Payments: The consumer desire for control

Executive summary

We currently stand at a critical juncture in the development of UK payments. The way we pay is rapidly changing due to the pace of technological change. At the same time, our payments infrastructure is ageing and is long overdue an upgrade to allow the UK to remain at the forefront of payments innovation. As decisions are made about the future of the UK’s retail payments infrastructure, it’s imperative that what consumers want and need from payments is heard and reflected in what is developed.

To this end, Which? conducted a public dialogue in September and October this year. We took a public dialogue approach because despite payments being integral to our daily life, their future evolution is inherently complex. A deliberative approach tackles this by enabling constructive and informed conversation among diverse citizens and experts on strategic areas. This deliberative process involved 41 participants from Bristol and Bradford engaging in 14-hours of in-depth discussion including experts to actively explore their different needs and preferences for a future payments system and the practicality of delivering these from a systems perspective.

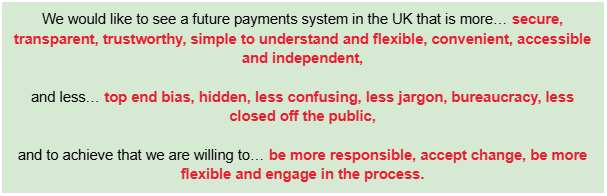

The core message from this dialogue is clear: consumers need payments to help them stay in control of their money

In an increasingly digitalised world where cost of living pressures have made it harder for people to feel on top of their finances, where consumers and businesses alike face huge cyber-security threats, and where consumers are constantly being offered more online shopping choices, consumers crave a payments system that gives them this feeling of control.

There is a strong appetite for more visible, predictable and flexible payments that can make consumers feel more in control of their everyday spending and recurring payments. Currently, consumers are provided with elements of control by consumer-centric features often delivered via banks' or payment firms’ apps. Participants often spoke warmly about such features. However, the ability to give control to consumers can be stymied by the way a payment scheme is built, or how scheme rules are drafted, and the inability to adapt infrastructure to new risks and needs. Frustrations cited included:

- Direct Debits not ‘working’ at the weekend;

- the lack of visibility of Continuous Payment Authorities (CPAs) in bank accounts; and

- payments remaining pending for some time.

These areas of frustrations are where consumers see payments as being inconvenient and failing to meet their expectations to deliver more control. They would welcome future innovation to address these issues. However, in general they are not actively seeking improvements to be made in payment speed, feeling they have optimal speed in paying today. Looking to the future, consumers expressed caution about moving to a more frictionless system, fearing that it may erode social interaction, increase isolation and lower their feeling of control (eg through leading to overspending).

Consumers' desire for control is also visible in their expectations for security, protection, choice and resilience.

Security and Protections: the foundation of control

Strong security and adequate payment protections are central to consumers’ maintaining a feeling of control over their personal finances and purchases. Fraud is feared precisely because it results in a loss of control, leaving people reliant on their bank for reimbursement while criminals are spending their hard earned money.

Participants view payment security as a shared endeavour, with responsibilities distributed between consumers, banks and payment providers, government and regulators. Although reassured both by the extent of what banks do to protect their payments, consumers place a high value on payment purchase protections (eg chargeback and Section 75) as a crucial last line of defence. These protections reinforce their sense of control over their shopping experiences.

Choice: greater control to more people

Most of the time, participants didn’t see an overarching need for greater choice in the payment options open to them individually. Instead, participants felt that greater choice should be deployed as a tool to ensure that payments become more accessible and inclusive, delivering greater control to a wider range of people. Crucially though, people need compelling reasons to try and to trust new payment providers and methods.

Resilience: maintaining control in all circumstances

Recent high profile cyber hacks were at the front of participants' minds and meant they prioritised the need to have back up payment options to ensure both personally being able to pay and the system as a whole continues to operate. The tangibility of cash makes participants feel more in control and acts as a personal safeguard against larger scale digital events that are outside of their control. Despite being sceptical that resilience can be delivered through solely digital means, participants are open to being convinced how this might be achieved.

Recommendations

Based on the detailed discussions and insights from the payments dialogue, we make three strategic recommendations to ensure that the consumer interest is embedded in the development of future payments both now and on an ongoing basis:

- Government’s central role: Payments are critical to the functioning of modern society. Participants want and expect the government to play a central role in guaranteeing the resilience of essential payments infrastructure, setting the strategic direction for payments innovations, and defining public policy challenges to be addressed.

- Consumer engagement is critical: Members of the public are able to quickly grasp complex topics, assess trade-offs and conflicts, understand the different drivers which motivate actors in the payments ecosystem, and suggest pragmatic and realistic ways forward. Engaging with a cross section of consumers should be a mandatory and integral part of the policy and design process which will determine the future of payments in the UK.

- Dynamic and responsive systems: The payments system must retain a sense of dynamism and remain responsive to consumer needs and preferences. The Payments Vision Delivery Committee (PVDC) must ensure there are regular (eg annual) reviews of the current state of UK payments. Mechanisms should be put in place to increase the ambition of standards / schemes over time, in line with changes in consumer expectations and technological developments.

Immediate improvements consumers want to see

Through conducting this public dialogue, this research identified a number of immediate, practical improvements consumers want to see in payments that will give them greater control. These should be actively explored by the Retail Payments Infrastructure Board (RPIB) and Delivery Company under the innovative new model to deliver the next generation of UK retail payments infrastructure. Further consumer engagement will be required in each of these areas to ensure their design meets end-user needs. These immediate improvements include:

- modernising payment protections to reflect how people shop now (eg via online marketplaces, booking platforms, social media sites).

- optimising and personalising security to minimise disruption but still reassure consumers.

- offering less clunky person-to-person payment options which simplify setting up new payees.

- giving consumers more clarity and certainty about when payments leave their account.

- putting consumers in control of recurring payments through the adoption of commercial Variable Recurring Payments (cVRPs) with the right protections.

- developing and promoting features which offer consumers greater convenience and control, such as notifications, pots and better options to allow people who need extra help with their money to give trusted individuals limited access to funds.

- addressing the inability to make offline digital payments to give consumers more confidence in the resilience of digital payments.

pdf (1.93 MB)

There is a file available for download. (pdf — 1.93 MB). This file is available for download at .

Introduction

We currently stand at a critical juncture in the development of UK payments. The way we pay is rapidly changing due to the pace of technological change. At the same time, our payments infrastructure is ageing and is long overdue an upgrade to allow the UK to remain at the forefront of payments innovation.

Recognising this ‘inflection point’, and the consequent need for action, the UK government has taken a series of important steps over the last year. It published the National Payments Vision (NPV) which seeks to achieve a trusted, world-leading payments ecosystem delivered on next generation technology, where consumers and businesses have a choice of payment methods to meet their needs. Building on this, the Payments Vision Delivery Committee (PVDC) announced an innovative new governance model. The PVDC is a senior cross-authority group featuring the Bank of England, Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR), and chaired by HM Treasury. Its new model seeks to drive the renewal of the UK’s retail payments infrastructure, and is based on collaboration between the public and private sectors, signifying a greater involvement for government and the regulators in strategic decisions about payments.

In November 2025 the PVDC published its Strategy for Future Retail Payments Infrastructure. This document featured five high-level strategic outcomes anchored around expanding payment choices, promoting inclusion, combating financial crime and ensuring resilience. The newly-formed Retail Payments Infrastructure Board, chaired by the Bank of England and including broad representation across the payments ecosystem, is tasked with leading design and delivery oversight of the Strategy.

With this flurry of activity, it’s clear that foundational building blocks are being put in place to enable a transformation of the UK retail payments infrastructure. Over the next few years, a series of far-reaching decisions will need to be made to turn the aspirations of the NPV, and the desired outcomes of the PVDC strategy, into reality.

