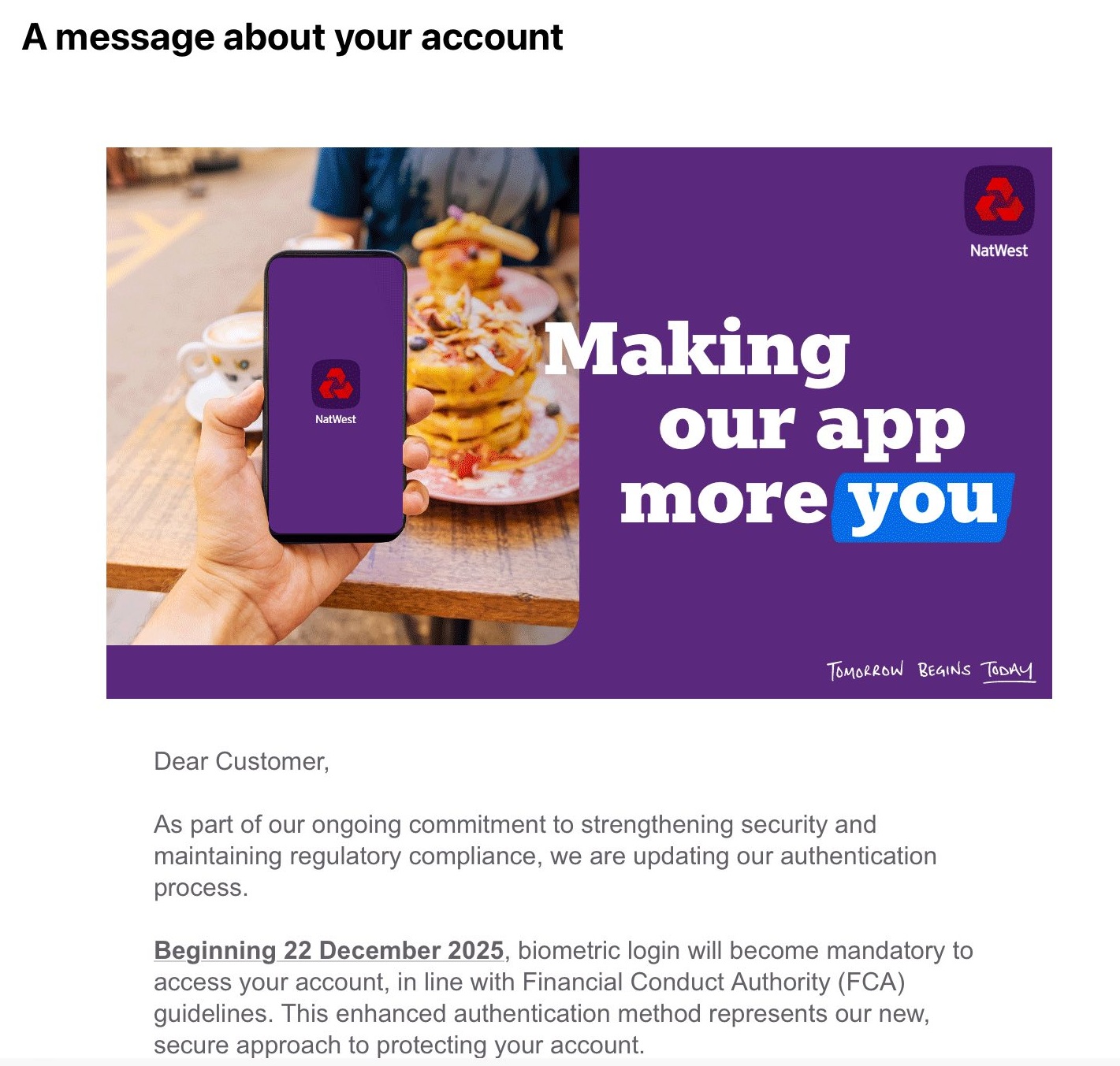

NatWest scam email

A scam email which claims to be from NatWest tells you that the Financial Conduct Authority (FCA) will be making biometric login, using a biological trait like your fingerprint, mandatory.

This isn't true. The FCA does require banks to implement Strong Customer Authentication (SCA), such as getting you to enter in a one-time passcode sent to your phone before logging into online banking on a computer, but biometric checks aren't mandatory.

Scammers have used this lie to coax you into clicking on a malicious link and parting with your personal and financial data.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

Dodgy websites can be reported to the National Cyber Security Centre.

9 December

Costa Coffee scam

Trading Standards services across the country are warning of a scam email impersonating Costa Coffee.

The email claims that you're in with the chance of winning a Yeti Rambler Tumbler, complete with a link leading to a phishing website that will steal your personal and financial information.

You can report scam emails like this by forwarding them to report@phishing.gov.uk.

Dodgy websites can be reported to the National Cyber Security Centre.

3 December

Arthritis UK scam calls

Arthritis charity Arthritis UK has warned of a wave of scam calls claiming to be from the organisation.

The calls tell you that you're eligible for help with the completion of benefits forms in return for a fee, but this isn't the case, and you never should pay to fill out benefit forms for support you're eligible for.

You can report phone scams on your mobile by forwarding the number to 7726.

On WhatsApp, find the number on your call log, select the 'i' and then 'report.'

1 December

Postcode Lottery scam email

A dodgy email impersonating the People's Postcode Lottery telling you you've won a 'scratch card advent calendar' with daily 'surprises, prizes and discounts' is circulating.

You're encouraged to follow a link to complete a survey to receive the advent calendar, which will lead to a malicious website designed to grab your personal and financial details.

The People's Postcode Lottery has also warned of this scam, stating that this email isn't from them and they would never ask you for any form of payment before claiming a prize.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

Dodgy websites can be reported to the National Cyber Security Centre.

