Compare home insurance deals

Check Which? insurance ratings and compare deals using the service provided by Confused.com

Get a quoteBy clicking a retailer link you consent to third-party cookies that track your onward journey. This enables W? to receive an affiliate commission if you make a purchase, which supports our mission to be the UK's consumer champion.

Rats and mice are common household pests, but motorists should beware too – car insurance claims for rodent damage jumped by nearly a third in 2024.

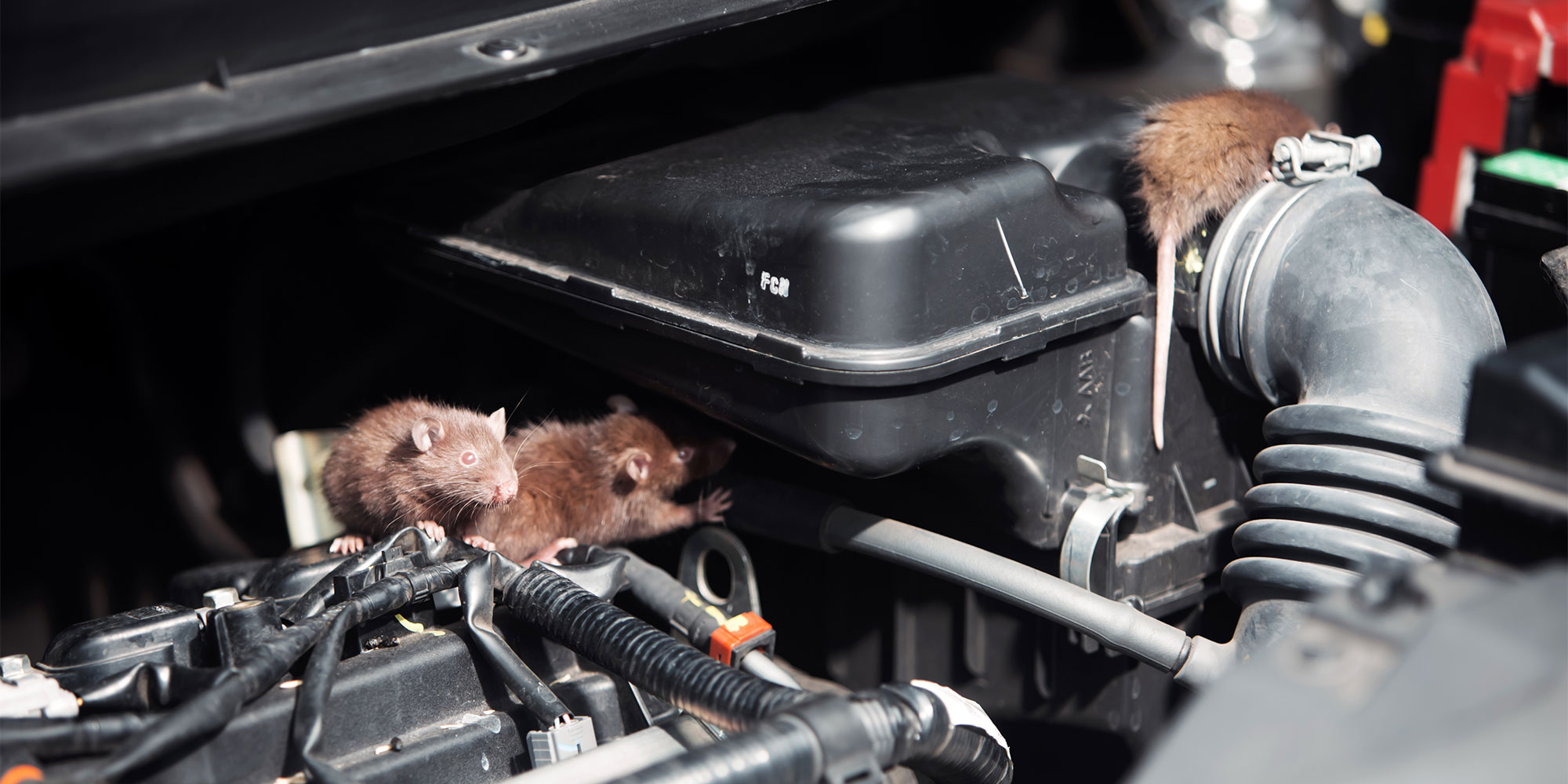

Once inside a vehicle, these vermin can chew through wires, gnaw on upholstery and nest in engines. Aviva's research found repairs can set you back thousands of pounds and even lead to your car being written off.

As the nights draw in and temperatures drop, rodents are more likely to seek shelter in a cosy car or warm home. So what protection does your insurance policy offer and what can you do to avoid a 'rat-astrophe' this winter?

Check Which? insurance ratings and compare deals using the service provided by Confused.com

Get a quoteAviva said it recorded a 28% annual increase in motor claims for rodent damage in 2024 and is urging drivers to take precautions to protect their cars from rats and mice in the colder months – a time of year when claims tend to increase as animals look for shelter.

The average claim in 2024 was for £2,494, according to Aviva’s data, but in one case seen by the insurer the cost was more than £24,000, resulting in the vehicle having to be written off following damage to its interior and exterior.

Average claim costs for rodent-related damage increased by around 11% annually last year, with the average claim in 2023 put at £2,253.

Rodents can squeeze through the tightest of gaps in your car, including the grilles, vents or open windows, and can wreak havoc once inside.

Aviva says types of damage commonly cited by its customers include nests in engine compartments and behind passenger airbags. Chewed wiring and cabling are also typical, leading to damage across dashboard sensors, batteries, suspension systems and gear mechanisms.

The insurer found other claims in 2024 were for gnawed seats, seatbelts, footwells and carpets. Drivers also reported fuel and water leaks caused by rodents biting into tanks and piping systems.

It's not just mice and rats that can cause a problem. Breakdown cover provider the RAC has been called out to assist with damage caused by squirrels.