As decisions are made about the future of the UK’s retail payments infrastructure, it’s imperative that what consumers want and need from payments is heard and reflected in what is developed. On this front, both the National Payments Vision and the PVDC Strategy say many of the right things, for example the Strategy asserts that it “has been developed with the needs of users, including those of end users, at its core.” Meanwhile, both the FCA [1] and PSR [2] have explicit statutory objectives to protect consumers and take their needs into account.

Some might question whether this really matters - isn’t it better to focus on the technical aspects of building payments infrastructure or developing scheme rules first and leave all the end-user stuff until later? This would be a fundamental mistake, and could potentially undermine government ambitions. Recent history makes clear that failure often follows when initiatives don’t actively seek and reflect consumer input, for example industry plans to phase out cheques which had to be abandoned since the proposals did not properly consult with, or account for, consumers who relied on this payment method. Meanwhile, the struggle for adoption and the subsequent withdrawal of PayM was at least partially due to a failure to properly take account of the consumer interest when building the user experience [3].

Over recent years we have also seen that the primary focus of payments initiatives has often been on delivering a technical solution or meeting commercial industry interests, such as meeting industry demands for speed and convenience. While it is right that new payments initiatives take account of commercial considerations, this should not be at the expense of consumer interests. Prioritising the commercial focus has meant that payments propositions have not met wider societal needs, most notably in the failure to develop and deliver inclusive digital payments options. To date, the full social and economic cost of this failure has been masked by an ongoing reliance on cash as an alternative. However, as the trend away from cash usage and acceptance continues, the risks and costs associated with this approach are likely to increase significantly. More pressingly, this accelerating trend increases the risk of people being actively excluded from essential services and everyday life. People may struggle to pay for things like public transport or car parking because inclusive digital alternatives have not been developed. This makes the need to tackle payment exclusion an increasingly urgent issue, and one that will worsen over time unless proactively addressed.

The exclusion of consumer voices has also meant that payments developments have not addressed issues of most importance to them. In several cases the payments industry has had to introduce extremely costly, reactive measures to correct flaws in the system. These problems could have been better addressed in the formative stages of development if consumer input had been sought about what they want and need from payments. A good example is the Confirmation of Payee (CoP) service. CoP checks if the payment recipient’s name matches the account details. However, it was only introduced many years after the Faster Payments System went live, and after countless instances of misdirected payments and Authorised Push Payments (APP) where criminals tricked consumers into sending money to accounts using fake names.

This failure to integrate consumer wants and needs into the development of payments initiatives has continued with more recent initiatives. Even now - some eight years after Open Banking launched in the UK, and with rising numbers of Open Banking payments now being made - these payments still do not feature any form of payment purchase protections. The Open Banking Implementation Entity (OBIE) featured both a designated Consumer Representative and an SME (Small and Medium Enterprise) Representative on its Steering Group so the technical implementation served the needs and interests of end-users. Although they were able to achieve notable successes, for example in the development of the Customer Experience Guidelines, they had limited formal decision-making power within the OBIE's governance structure, meaning their input amounted to more of an advisory role.

Looked at in the round, we can see that the UK has persistently followed a model that does not work well for consumers or the payments industry. This approach has necessitated extremely costly retrospective action to correct flaws in the system which could have been better addressed at the formative stages of development.

We now have a once in a generation opportunity to learn from past mistakes and to do something differently. This is not just about embedding the consumer voice at the heart of payments, to ensure that the single biggest user group has an opportunity to influence what is developed. It’s about seeking a way to do things better and smarter, to avoid the need for subsequent costly interventions, and to ensure that future payments innovations truly meet consumer needs now and over their lifetime.

The NPV and the associated PVDC Strategy address some of these issues, for example signalling more involvement from government and the regulators in setting the strategic direction for payments innovations, and defining public policy challenges to be addressed (eg to tackle fraud and to address digital payments exclusion). But there is more to do to ensure that what is developed properly takes account of the consumer interest. It's important that as we stand on the cusp of a new dawn for payments in the UK, we don’t just pay lip-service to the need to meet consumer needs but make the most of this moment, and embed it in the way that payments innovations and initiatives are developed.

What we know about consumers

Past research and behavioural data have been valuable in highlighting changing consumer behaviours, what consumers’ top priorities are when using different payment systems and the needs of specific communities experiencing challenges.

Payment behaviours

Consumers’ payment behaviours have changed dramatically over the years, most notably a shift away from cash towards digital methods in the last 20 years. This digital transition was accelerated by the COVID-19 pandemic. Debit cards are now the dominant payment method, accounting for over half of all UK payments in 2024, with contactless and digital mobile wallets having seen rapid adoption in recent years, particularly among younger demographics. Despite the dominance of digital payments, cash remains essential for a significant minority of the population.

What people want from payments

Past consumer research has consistently shown that people prioritise convenience, ease of use and speed in their payment methods of choice. However, as noted in the Future of Payments Review, “the critical needs of reliability and security are assumed”. Other important factors to consumers include familiarity, control, flexibility, and trust. More granular research, such as the PSR’s annual consumer research reports, have shown how these priorities change in different scenarios and settings, showing that ease of use and speed matter more for frequent, low-value payments, while protection and security become more important for larger payments, and reliability is key for recurring payments. While these insights are valuable in highlighting the broad priorities for consumers, they do not engage with the practicality of delivering these preferences, or the insights only apply to specific payment methods, meaning that they cannot be extrapolated to consumers' overall needs and preferences from a future payments system.

Consumer harm in payments today

Many organisations have conducted important research evidencing the consumer harm that some consumers experience in making payments. The Access to Cash review and subsequent publications, such as the cash census, have shown where cash ceases to be accepted, those who cannot or do not wish to use digital payments face increased risks of social exclusion, as well as overspending and going into debt. Other research has highlighted further consumer harm in payments, including poverty premiums for people who cannot or do not wish to use specific digital payment methods or significant gaps in both the protections consumers have for different types of payments and their understanding of these payments.

Additionally, certain groups, such as adults with a learning disability, people with visual or hearing impairments or care receivers, can face significant challenges with payments. There has been a lot of valuable research with people with lived experience exploring their needs and preferences. These projects have been instrumental in driving innovations in the support offered to specific groups, such as carers’ cards, spending controls and accessible chip and PIN devices. While there are many digital features available today that support people’s needs, the variation in their functionality, together with the relatively small size of specific user groups, has made it relatively difficult to make practical progress towards market-wide adoption of these tools. This means that access to these tools and features remain fragmented and depend on who a customer banks with and their ability to know about and opt in to the services available.

In summary, we already know a lot about how people make payments, their general views towards and preferences for how payment systems should operate and areas of consumer harm today. None of this past research, however, have actively engaged with the practicality of delivering these preferences from a systems perspective and how they would translate into a future payments system.

Methodology: A public dialogue

As the UK’s consumer champion, Which? wants to ensure that the work of the PVDC to deliver the National Payments Vision reflects the needs and preferences of all UK consumers. A public dialogue approach was chosen for this purpose.

As consumers, we make payments almost every day of our lives. However, thinking about the future of payments - for individuals, wider society, and the industry - is complex. Public dialogue is a deliberative process during which members of the public interact with specialists, stakeholders and each other to deliberate on issues relevant to future decisions. It enables constructive conversations amongst diverse groups of citizens on complex topics. Not only does it provide in-depth insight into public opinion, it also offers a window into understanding people’s reasoning.

Deliberative research specialists, Hopkins Van Mil (HVM), were commissioned to conduct this research project in partnership with Which?. This partnership approach meant that both Which? and HVM took an active role in designing the research process as well as managing both the project fieldwork and analysis.