24 November

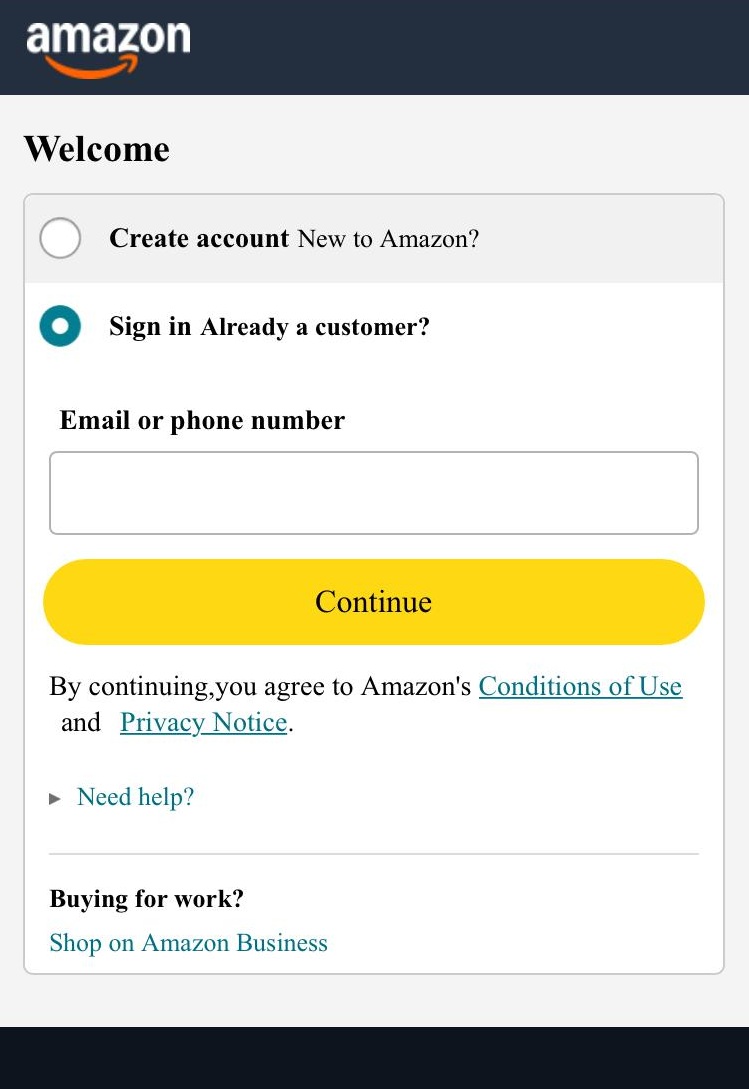

Amazon scam text

A scam text claiming to be from Amazon tells you that you've been given a full refund following an 'investigation into a seller violating Amazon's policies.'

The text is sent from a random, likely spoofed, mobile number and includes a link to a convincing copycat Amazon page which was created in March this year.

This page asks for your Amazon login information, which will hand them over to a fraudster.

Scam texts can be reported by forwarding them to 7726.

Dodgy websites can be reported to the National Cyber Security Centre.

17 November

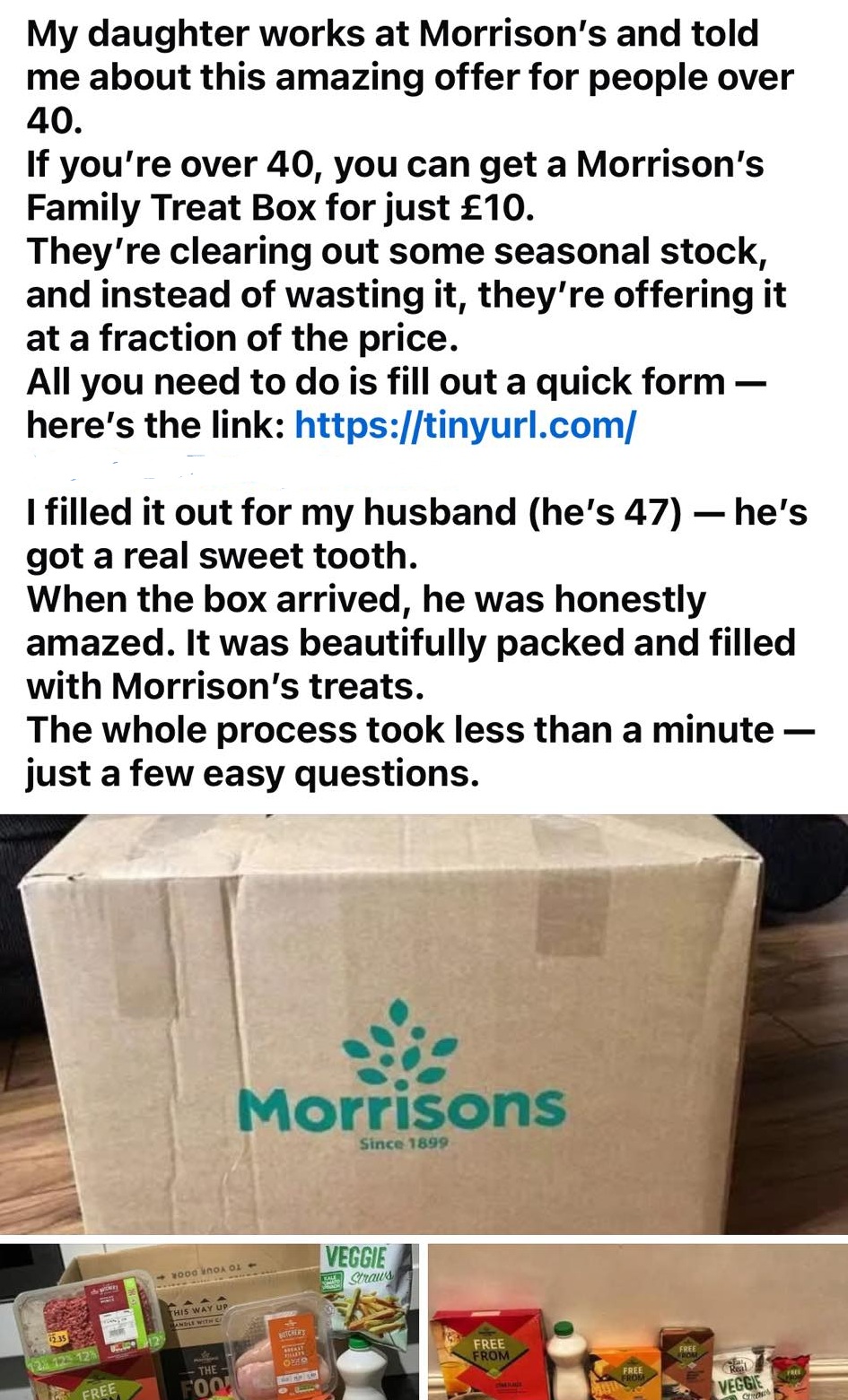

Morrisons scam ad

An advert on Facebook, claiming to be posted by a person whose daughter works at Morrisons, offers a 'family treat box' for just £10 for people over 40.

It goes on to give you a link to fill out a form in order to receive the treat box.

This will lead to a website designed to steal your personal details.

You can report scam ads on Facebook by selecting the three dots in the top right corner and pressing report.

Phishing websites can be reported to the National Cyber Security Centre.

10 November

Loft insulation scams

Dodgy unsolicited calls about loft insulation are circulating.

Recipients of such calls have claimed of being asked if they have white fluffy stuff in their loft, told that their property has been identified as having loft insulation that would cause condensation and damp and being offered free loft insulation services.

Which? has previously reported on fraudsters targeting people in spray foam loft insulation scams.

You can report phone scams on a mobile by forwarding the number to 7726.

On WhatsApp, select the 'i' next to the number, scroll down and press report.

4 November

'Goat Agency' scam text

A dodgy text message falsely claims to be from marketing company The Goat Agency and offers a 'flexible remote job providing product reviews.'

These scam texts impersonate legitimate companies to appear genuine and always offer easy task-based work with high salaries.

At first you'll see earnings for your work, before being asked to invest in more money to complete tasks where the earning potential is higher.

You'll never get any money you put into the job back and you'll never be able to retrieve your earnings.

Report scam texts like this to your mobile provider by forwarding them to 7726.