RAC patroller Nick Isaac, who works around the south west of England, said: 'The car had lost power and had an odd smell. When I lifted the bonnet and revved the engine, the air filter moved like it was being sucked towards the engine.

'It turned out a squirrel had been taking nuts from a bird feeder and storing them in the air box, restricting air flow to the car.'

The good news is that most comprehensive car insurance policies will pay out for rodent damage, but cover can vary so it's important to check the policy wording.

Aviva suggests drivers take these measures to protect their car from rodent damage:

Find out more: what's happening to car insurance premiums?

Warning signs of rodents include droppings and scuttling noises in ceilings or walls. Beyond being a health risk, they can cause serious damage.

Mice and rats may chew through wood, plastic pipes and electrical cables, leading to leaks, floods, power cuts or even fires. However, home insurance customers are often left to pay for repairs themselves.

Rodent infestations are usually covered under home emergency policies, but most standard home insurance products don’t include this.

Which? analysed 77 policies offered by 35 providers and found only 19% include home emergency cover as standard – all of which cover ‘removal or treatment of vermin and pests’. Of the remaining 81% that offer it as an optional extra, 97% include pest cover.

Callout limits typically range from £500 to £2,000, covering labour, callout fees and materials to fix the issue. But these policies rarely cover damage, proofing or repeat visits if you don’t follow advice.

Even without home emergency cover, buildings insurance should protect you against resulting damage. For example, while chewed wires may not be covered, if a fire breaks out as a result, the insurer should cover the wider loss.

One thing to consider when making any claim, however, is the excess on your policy. This is the amount you'll have to pay upfront if you make a claim on your insurance.

If the cost of repairing the damage is less than or the same as this amount, then you might feel it's not worth making a claim.

Filing a claim may also impact your no-claims bonus. This is a percentage discount on your insurance premium to reward you for not having made a car insurance claim in the previous year. If you make a claim, however, you could lose your discount and your premium could rise.