Structure of the research

Prior to the start of the public dialogue, Which? conducted 20 interviews with stakeholders across the world of payments. This included payment experts, consumer group representatives, large retailers and retail group representatives. These interviews were conducted to improve our understanding of the variety of views and perspectives on the UK payments system today and potential for future innovation. These interviews helped inform the design and generation of research material for the public dialogue.

The future of payments public dialogue involved 41 participants who took part in 14-hours of deliberation over the course of four workshops from early September until mid-October 2025. Participants attended an online context webinar, three online workshops and one in-person workshop (Table 1). They also spent up to an hour contributing their thoughts in their own time to an online space, Recollective.

Each session was carefully designed to build upon the learning and discussions of the previous session, with the structure and content adapted iteratively in response to emerging insights as the dialogue progressed. During each workshop we utilised a range of methods to inform participants and give them the space to deliberate. These included presentations from the Which? research team, expert external speakers, small group discussions and practical exercises. The breakdown of the workshop structure is outlined in the table below.

Table 1: The research process

| Session | Session summary |

| Online Webinar (1hr30) | Participants were introduced to the public dialogue process, the topic of the future of payments and Which?. This was done to ensure participants knew the scope [4] and purpose of the dialogue, and to demonstrate the importance of this piece of work. |

| Online workshop 1 - Payment Choices (2hrs30) | The purpose of this workshop was to explore how payment systems work and the challenges in designing and delivering a payments system that is inclusive of the diverse needs of consumers at a reasonable cost. This was done through participants discussing in small groups their own pros and cons of different payments and then case studies of specific consumer challenges people experience with payments today. In the second half of the workshop participants listened and asked questions to three expert speakers from a small, independent retailer, a large retailer and a payments system representative about their roles in offering payments to consumers. |

| Online workshop 2 - Security, Fraud and Protections (2hrs30) | The purpose of this workshop was to explore how crucial elements of payments infrastructure and regulation that protect consumers work and the cost of these. Participants first split into small groups to discuss their experience of security and protections in the payments system. They then heard from two expert speakers about the protections they have when problems occur with their payments and the work banks do to keep payments safe and were given the opportunity to ask questions. In their small groups they discussed these topics in more detail. |

| Online workshop 3 - Innovations (2hrs) | The purpose of this workshop was to expose participants to potential future innovations in the payments space. They explored what issues innovations may help solve but other challenges they could potentially exacerbate. This was done through expert presentations, firstly on innovations that can create better recurring payments and then exploring how some of the benefits of cash can be applied to digital payments. These included information on what is available now in the UK, international examples and potential future innovations. After each presentation participants could ask questions and then discuss the technologies in their small groups. It should be noted that rather than engaging with specific technologies, these sessions focused on the functionality of these technologies as we were interested in exploring what participants want to be able to do with their payments, both now and into the future. |

| In-person workshop 4 (5hrs) Separate sessions in Bristol and Bradford | The purpose of this workshop was to explore participants’ priorities for future payments innovation, bearing in mind both system and consumer needs covered in the preceding workshops. This was done through four sessions: 1. Re-capping content from the online workshops, 2. Designing how individual features of the payments system should work in an ideal world, 3. Discussing three future system design scenarios of what the payments system could look like in 10 years time, and 4. Writing a message to government in small groups with similar views. |

Between each workshop participants were asked to complete small tasks on the online space, Recollective, and were able to re-watch the expert speaker presentations. More detail of the research process can be found in the Annex.

The participants

To ensure a diverse range of public perspectives, participants were recruited through HVM’s specialist partner, Acumen, following a detailed recruitment specification developed by HVM and Which?. The recruitment approach was designed to reduce the likelihood of bias and achieve demographic balance across the overall sample in terms of age, gender, life stage, social grade, household income and ethnicity, to broadly reflect the UK population.

A total of 46 adults were recruited to achieve 41 participants across two locations: Bristol and Bradford [5]. Participants were recruited from areas within a 10-mile radius of both locations, with a mix of urban and rural residents included. We chose these locations because the south west and Bradford had amongst the highest and lowest drops in cash use during the pandemic, respectively. Additionally, they suitably offered a good mix of urban and nearby rural inhabitants and diversity of population to conduct the research.

To achieve the aim of reflecting the needs of all consumers, including those who might struggle to make payments, the sampling employed targeted quotas to boost representation among groups whose voices are often underrepresented or who might face particular challenges in making payments, including disabled people or those with long-term health conditions reliant on care, carers, and people in financially vulnerable circumstances, including living on fluctuating incomes. Participants were selected to include those with varying levels of financial literacy, digital confidence and at least two in each group were reliant on cash.

Participants were also screened to exclude anyone working in financial services, fintech, consumer policy or regulation to ensure that the dialogue genuinely represented consumer perspectives, not professional or sectoral interests.

Advisory Group

We appointed an independent advisory group for the public dialogue to provide constructive challenge to Which? on the overall approach to the research and its relevance and to advise on the appropriateness and balance of the information and stimulus included in the research. Advisory group members represented a wide range of experts across the payments industry, including banks, payment providers, retailers and consumers (see page 1 for the list of advisory group members).

The advisory group met three times during the project, providing feedback on the purpose of the project, structure of and materials used in the research and to discuss emerging findings and policy recommendations. Their feedback was influential and constructive throughout the research project. They challenged us to be more future framing in our design, ensuring that participants both thought through the pros and cons of the payments system today but also looked to the future, exploring the opportunities and risks that could arise. They were instrumental in helping to shape the questions we asked participants on how individual features of the payments system should work and the framing of our future system design scenarios.

A note on language and reporting on a qualitative process

This project was designed as a public dialogue, a qualitative approach that brings together members of the public to learn about, discuss and reflect on complex issues in society. Rather than seeking statistical representation or quantifiable measures of opinion, public dialogue focuses on the depth and diversity of views. It enables participants to consider new information, explore trade-offs and deliberate collectively about what matters most to them and to society.

Findings presented in this report are therefore interpretive and illustrative. They reflect the themes, priorities and reasoning expressed by participants during discussions, rather than fixed percentages of opinion that can be generalised. The insights represent what participants thought and felt after they had the opportunity to engage with expert evidence, hear others’ perspectives and reflect on their own experiences.

Throughout the report we use qualitative language, such as many participants feel … a few participants raised concerns that… there is broad agreement that… These phrases indicate the balance of views observed throughout the dialogue while recognising that there was nuance and variation within and between groups.

Our aim throughout this report is to represent our participant’s views accurately and in their words, wherever possible. Quotations are used to illustrate key themes, with identifying details and filler words removed to conserve anonymity and aid clarity.

This report

The rest of this report presents our research findings and recommendations to the payments industry as follows:

Chapter 1: How consumers feel about payments - the context to our future dialogue discussions outlines how our participants view payments today and three critical factors which influenced participants' views towards future payments innovation.

Chapters 2 to 6 go through participants’ views on different pillars of a future payments system; control, security, protections, choice, and resilience.

Chapter 2: Control demonstrates the centrality of participants' desire to feel in control of their payments, emerging as an overarching theme from our dialogue. The chapter outlines areas participants have welcomed more control in recent years but also areas where the current functionality of the payments system limits consumers’ feeling of control.

Chapter 3: Security explores the importance of strong security in the payments system to participants and where they would like to see future innovation.

Chapter 4: Purchase protections covers participants' discussions on how they think payment purchase protections should be delivered in the future, as well as their interest in conditionality and reversibility of payments as alternative means of offering protection.

Chapter 5: Choice explores participants' views towards greater choice in a payments system, both from their individual perspective and a societal perspective.

Chapter 6: Resilience covers participants’ views on resilience being crucial in the future payments system, both to meet individuals’ need for personal resilience and the need for strong system-level resilience.