30 October

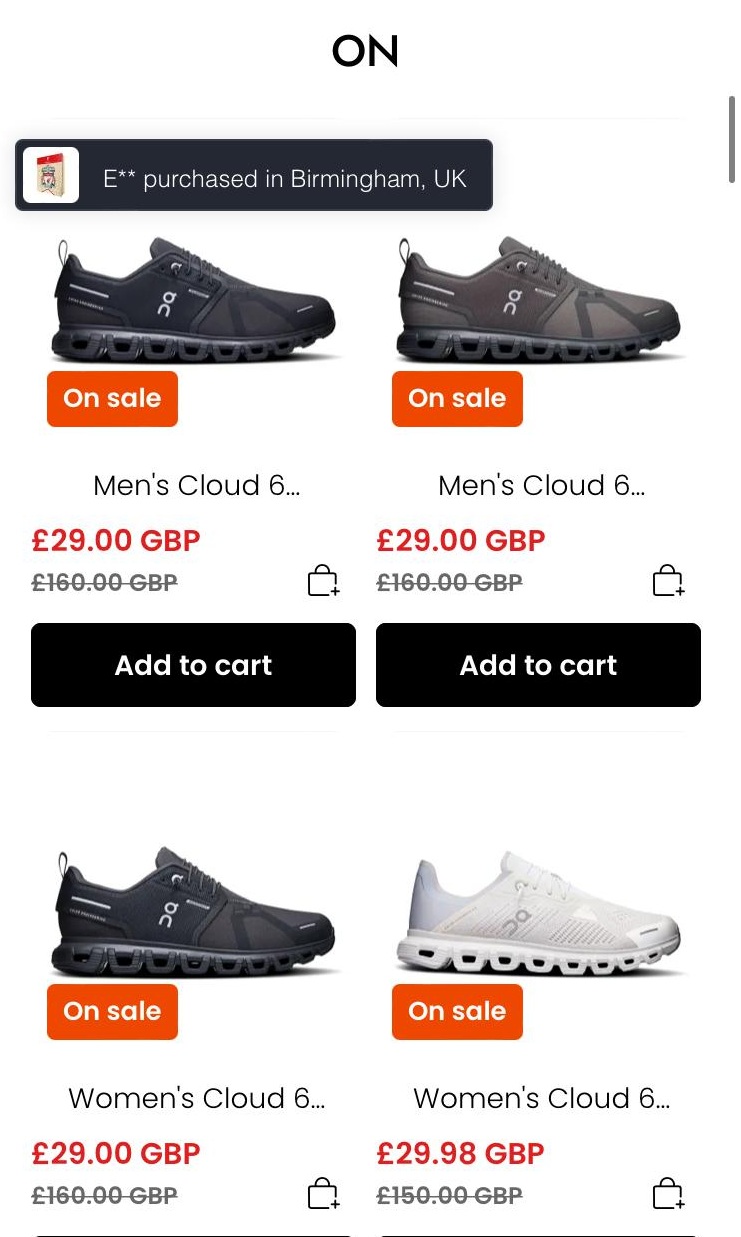

Fake Sports Direct website

A copycat website impersonating Sports Direct lists heavily discounted items to look genuine and asks for your personal and payment information to purchase products.

It uses the retailer's branding to appear legitimate. Which? also found the website was only created earlier this year.

If you enter this information you'll be handing it straight to the scammer.

If you spot a site like this, report it to the National Cyber Security Centre and contact your card provider if you've already entered payment details.

29 October

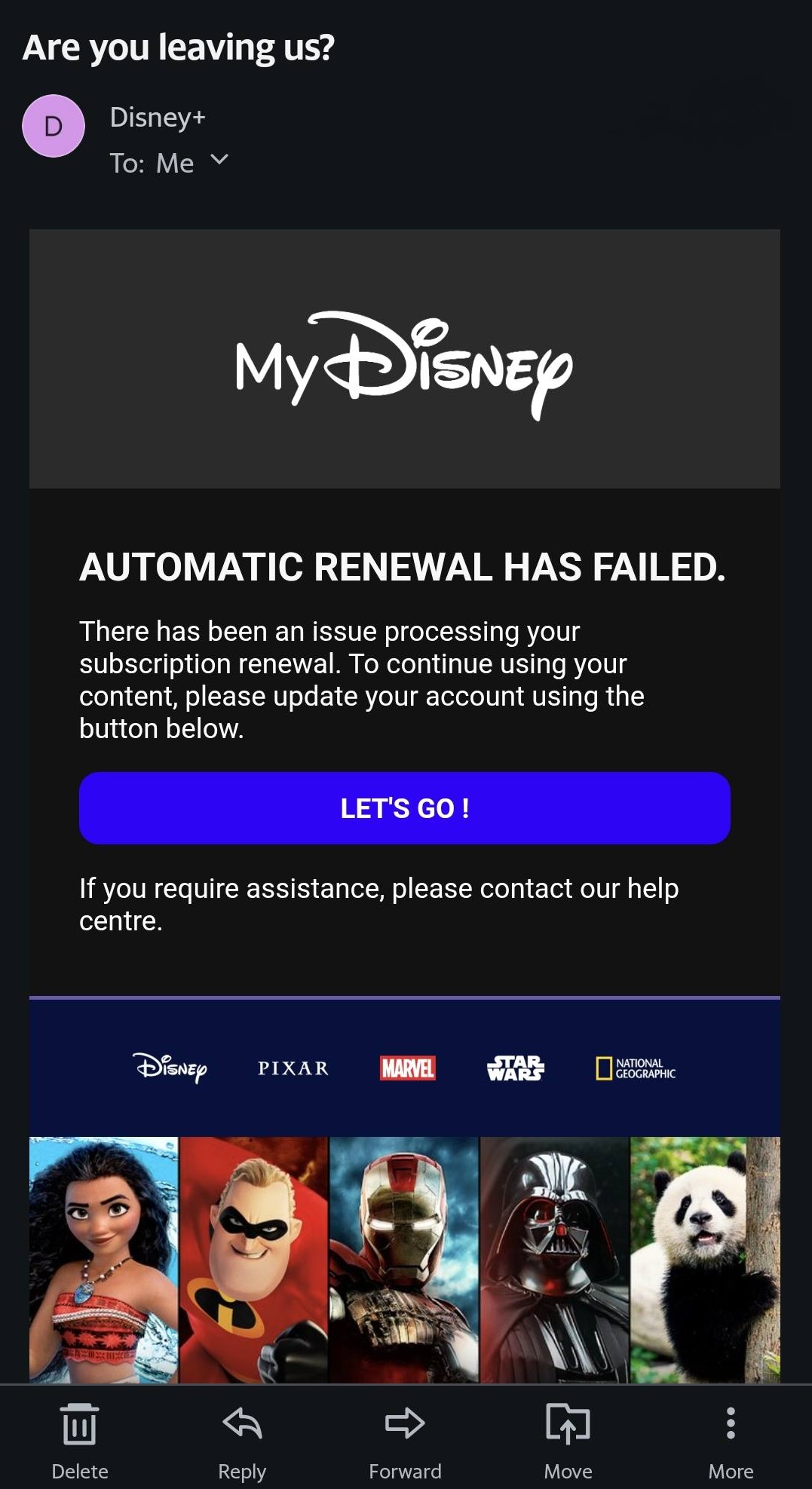

Disney scam email

A suspicious email that claims to be from Disney tells you that there's been an issue renewing your subscription to the streaming service and to follow a link to rectify this.