Chapter 7: Summary and Recommendations brings together our research findings and recommendations, outlining a number of immediate improvements consumers want to see to payments and broader recommendations to the PVDC.

Chapter 1: How consumers feel about payments - the context to our future dialogue discussions

Chapter summary

- While the vast majority of participants think that payments work well today, they organically picked out many areas of the payments ecosystem that do not work well and frustrated them throughout the research project.

- Person-to-person payments and the speed of payment clearing were two areas that participants would like to see improvement.

- Additionally, the ability of different payment methods to meet consumers' needs and preferences changes over time, so agility must be built into the system design. Three recent events / changes in consumer behaviour underpinned many of participants’ conversations during this public dialogue, highlighting the need for agility:

- Cyber-security threats: The recent computer system hacks suffered by major businesses were central to consumers’ views that security and resilience must be prioritised in system design

- Changing shopping habits: Changes in shopping behaviours, particularly the growth in social media commerce, meant that participants felt that payment protections must better keep pace with changing behaviours

- Cost of Living: Many of participants’ discussions on problems with current payment options and future innovations they would like to see were underpinned by the need to be able to better manage their payments and finances, given continued cost of living pressures.

1.1: The vast majority of consumers are happy with their payments but still have their own individual pain points

For the vast majority of UK consumers, payments are not something they think about in their day-to-day lives. For most, it is a seamless background activity which allows them to go about their days smoothly, from purchasing a morning coffee and paying for public transport via their phones, to automatically paying for their monthly energy bill. As noted by the National Payments Vision, “the UK has long been a global leader in payments” and this is visible when talking to and surveying consumers [6].

At the start of our public dialogue we asked our participants how well or badly they think payments work at the moment. Almost half of them (49%) said very well and 47% fairly well. Only two participants (4%) said they work fairly badly. These figures broadly reflect a lot of consumer research into payments to date that shows the vast majority of consumers are content with their payment options, with a small but nonetheless sizable percentage of society experiencing more acute problems with their payments [7].

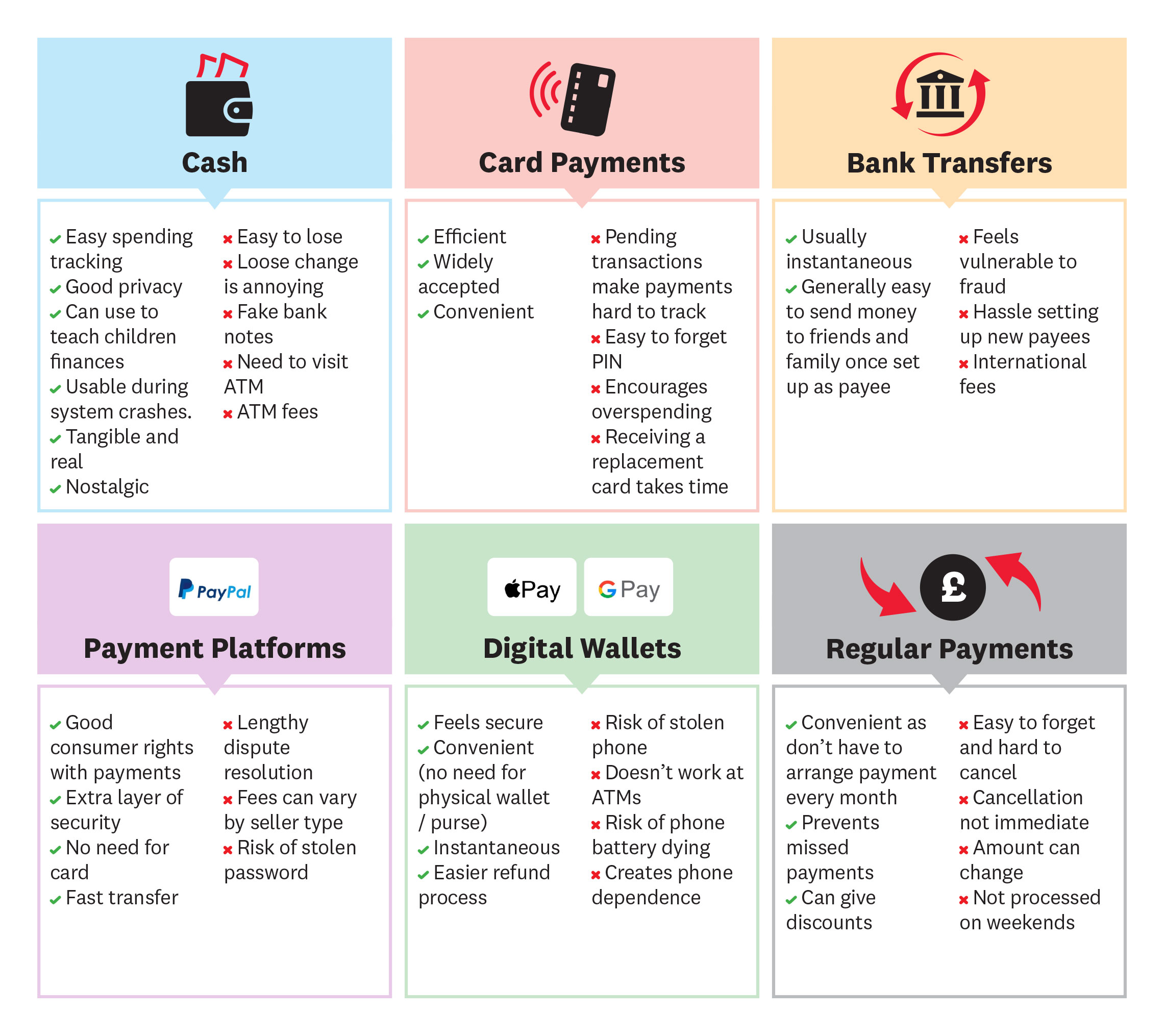

Despite the vast majority of our participants being very positive about their personal payments experience, by following our public dialogue and getting them to really think about the minutiae of payments, lots of individual pain points organically materialised. The graphic below outlines some of those that arose in participants' discussions during the first workshop, as well as the aspects of different payment options they like.

Figure 2: Participants’ pros and cons of current payment methods

These pain points came out naturally through discussion, with participants questioning why certain systems are designed in the way they are and why they can’t work differently. Many of these pain points and benefits of different payment methods are known already, such as the reasons why many prefer to use cash over digital methods, the reasons why many choose not to use Direct Debits or the hassle of setting up new payees for bank transfers [8].

Two of the biggest current pain points for our participants were person-to-person payments and the speed of payment clearing.

Person-to-person payments

A number of participants said they found setting up person-to-person payments within banking services frustrating. Participants griped about the clunkiness of setting up a new payee, having to find out and enter their sort code and account number. One participant was frustrated that people's details are saved, even if they plan to just pay them once.

“I know PayPal actually pays someone with their email or phone number. And I have used it more when I'm paying someone at work who I don't want to ask for their sort code and account number, because I don't want them in my bank forever. I just want to send them a one-off payment and that kind of makes it easier because I can just search my numbers, it's there, it goes.” Participant, Bradford, Workshop 2 (W2)

This rigidity in the current person-to-person infrastructure does not meet consumer needs. In our workshop on innovations, participants heard about the M-PESA payment system in Kenya that uses mobile numbers rather than account numbers for person-to-person payments. Many participants would like a similar system in the UK that works more seamlessly with the rest of the payment systems they use.

“We were talking over the last few weeks about using your telephone number rather than your bank details and things like that, which sound to me really, really interesting. So this enhanced functionality and flexibility, using the technology we've got now, is what I would like us to be doing.” Participant, Bristol, W4

The policy perspective

The Future of Payments Review called out the process of manually entering a sort code and 8-digit account number as "clunky (relative to international comparators)" and suggested this needed to be improved in the coming years. While some banks have innovated in this space to streamline some elements of person-to-person (P2P) payments [9], for many consumers, the current process for setting up a new payee (whether it is sending money to a friend, family member or tradesperson) remains a source of frustration.

There is a clear desire for something better to be developed so that it improves the customer experience without compromising the security of payments. In this regard, we are encouraged that the PVDC Strategy makes clear that the next generation retail payments infrastructure should explore the use of alias-based payments - ie facilitating payments between parties without the need of sensitive or account-related information. As part of this activity, careful consideration should be given to the reasons for the failure of PayM which was launched in 2014 to simplify person-to-person payments but was closed in March 2023. The Future of Payments Review attributed its failure to a clunky ‘opt in’ process rather than automatic opt in, lack of consistent branding, and disproportionately high per-transaction costs. It concluded that “looking to the future, for new and improved payments journeys to be widely adopted, they need to be: ubiquitous, slick with an easy or automatic sign-up process, commercially sustainable, embedded in the existing customer journey/app and widely promoted”.

It will also be important to take into account the widespread adoption of a convenient and secure person-to-person service could have on the demand for cash and other payment methods.

Speed of payment clearing

Delays in payments being debited from bank accounts and credit cards was raised as a stressor by many participants. They spoke about feeling frustrated that payment clearing isn’t always in real time. Participants said that in the future they wanted to be able to look at their bank account or credit card and see, immediately after a purchase, a totally accurate value of their money available or credit card spending level.

“Even when I log on to my banking app, it says the payment is pending, but I never quite know as to whether the balance that is showing at the top is pre or post pending. So I always have to worry about that.” Participant, Bristol, W4

“Also I feel like, because it says sometimes it takes however long for money to be pulled out of your account. I also wonder if it takes a week and you go through the week and you spend a lot of money on Monday and then you don't know how much you've spent on Monday and then you keep going, keep going, keep going.” Participant, Bristol, W3

International bank transfers were also mentioned. Participants would welcome improved processing in this area.

“If you want to do an international bank transfer it takes a horrendously long time. Why would I have my money stuck somewhere for like 30 days when I could literally go pay whatever percentage I'm charged by Western Union whatever and get it sent straight away. So I, as much as I say I don't like to pay for things, I pay for that convenience, I pay for that ease because it means that I can get what I want done faster. So yeah, I think sometimes you do have to pay for what you want.” Participant, Bradford, W4

The policy perspective

Instant clearing for all consumer transactions is a critical component for enhancing the consumer experience and improving the visibility of payments. It would allow consumers to see money leave and arrive in their accounts simultaneously with the transaction itself.

While we understand there are technical reasons for the current variation in payment clearing times related to system functionalities / limitations and other factors, from a consumer perspective these are not visible or predictable. Going forward, instant clearing is required across all payment types, whether a consumer is paying their gas bill, using contactless to pay for their travel to work, or receiving a salary. A fragmented system, where some transactions clear instantly and others do not, introduces confusion and inconsistency which undermines the feeling of control.

Only as a critical, last-resort intervention where there are reasonable grounds to suspect a payment is fraudulent and more time is needed to investigate should banks make use of recent legislative changes to delay payments. Where this is the case, clear communication with consumers is required.

The need for improvement in person-to-person payments, the speed of payment clearing and the other pain points outlined in Figure 2, shows there is always room for improvement in payment systems. Additionally, the ability of different payment methods to meet consumers' needs and preferences changes over time, so agility must be built into the system design. Three recent events / changes in consumer behaviours underpinned many of participants’ conversations during this public dialogue, highlighting the need for agility.

1.2: Hacking, increasingly digital shopping habits and cost of living pressures were topics that underpinned many of our conversations during this dialogue

Hacking

In the weeks around our workshops, the news was full of headlines about the continued impact of computer system hacks suffered by Jaguar Land Rover and Marks & Spencer [10]. There was a strong sense that if these large, household-name companies could be hacked and held to ransom by computer hackers, then parts of the payments system could be too. This context was raised most often in conversations around the security and resilience of the payments system and served to sharpen participants’ appetite for ongoing innovation to fend off hackers and scammers.

“Judging by the last few months of the finances of large scale companies, that one would imagine have a better security than you or I, (BBC; JLR; M&S; CO-OP; Harrods), it must rock the system that the "staying in control" is no longer a certainty and the hackers seem to be winning on an unprecedented scale.” Participant, Bristol, Recollective

Shopping habits

The way we shop and where we shop, particularly the shift in online shopping from merchants to social media channels, were referred to often during our process. This is not surprising. Recent Which? research has found that nine in 10 consumers have made purchases on online platforms like eBay, Amazon Marketplace, Etsy and AliExpress within the last two years. One in nine have bought directly from either Instagram or Tiktok Shop in the last two years (12%) [11].

Participants spoke about their changing shopping behaviours, with many talking about their increased use of social media as a source for buying products. There is a sense that social media companies are increasingly powerful experts at keeping our attention and monetising it. Throughout the research participants had questions about how this relatively new area is regulated to protect consumers from harm.

“When someone's advertising something like a car and they're asking for a deposit - you go, that's obviously a scam. Personally I will kind of report it immediately, saying this looks dodgy to Facebook or something but how does anything happen? I guess, if there is a gap on social media in terms of advertising and stuff like that, what can be done about it? Are there things that we can already do or do they need to be improved?” Participant, Bradford, W2

The cost of living

The ability to efficiently and effectively manage your own money has always been a crucial need for all consumers from a payments system. Despite our participants having varying levels of incomes, this need to feel more in control of their payments was seemingly front of mind for all our participants.

The cost of living crisis continues to have a lasting impact on consumer sentiment. Our Consumer Insight Tracker, which has tracked consumer sentiment for over 12 years, shows that worry about high prices has remained high throughout the last four years and doesn't show any signs of falling to pre-cost of living crisis levels. The chart below shows over four in five UK adults are currently worried about food and energy prices (both 83%) and this worry remains high across all income levels. Further, recent research by More in Common showed many feel the high cost of living is a permanent state, with 57% of Britons saying they are unsure whether the crisis will ever end.

Figure 3: Consumer worry about the price of essentials has remained high from late 2021 onwards

Source: Consumer Insight Tracker. Approximately 2,000 respondents per wave. UK level data are weighted to represent the adult population of the UK by age, gender, region, social grade, working status and housing tenure. Respondents had the option to select not applicable if they felt that consumer issue did not apply to them. If they selected not applicable they are not included in the proportion.

Rising prices and a sense that wages aren't keeping up, led participants to talk about actively choosing payment options that help them afford what they need and better manage their finances. Payment platforms offering Buy Now, Pay Later options (a form of interest-free credit that lets consumers split purchases into installments) such as Klarna were referred to in this context.