This link will lead to a malicious website designed to steal your personal and financial information.

Dodgy emails can be reported by forwarding them to report@phishing.gov.uk.

Phishing websites can be reported to the National Cyber Security Centre.

28 October

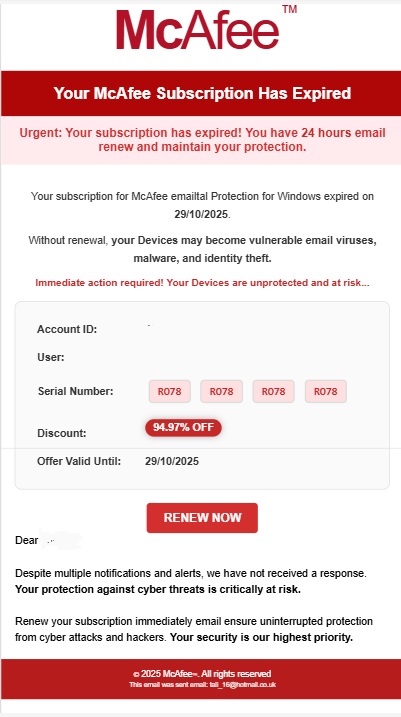

McAfee impersonation email

Scammers are continuing to impersonate security brands in phishing emails.

One of the latest versions claims to be from McAfee and tells you that your subscription has expired and you have '24 hours to maintain your protection.'

It also includes a link to 'renew now' which will lead to a dodgy site designed to get you to enter in your personal and payment information.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

Phishing websites can be reported to the National Cyber Security Centre.

21 October

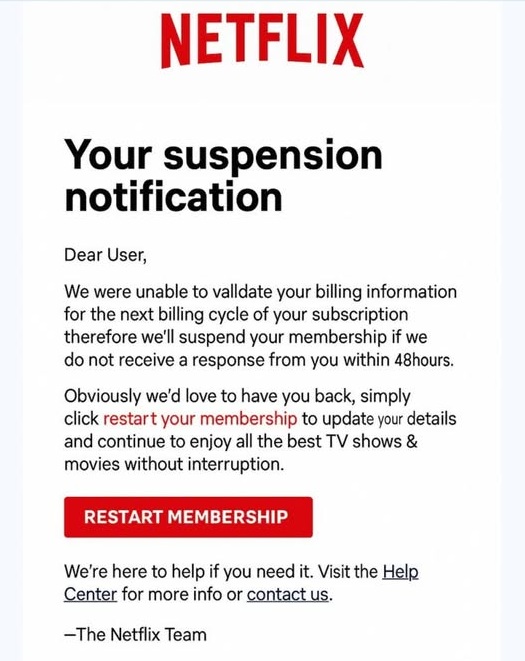

Netflix scam email

A dodgy email impersonating Netflix titled 'suspension notification' warns you that you need to update your details in order to keep using the service.

It claims that your billing infomation couldn't be 'validated' and encourages you to follow a link to do this within '48 hours'.

This link will lead to a malicious site that will steal your personal information after entering it in.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

Phishing websites can be reported to the National Cyber Security Centre.

20 October

Royal Mail scam text

Scam texts impersonating Royal Mail tell you: 'Your parcel has been temporarily held due to an unclear or invalid delivery address'.

It includes a malicious link to follow to 'verify your address.' The link will lead to a site posing as Royal Mail in order to grab your personal information after you enter it in.

Scam texts can be reported by forwarding them to 7726.

15 October

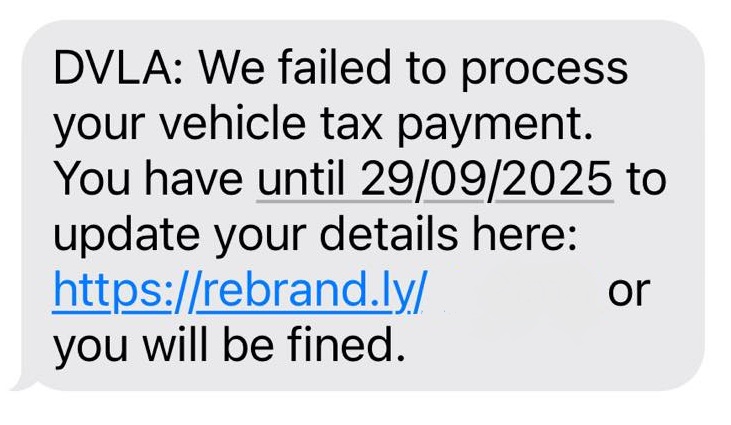

DVLA text scam

A scam text impersonating the Driver and Vehicle Licensing Agency (DVLA) tells you that it's 'failed to process your vehicle tax payment.'

It includes a link to 'update your details,' which will lead to a phishing website intent on stealing your personal information.

Scam texts can be reported by forwarding them to 7726.

13 October

WhatsApp Gold scam and Martinelli

Reports of a resurgence of the WhatsApp Gold and Martinelli scam are circulating. The scam installs malware on your phone.

It begins with a WhatsApp message promoting a sham version of the messaging service called 'WhatsApp Gold,' which has special features that can be unlocked by clicking a link.

This link will lead to malware being downloaded to your device.

Another version of this scam features a message which warns of a video called 'Martinelli' installing malware to your device if opened. However, there is no evidence that this video exists.

You can report a WhatsApp message by selecting it in your conversation and tapping ‘report’.

To report the sender on WhatsApp, open up the chat, tap on the sender's contact details and select 'block and report'.

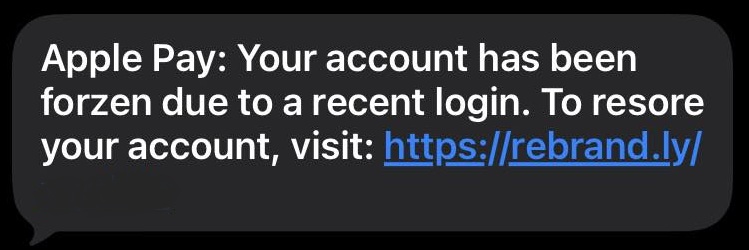

Apple impersonation text

A scam text claiming to be from Apple tells you that your Apple Pay account has been frozen and provides a link to 'restore' it.

This link will lead to a dodgy website which will attempt to steal your personal and payment information.

Scam texts can be reported by forwarding them to 7726.