“I do tend to go to PayPal. I have also used Klarna in the past. Again, if it's a bigger sort of buy, it is nice to pay it in three without any interest.” Participant, Bristol, W1

“It's now very easy to overspend your budget when you're tapping on a credit card. Now I try to keep all my receipts so I can have a morning of doing my admin and making sure that I haven't missed anything. And missing stuff is on a card. Whereas if you put your hand in your pocket, and you've no longer any cash, then you know, we're all working to a budget nowadays.” Participant, Bristol, W1

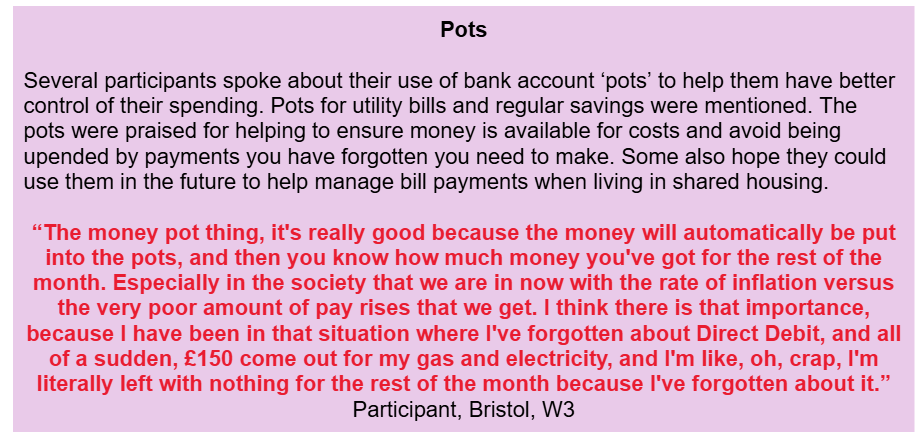

Spending tools like payment notifications, pots and spending controls were also mentioned as useful tools to help consumers manage their money and stay in control. Participants who weren’t aware of these tools, either because their bank doesn’t offer them or require an opt-in, were very interested in them, asking other participants questions about how they work and how they can access them.

The policy perspective

The fundamental desires that underpin consumer behaviour in payments largely remain constant. What evolves is the expectation of how these needs are met. For example, until recently the desire for security meant using a physical card with chip-and-PIN, while today consumers unthinkingly make use of multi-factor, biometric authentication. Meanwhile, we have witnessed significant leaps in the technology which has transformed payments.

The pace of change looks set to continue, or even accelerate. With this in mind, there is a need for a migration towards a more agile, nimble payments framework that would be better positioned to respond to emerging, as yet unthought of, risks and challenges, as well as being able to integrate new technologies seamlessly and to respond to evolving consumer expectations.

A core component of this new framework should be the scheduling of regular reviews. These would help to make sure that the framework remains responsive to evolving consumer needs and technological developments over the coming years, helping the system retain a sense of constant dynamism. We discuss this in more detail in Chapter 7.

Chapter 2: Control

Chapter summary

- The core message from this dialogue is clear: consumers need payments to help them stay in control of their money.

- Consumers need greater visibility, predictability and flexibility to enable them to feel more in control of their everyday spending and recurring payments.

- Currently, consumers are provided with elements of control by consumer-centric features often delivered via banks' or payment firms’ apps. Research participants often spoke warmly about such features.

- However, the ability to give control to consumers can be stymied by the way a payment scheme [12] is built, or how scheme rules are drafted, and the inability to adapt infrastructure to new risks and needs. We see this in the frustrations voiced about Direct Debits not ‘working’ at the weekend, CPAs not being visible in bank accounts and some payments remaining pending for some time.

- Participants feel they have optimal speed in paying today and fear a more frictionless system.

- Embedding consumer control into the core design of payment systems should be a focus of the PVDC’s work.

In our more digitalised world where cost of living pressures have made it harder for people to feel on top of their finances, where consumers and large businesses alike face huge cyber-security threats, and where consumers are constantly being offered more and more choices online of places to shop, staying in control of their money felt more crucial than ever for our participants. This desire for a future payments system that gives them a greater feeling of control is central to participants' vision for the future and an overarching theme from our dialogue with consumers. In this chapter, looking at everyday spending and recurring payments, we will explore the strong appetite for more visible, predictable and flexible payments that can make consumers feel more in control of their payments.

2.1: Everyday spending

Maintaining control over their everyday spending was a strong driver of participants’ preferences for the future of payments. Participants talked of wanting a clear view of where their money is going and what their financial situation looks like.

System overlays and consumer-centric features improve control but only benefit some consumers

Currently, consumers are provided with elements of control by scheme overlays (eg Confirmation of Payee is an overlay for domestic UK-based payments applied to Faster Payments) and the development of consumer-centric features are often delivered via banks' or payment firms’ apps. During the research many participants spoke about using these new tools that have improved the visibility of their spending. Other participants, who were not aware of them, were interested in hearing about these from others. The most common tools discussed were notifications, spending forecasts and pots.

Through a series of case studies and drawing on their own experience, participants discussed how a future payments system could help people in vulnerable circumstances to feel more in control of their payments and finances. Participants felt that the specific tools that they use for their everyday spending could benefit certain groups of people or other tools could be generated to work for other vulnerable groups.

One specific idea participants had is being able to have sight, and even approval, of what an older or younger or otherwise vulnerable family member is purchasing to check its validity. This is a spending control that several participants would like to see in the future.

“We mentioned vulnerable people and if you know that you've got a vulnerable person in your life, there should be something built in so that you get the messages or whatever to your phone to say when this person has made a payment, because they might be able to do certain things, but if you think, “oh yeah, that's okay, mum can carry on, because that looks okay”.” Participant, Bradford, W4

Some participants see a role for Artificial Intelligence (AI) to help spot spending patterns that signify someone may be experiencing a mental health crisis and then trigger an intervention, such as contacting a carer or blocking a transaction.

“With artificial intelligence these days, maybe it could pick up on certain patterns of people when they're spending a bit more recklessly. It might be hard to track who's just being irresponsible with the spending and who's actually got a mental health issue, but it's just something that's come to mind. And then maybe they could notify the user of the spending or give them a call or something.” Participant, Bradford, W1

Many of the ideas participants put forward in this discussion aligned with those proposed by organisations working specifically with communities experiencing challenges, for example Project Nemo and the Money and Mental Health Policy Institute.

The limitations of consumer-centric features

Despite many participants' positivity around controls and tools they now have available, participants openly discussed some of the drawbacks of them. In the first instance, many participants are unaware of the existence of these tools. Throughout the research process participants were talking to each other about the different payment options they used, with other participants probing them for more detail and saying they would look into these when they got home. This also applies to tools that could benefit vulnerable groups; one participant, for example, talked about the idea of a “carer’s account” and said they “don’t know if that exists” already or not.

Additionally, not all participants want to have these tools for their payments. For example, there is a recognition that for some people, a spending summary or forecast is something to avoid, in the same way you might avoid looking at the dial of the scales in your bathroom – life is easier if you aren’t faced with a list of all you’ve spent or upcoming transactions.

“I personally am on a fluctuating income and I have seen on my Lloyd's Bank app a spending insights page. I'm too scared to click on it. My weekly spending varies massively, like I could have a week where I don't do anything, I just go to uni, I go to work and I could spend like, maybe like £30 per week, and that's it. But I could have a week where my friend would come down from the city and I could spend far too much money.” Participant, Bristol, W4

This prompted a debate over whether certain payment controls should be opt-in or opt-out. Some said they only want a notification to warn them if a pending payment is going to bounce or tip them into debt. Others would like to see a notification every time they spend, to make each transaction more conscious and help influence what they do and don’t buy for the rest of the day or week or what percentage of their funds they’ve spent that day. Most participants felt that, so long as they are tailorable, it should be an opt out system, as they felt most people would benefit from some sort of notification to keep track of spending and avoid it becoming out of control.

While specific consumer-centric features can improve the visibility and control consumers have in their everyday spending, a lack of awareness of them and the fact that different tools only meet certain people’s preferences shows their limitations.

The policy perspective

Research participants were very interested in tools which some challenger banks offered their customers, suggesting that they would help to meet existing needs, or those with specific requirements (eg people who might need to provide some form of access to their account to a trusted friend or carer). However, most were unaware of the existence of such options. This suggests that the current approach of expecting consumers to research what is available to them, to switch accounts, and to opt-in to such tools is not working well.