7 October

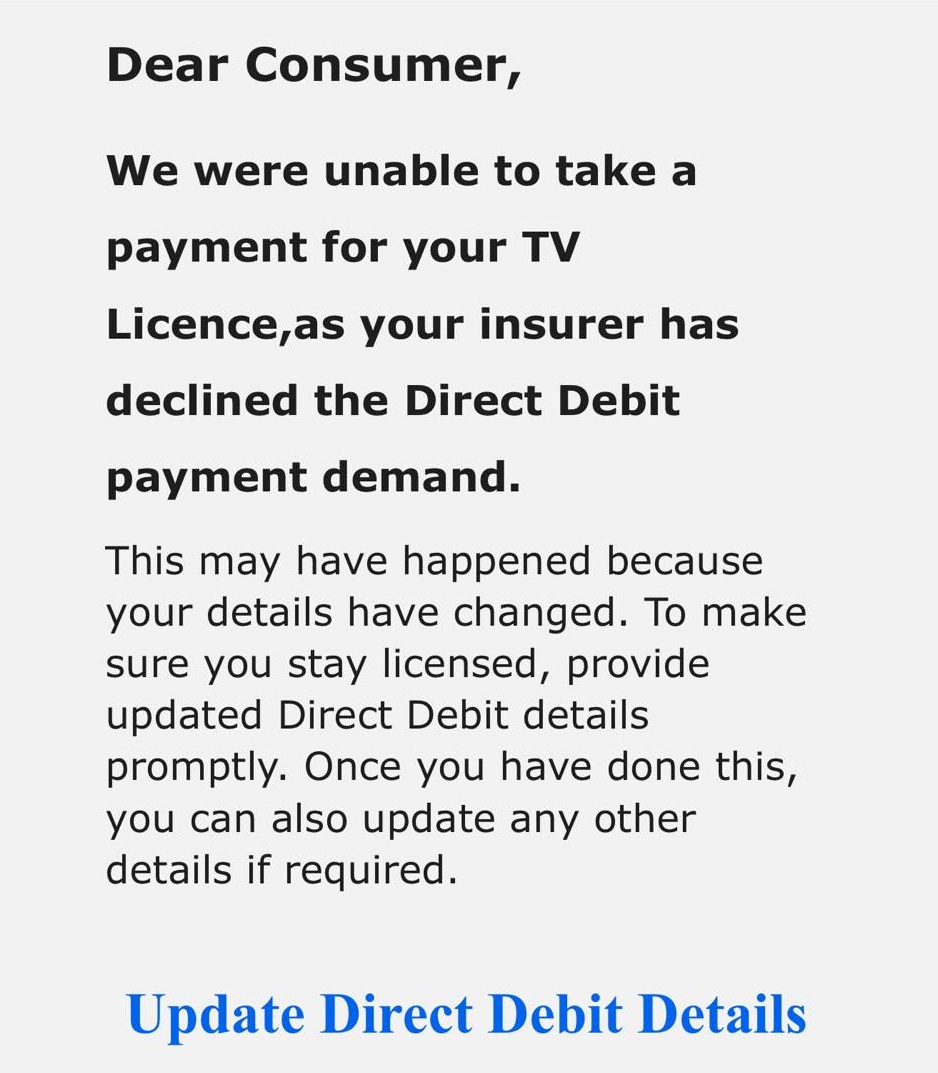

TV Licence scam email

A dodgy email claiming to be from TV Licensing tells you that your direct debit payment has been declined.

It goes on to give you a link to update this, which will most likely lead to a site impersonating TV Licensing to get you to fill in your personal details.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

Suspicious websites can be reported to the National Cyber Security Centre.

29 September

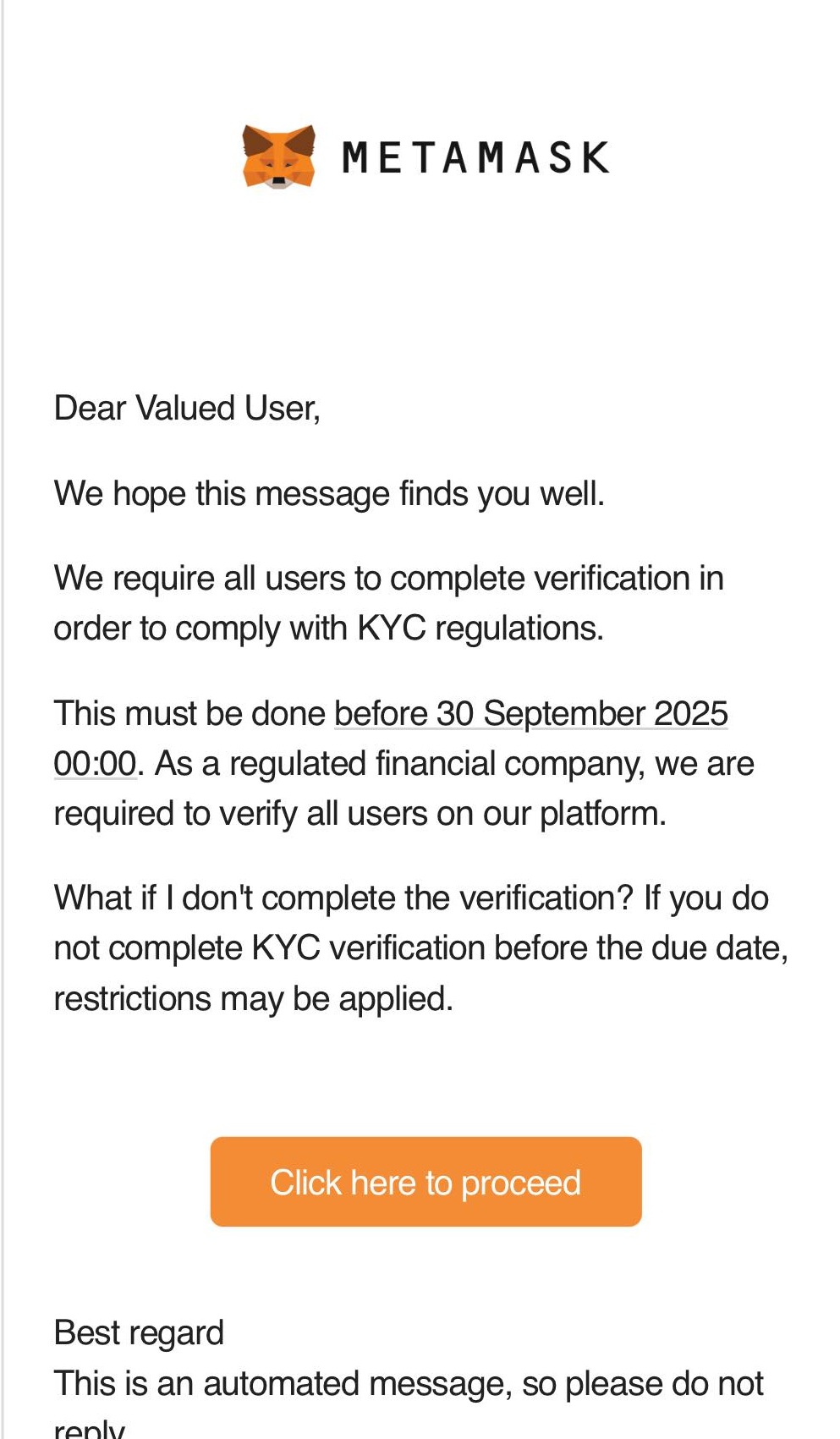

MetaMask email scam

A scam email claiming to be from cryptocurrency company MetaMask is circulating again.

The email tells you that you must complete the platform's verification process and gives you a tight deadline in which to do this as well as a link to 'proceed.'

This link will lead to a fake website impersonating MetaMask to steal your personal data.

MetaMask maintains that it will never send you unsolicited emails.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

24 September

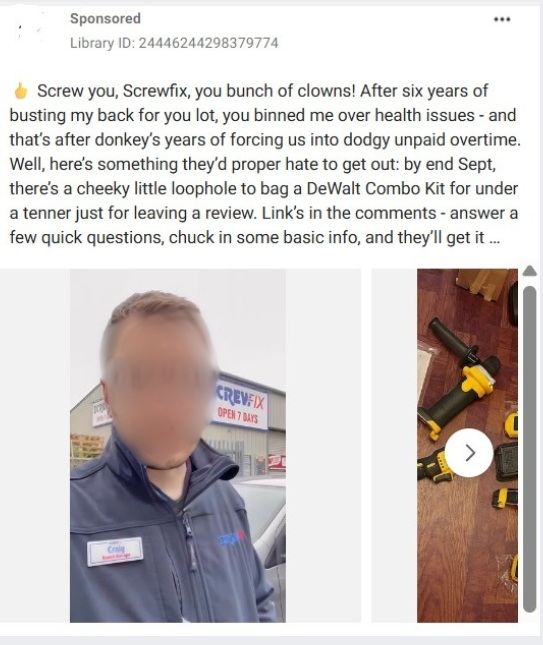

Screwfix scam ads

Adverts on Facebook and Instagram depicting the fake stories of disgruntled ex-Screwfix employees who claim to know 'a hidden way' to get a Dewalt 20V MaxPower Tool Kit are circulating.

These adverts go on to say that this is a 'limited time offer' and lead to malicious links which will ask for your personal and financial data in order to receive the item.

To report scam ads on Facebook and Instagram, select the three dots in the top right corner and press 'report.'

Suspicious websites can be reported to the National Cyber Security Centre.

22 September

ParentPay scam app

Schools are warning about an app available on Apple's App Store impersonating ParentPay, an online payment service used by schools to collect money from parents for events such as school trips and dinner money.

The app claims to offer financial advice to parents. However, reviewers of the app say that they were redirected to a website after downloading it which targeted them with a £40 a month subscription scam.

The genuine ParentPay app can't be downloaded on an app store but can be installed by visiting it's official website.

To report apps on the Apple App Store, visit Apple's 'Report a problem' website.

17 September

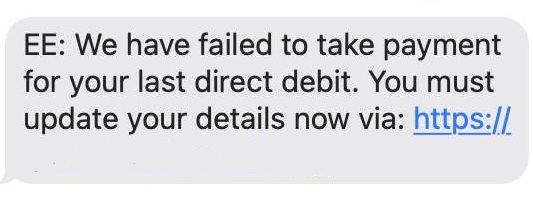

EE scam text

A dodgy text message impersonating phone network EE tells you that your last direct debit payment failed.

The message is sent from a spoofed UK mobile number and includes a malicious link which will lead to a website intent in stealing your personal and financial information.

Scam texts can be reported by forwarding them to 7726.

Suspicious websites can be reported to the National Cyber Security Centre.

15 September

Pension fraud warning

Action Fraud figures reveal that £17.4m was lost to pension scams in 2024, with an average loss of £33,848 per person.

According to reports to Action Fraud, criminals targeted people's pension pots through fraudulent investment schemes and account takeovers.

Always be suspicious of tempting investment offers and make sure you research the opportunity before you part with any money. Seek independent financial advice if you're unsure.

Protect your online pension account by choosing strong and unique passwords and enable two-factor authentication where possible.

If you have lost money to a pension scam or you believe your account details have been compromised, contact your provider immediately. Report the scam to Action Fraud or call the police on 101 if you’re in Scotland.

3 September

Coinbase scam call

Reports of scam calls impersonating cryptocurrency platform Coinbase are circulating.

Recipients describe being cold called from a random number and told their 'Coinbase API key' has been used by someone else.

An API key is what allows you access your Coinbase account.

Typically, these phone scams attempt to keep you on the phone and get you to reveal your personal data so that they fraudster on the other end can access your account.

Scam calls can be reported by texting the word ‘call’ followed by the phone number to 7726 on an iPhone or texting the word ‘call’ to 7726 on an Android. Then, you’ll receive a message asking you for the scam number.

On WhatsApp, open the WhatsApp chat with the scam phone number and tap 'block.' You can report the contact by tapping 'report contact' and 'block'.