With relatively low levels of current account switching, particularly among older and vulnerable groups who may face cognitive, emotional, and practical barriers to engaging with the market [13], there is a need to consider how such potentially helpful tools could be disseminated more widely, as well as whether they should be opt-in or opt-out. The current approach does not serve consumers well. For example, in relation to arranging support from a trusted person to manage their everyday finances, the Money and Mental Health Policy Institute (MMHPI) has recently highlighted the wide variation in what banks offer their customers: seven out of 18 offer carers' cards; three offer third party notifications; one offers third party payment control. The lack of a standardised approach means that many consumers have to adopt risky workarounds to manage their money. As a result, one in five people with mental health problems resort to sharing their PIN code or bank details with another person to get help with managing money, leaving them at risk of fraud and financial abuse.

Participants feel they have optimal speed in paying today and fear a more frictionless system

Beyond the pain points of person-to-person payments and payment clearing outlined in Chapter 1, participants generally feel that payments for everyday spending are convenient for most people. They certainly do not feel that there is much improvement to be made when it comes to payment speed.

“I feel like they've fixed that problem, really, haven't they, the faster payments? Because we get faster payments, don't we, already?” Participant, Bradford, W4

“I can't really speak for everyone, but I've never really run into a situation where I've needed a payment going faster. It's always felt like... It's been fast enough. Yeah, it's like we've got faster payments, which covers bank transfers, that's pretty much instant. We've got Direct Debits. Recurring payments doesn't really matter how long they take as long as they do. Payments by card are pretty instant and cash is obviously instant.” Participant, Bradford, W4

Looking more to the future, most participants feel that the current ease and speed of the payments system meets everyday needs and expressed caution about a more frictionless future, fearing that it may erode social interaction, increase isolation and lower their feeling of control.

“We already can pay really easily, we can just tap, so I don't know, some of it is just like, just doing it for the sake of it. Innovation for the sake of innovation.” Participant, Bristol, W4

Primarily, many were concerned about how this would impact human interaction in society, which could lead to greater social isolation for many. Some participants are specifically concerned about the impact this could have on the social value of businesses.

“I do sometimes feel that it takes away a bit from human interaction because we're all using self-service tills. We're sitting, looking at our phone, ordering a meal on our app, which is a bit depressing. You're not actually talking to anyone a lot of the time… But if you're maybe older and isolated and maybe lonely in your life, then to have that all taken away from you, a very normal piece of interacting with other people, it's quite sad really, that we're increasingly going towards that.” Participant, Bristol W1

Several participants view a future society where everyday payments are frictionless as “dystopian”, where individuals move through life “like zombies”. They also spoke about the risk of it leading to the erosion of cultures and changing the nature of social spaces like coffee shops and pubs.

“I hate that because that's not the art and craft and culture of going in a pub, it's all waiting in the bar and there's a little bit of, you know, and the barman knows who's next and it's all part of the socialisation of the people, you know, if you're just all standing in a line.” Participant, Bradford, W4

Participants are also concerned about how an increasingly frictionless payments system would make them less in control of their spending. Participants seem to like the idea of the act of spending currently and knowing what you're paying for.

“If you are in a restaurant and it automatically charges you for what you've ordered and your presence at the restaurant, you want to make sure that that's right before you leave.” Participant, Bradford, W4

There is also the concern that more frictionless payments could encourage overspending and unhealthy financial habits. Several participants said that paying with contactless makes money seem “less real” as it requires less thought and action on the consumers’ part to make the transaction happen. Frictionless payment makes several participants feel less in control of their money, and therefore more vulnerable. Some participants feel it can also make it easier to overconsume or overspend, as shown in academic studies [14].

“I think you would maybe end up spending more as well, picking more things up, because there's a kind of, I can't remember the figure, but it's something like 11%, I think, you spend more when you use a card, because it's less friction, you're not given any weight. That's interesting. So if you've got even less friction, that extra chocolate bar that you may need suddenly goes in every week.” Participant, Bristol, W4

However, there were some participants that did like the idea of more seamless transactions and there were scenarios participants saw merits in hands-free/more frictionless payments.

“I would actually rather not have that interaction. I would quite like to, for example, if I post something, I like to post it [using a locker service] because I don't have to speak to anyone. I just want to go and do what I'm doing and get whatever, and I don't really like talking to a stranger, so I'd rather just cut that out. The choice to be able to do that is actually great, I do really like that.” Participant, Bristol, W4

The couple of participants in Bristol and Bradford who did want more frictionless payments to be a focus of future payments innovation felt that it could create “less unwanted human interaction”.

The policy perspective

Removing friction from payments delivers clear benefits to businesses, offering the prospect of increased sales and conversion rates alongside lower operating costs [15]. While consumers also stand to derive some benefits from increased convenience, the vast majority of our research participants were content with current levels of friction in their payments journeys; in general and in most circumstances they did not want to move to a world of more seamless payments.

As industry enthusiastically embraces the possibilities offered by agentic payments, and the Payments Strategy seeks to deliver a world-leading payments ecosystem delivered on next-generation technology, we urge a degree of caution over removing friction. We are not opposed to innovations which genuinely offer benefits to consumers, including removal of friction that is unhelpful or causes consumers frustration - for example, we’re keen to see friction removed from the current process for setting up new payees when making a person-to-person payment. But what is developed should be grounded in giving consumers what they want, rather than being based on the assumption they always want frictionless journeys. In particular, retaining an appropriate level of friction is important to reassure consumers that they retain control and visibility over their spending, and plays an important part in helping to prevent overspending.

2.2: Recurring payments

Recurring payments are valuable tools both to consumers and businesses, providing convenience and predictability for regular payments. Throughout our workshops we explored the benefits and drawbacks of how recurring payments work today and potential future innovation.

Rigidity in Direct Debits mean they do not always meet consumer needs

Direct Debits were widely used by our participants, with many finding them useful tools to manage their regular payments. Participants, however, brought up various shortcomings with them, specifically rigidities in their design that have meant payments aren’t always predictable. One of the main frustrations participants had is when Direct Debit payments fall on the weekend, they don’t go out on the date participants expect them to. This results in consumers feeling less in control of their regular payments as they can’t always trust their balance is reflective of their current financial situation.

“If it lands on a weekend, it sometimes doesn't come out until the Monday. So weekend days can be hit or miss with Direct Debits.” Participant, Bristol, W1

“It is inconvenient when a payment that's supposed to come on a certain date doesn't come out that day and it comes out either earlier or later and then you have to make sure that you've got that money in that account.” Participant, Bradford, W3

Many participants also shared their frustrations with Direct Debits where they either have little or no control over when the payments are made. They spoke about some businesses only offering one fixed date or only the 1st, 15th or 30th of the month to pay. This rigidity is at odds with the reality that many people face who are freelancers or working on zero-hour contracts and their income comes in at different times. Participants spoke about wishing to be able to tweak the timing to match their pay day.

“Some businesses still only offer you a 1st, the 15th, or the 30th to pay your Direct Debit. That's just completely inflexible and doesn't suit so many people, the students or freelancers or whatever the reason might be where you don't have a certain amount of money consistently in your account. I really think flexibility has to be at the heart of the innovations.” Participant, Bristol, W3

“That's always driven me mad, you're like, ‘oh, can you take this payment on the first when I get paid?’ ‘No, it has to be on the 20th.’ What, when I'm out of money? No, thank you.” Participant, Bradford, W1

In the third workshop with participants, which focused on payments system innovation, they heard about India’s UPI Autopay service. The service allows customers to set up pre-authorisation of a recurring payment if it is going to be above a certain amount. Participants felt this is useful, particularly for bills which can vary quite considerably. Many participants liked the prospect of being notified via an app, rather than via an email, which is easily missed or ignored. They felt it gave them more agency over their payments.