1 September

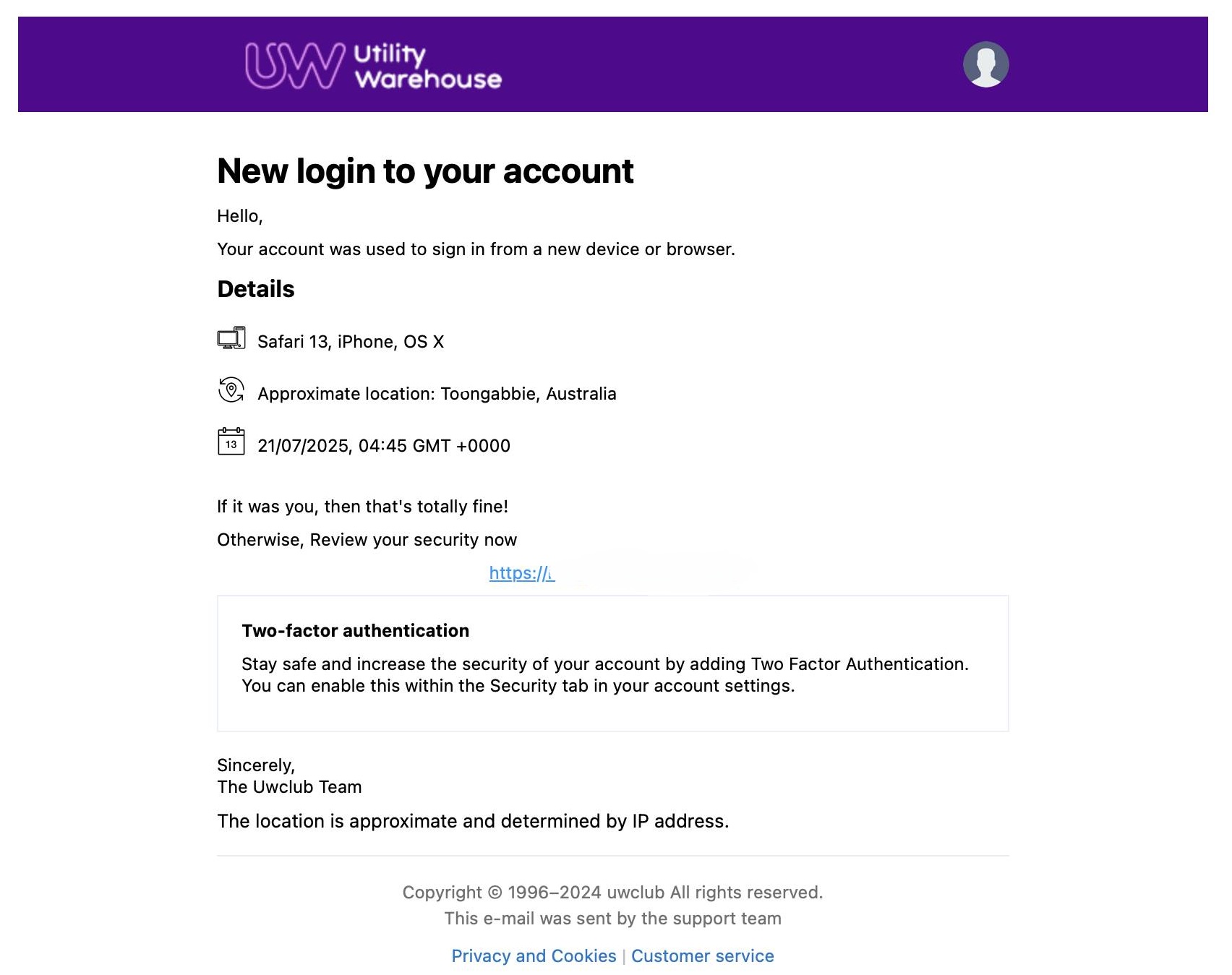

Utility Warehouse impersonation email

A dodgy and convincing email claiming to be from service provider Utility Warehouse tells you that someone logged into your account from a new device or browser.

It goes on to provide a link to 'review your security' which most likely leads to a malicious site intent on stealing your personal information.

The main scam giveaway is that the email is sent from a random Gmail email address.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

Suspicious websites can be reported to the National Cyber Security Centre.

27 August

Financial Conduct Authority scams

Scammers are impersonating the Financial Conduct Authority (FCA), with almost 5,000 reports made to the regulator in the first six months of 2025.

The regulator has warned that it will never ask for money or for sensitive banking information, such as PINS and passwords.

26 August

Scam text messages

Almost 7 in 10 consumers have received a scam text message, according to a survey carried out by the insights company TransUnion.

Always be wary of messages that come out of the blue and especially if they're from an uknown number. If the message asks for information or for an urgent payment then you should treat it with caution. Never follow a link from a message as it could infected with malware.

Read more on how to spot a scam text message.

20 August

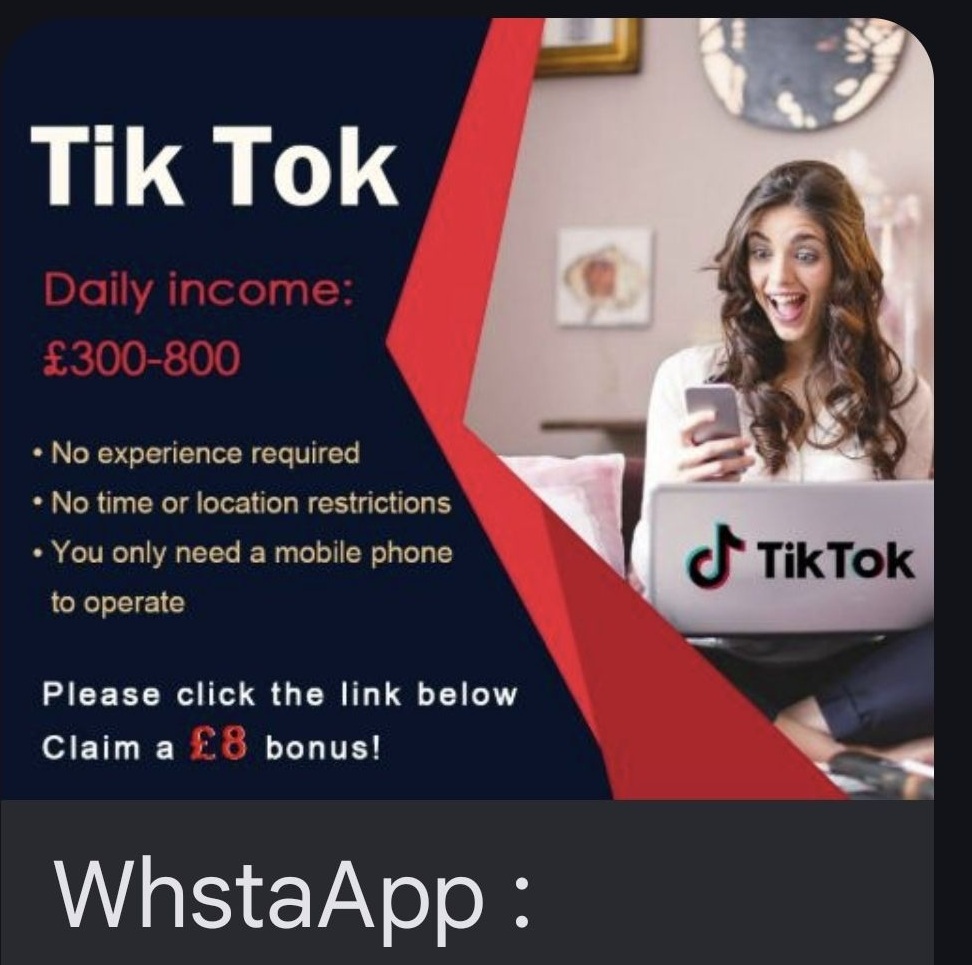

WhatsApp job scam

A job scam being promoted on WhatsApp claims to offer a remote position at TikTok with a 'daily income' of £300 to £800.

The scam message is sent via a spoofed mobile number and provides a link to a WhatsApp chat to 'claim a £8 bonus,' which will lead to having a conversation with a scammer via WhatsApp.

Bogus work opportunities like this typically lead to task scams which claim to offer money for completing simple tasks such as completing surveys or reviewing films. However, you'll eventually be asked to invest money to complete more tasks and never be able to withdraw your 'returns.'

You can report numbers on WhatsApp by opening up the WhatsApp chat with the dodgy phone number and tap 'block.' You can report the contact by tapping 'report contact' and 'block'.

Scam text messages can be reported by forwarding them to 7726.

18 August

Social media ads impersonating Michael Mosley

The Times has reported that deepfake videos of health experts making false medical claims are circulating on social media.

Fake videos featuring former presenter Michael Mosley, doctor Tim Spector, the founder of health brand Zoe, physician Gabor Mate and alternative medicine advocate Deepak Chopra are making unsubstantiated health claims.

Fraudsters typically create videos like these to sell dodgy products which either don't work, are dangerous or don't exist.

The Times found that over 1.5 million people followed the social media accounts it uncovered in its investigation, with each account having posted hundreds of AI-generated videos.

Scam posts and adverts on social media can be reported to the platform by selecting the three dots in the top right corner and pressing 'report.'

13 August

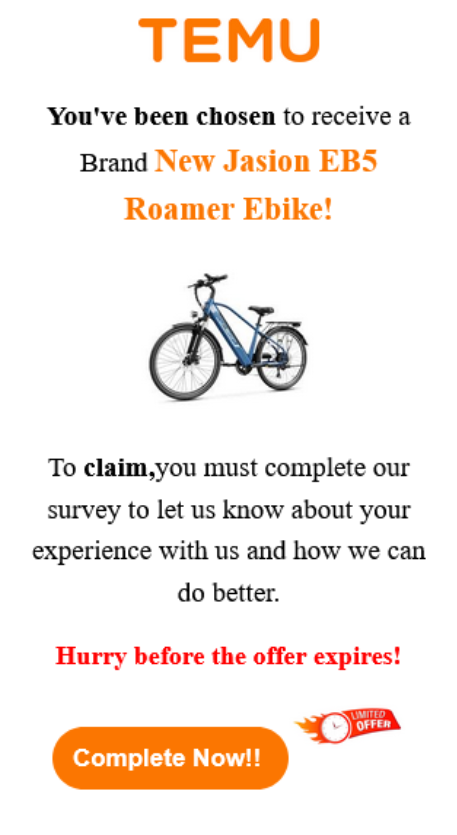

Temu impersonation email

A scam email claiming to be from online retailer Temu tells you that you have the opportunity to receive an e-bike in exchange for answering a few questions about your shopping experience with the brand.

The email includes a link to answer these questions which will lead to a malicious website set up to grab your personal and financial data.

Scam emails can be reported by forwarding them to report@phishing.gov.uk.

Suspicious websites can be reported to the National Cyber Security Centre.

12 August

Beware of car finance scam calls

The Financial Conduct Authority (FCA) is warning of scammers posing as car finance lenders over the phone.

The warning comes after reports of the scam detail that callers are claiming to offer compensation in exchange for personal details including your name, address, date of birth and bank information.

Scammers are attempting to capitialise on the FCA's recent announcement about potential plans for a car finance compensation scheme. However, no such scheme is currently in place and car finance lenders are not yet contacting customers about compensation.

Suspicious calls received on an iPhone can be reported to your provider by texting the word ‘call’ followed by the phone number to 7726.

On an Android phone, text the word ‘call’ to 7726. You’ll then receive a message asking you for the scam number.

For scam calls received on WhatsApp, open the WhatsApp chat with the dodgy phone number and tap 'block.'

You can report the contact by tapping 'report contact' and 'block'.

11 August

'Winter Fuel Payment' scams

Action Fraud has revealed that since January 2025 it has received 571 reports relating to Winter Fuel Payment scams, with total victim losses reaching over £14,000.

These scams typically involve being sent a dodgy text from a spoofed number and told that you're eligible for money to help towards bills during the colder weather.

To receive this, you're encouraged to follow a dodgy link which leads to a copycat government website. It's here where you're asked to reveal your personal and financial information.

Winter Fuel Payment is available to some people born before 23 September 1958. If you think you could be eligible, check gov.uk website for further details.

You can report scam text messages by forwarding them to 7726.

Scam sites can be reported to the National Cyber Security Centre.

6 August

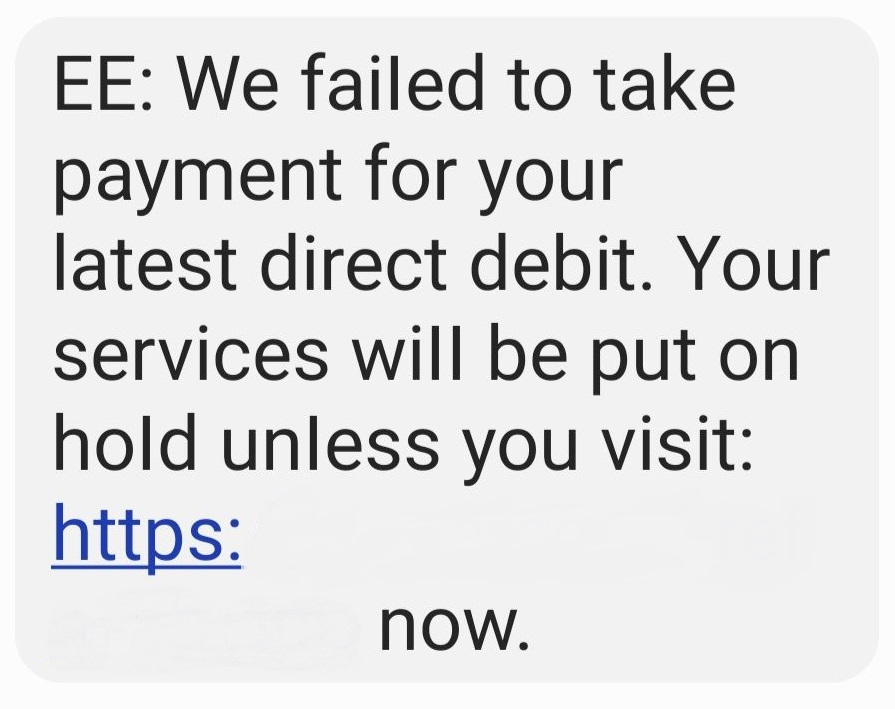

EE impersonation scam

A scam text impersonating EE send from a spoofed number tells you that your latest direct debit to the network didn't go through.

It goes on to give you a phishing link to follow to avoid your services being put on hold.

This will lead to a malicious website which will ask for your personal and financial information.

You can report suspicious texts by forwarding the message to 7726.

Phishing websites can be reported to the National Cyber Security Centre.

4 August

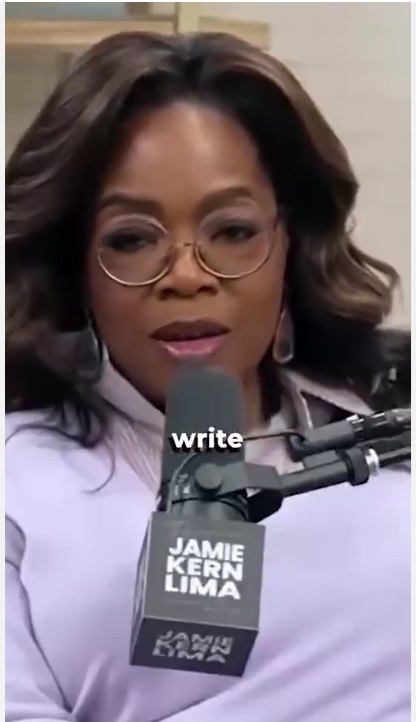

'Pink Salt diet' scam ads

A series of dodgy adverts posted onto Facebook and Instagram are promoting the 'pink salt diet.'

The diet claims to help you lose weight quickly, particularly in the stomach area, but this claim hasn't been scientifically proven.

One advert Which? came across used a deepfake video of Oprah Winfrey promoting the diet and another one led to a website which claimed to offer various tools to complement the diet such as recipes.

Dodgy ads can be reported by selecting the three dots in the top right corner of the advert and click 'report.'

Suspicious websites can be reported to the National Cyber Security Centre.