“The system from India, I would very much like to see authorisation for things above certain amounts, while having to manually authorise it when a recurring payment changes how much it costs. Because they have to notify you, but an email can very easily get lost. And then you're stuck on the hook for a month when you might have chosen to cancel.” Participant, Bradford, W4

“The one that was in India, the one that, if a transaction is over X amount, then you have to give your permission. I feel like that would help so many people. Obviously, you can set it to your own budget as well. So one person's budget might be £10, one might be £1,000. But I feel like that would especially make people that are a little more vulnerable feel safer as well, because they would have the option to approve, deny, et cetera, and work within their budget.” Participant, Bristol, W3

Another feature of the India UPI Autopay service that received a lot of plaudits is the visibility of all Direct Debits in one place. Some participants spoke about having Direct Debits coming out of different bank accounts and this being hard to manage effectively.

“The UPI, the good thing with that was all your Direct Debits are under that one app, so everything's just on one app on one platform so you can adjust things accordingly how you want to make payments and you can see everything in one place. For instance with me some of my Direct Debits come out of one bank account and then some are with another bank account so I guess having some kind of separate app where you can look at all your Direct Debits and make changes and see when a payment is going to be made or change the date or the frequency of payment. I think that was quite good.” Participant, Bradford, W3

Participants felt that a system like this could help prevent people tipping into a downward debt spiral.

“People who are sort of just living on the edge of their income, it would stop them from spiralling. I know myself when I was younger, you have a Direct Debit bounce that just has a knock-on effect, like dominoes, this bounces, this bounces, and then you can get into debt, which just becomes really, really serious.” Participant, Bradford, W3

Participants voiced support for more flexibility, and specifically being able to delay a recurring payment to allow them to better manage their outgoings with their available income. Participants were pragmatic in their wishes though, recognising the need to balance the needs of businesses in regular payments. There was acceptance among participants that a system that allows consumers to endlessly nudge payments back could lead to debt issues, and they therefore see the sense of companies offering a limited number of flex-payment opportunities.

“You can change the date up to two or three times a year or something like that. I guess it stops people running away, trying to hide from paying what they owe. They're figuring out how to make sure people don't take the mick and don't end up owing loads of money.” Participant, Bristol, W3

Invisible Continuous Payment Authorities (CPAs)

Many participants talked about their difficulty of seeing and managing the subscriptions they have. Participants shared their frustration with these payments that seem to creep out of your bank account and are not visible when you check your lists of standing orders or Direct Debits on your banking app. After explaining to them that these are delivered through Continuous Payment Authorities (CPAs), linked to their debit or credit card, several participants said they wanted them to be made more visible in the future so they can manage and cancel them more easily.

“The Continuous Payment Authorities, I prick my ears up at that because I have a number of those for various TV channels and magazine subscriptions, that kind of thing. And I diarise them. But I was struck when I looked at my banking app, it gave me a list of all my Direct Debits and standing orders, but not necessarily the continuing payment authorities. That would be very helpful.” Participant, Bradford, W3

“I have a lot of in-app subscriptions and a lot of the times I lose track. Sometimes I sign up for ones and forget that I did. And all of a sudden the money's gone and I don't know what it's for.” Participant, Bradford, W4

Research by Citizens Advice last year found that consumers spent over £600 million on unused subscriptions over the year prior, showing the harm that CPAs create through being less visible to consumers.

The policy perspective

The shortcomings raised by research participants about the lack of visibility and predictability they experienced in the operation of recurring payments, specifically CPAs and Direct Debits, are caused by the design of these systems.

Having existed for over 50 years, Direct Debits are viewed as technologically outdated and slow, with a three-day clearing cycle that can be further impacted by weekends and bank holidays. They are often criticised for a lack of flexibility and transparency, and the long lead times for setting up, amending, or cancelling instructions.

CPAs have attracted considerable criticism for severe problems with transparency and consumer control, with consumers often finding it difficult to cancel them and being unable to rely on similar protection to that offered by the Direct Debit Guarantee.

These payment methods have remained unchanged for very long periods, despite rapid changes in other areas of payments and the criticisms levelled at them. We need to acknowledge that part of the reason for this longevity is due to the fact that they work well for most people, most of the time. Critically, they work incredibly well for billers, providing them with guaranteed revenue on a specific day and predictable cash flow meaning that there is little impetus or appetite for change. Added to this, the challenges and costs associated with making changes or replacing major pieces of infrastructure militate against action to deliver improvements.

Going forward, we want to move away from an approach that creates monolithic systems that are difficult to amend to reflect changing needs or expectations, or to offer particular services for certain groups of consumers who may have different needs. We want to see a new approach which:

- embeds the consumer voice in the development of new payments initiatives

- adopts a more agile approach to infrastructure renewal; and

- regularly considers whether there is more that should be offered to reflect new challenges or evolving needs.

We discuss this in more detail in Chapter 7: Summary and Recommendations.

The promise offered by commercial Variable Recurring Payments (cVRPs)

Many of the shortcomings identified by research participants could be addressed by the planned introduction of commercial Variable Recurring Payments (cVRPs).

What are VRPs?

- The PSR defines VRPs as follows: "VRPs enable customers to safely connect authorised payment providers to their bank account using open banking so that they can initiate recurring payments. These payments only occur with express customer consent, can be made at flexible intervals, and can vary in amount within pre-agreed limits."

- VRPs are built upon Open Banking technology and utilise the Faster Payments Service rail in the UK.

- There are two main types of VRPs:

- Sweeping VRPs allow money to be automatically transferred, or "swept," between two accounts owned by the same person or business (often referred to as a 'me-to-me' payment); and

- Commercial VRPs involve payments between accounts held by different parties, typically a customer and a business (a 'me-to-business' payment).

- Sweeping VRPs were mandated by the Competition and Markets Authority as part of the Open Banking Order, while commercial VRPs are being rolled out commercially, with the features currently being developed and tested.

From a consumer perspective, commercial VRPs will offer consumers greater control and security than both CPAs and Direct Debits, addressing many of the frustrations that research participants voiced. In particular, they:

- enable 24/7 payment processing,

- offer a more secure set-up,

- provide greater visibility of the agreed payment parameters,

- can be amended or cancelled by the customer with immediate effect,

- automatically reject payment requests above the agreed maximum limit,

- do not require the sharing of sensitive bank or card details with the merchant, and

- enable refunds to be processed much more quickly.

While the potential benefits to consumers from cVRPs are clear, we envisage that there may be a need to overcome resistance from merchants / billers (eg utility companies) who are being asked to move from guaranteed payments under existing arrangements to a more flexible regime. Lessons should be learned from the failure of the Request to Pay initiative to achieve widespread take-up despite offering consumers greater control and flexibility over their recurring payments [16].

The development of cVRPs is a key part of the National Payments Vision, supported by the government for rapid, competitive, industry-led delivery. However, like other Open Banking payments, cVRPs lack payment purchase protections, such as card chargebacks or the Direct Debit Guarantee, leaving consumers exposed when things go wrong (eg, firm insolvency or retailer disputes). We cover the urgent need to ensure payment purchase protections cover newer payment methods in more detail in Chapter 4 on Purchase Protections.

2.3: The consumer desire for control

Through exploring what participants want from a future payments system, it is clear that there is a strong desire for greater control. Consumers need greater visibility, predictability and flexibility in their future payments system.

The policy perspective: Embedding consumer control into the core design of payments system

Currently, consumers are provided with elements of control by the development of consumer-centric features delivered via banks' or payment firms’ apps. As we heard above, research participants often spoke warmly about such features.

However, the ability to give control to consumers can be stymied by the way a payment scheme is built, or how scheme rules are drafted, and the inability to adapt infrastructure to new risks and needs. We see this in the frustrations voiced about Direct Debits not ‘working’ at the weekend, and some payments not becoming visible or not settling immediately and remaining pending for some time.