FCA launches new Firm Checker tool to fight scams

The Financial Conduct Authority (FCA) has launched a new tool to help consumers protect themselves against scammers who pose as legitimate companies to commit fraud.

'Firm Checker' allows you to investigate whether a firm is authorised and has the correct permissions to provide financial services such as investments, pension plans, mortgages and insurance.

Here, Which? explains why the FCA has launched the tool and what it can and can't do.

Why has the FCA launched this tool?

With the tactics used by scammers constantly evolving, it can be tricky to know whether a company is legitimate.

The latest figures from the FCA estimate as many as 800,000 people may have lost money to a pension or investment-related scam in the 12 months to May 2024.

Firm Checker will allow you to, in effect, conduct a basic background check on companies that offer financial products. This will be especially useful when you're approached out of the blue or when you come across firms online through social media.

The FCA hopes that using the tool will significantly reduce people's chances of falling victim to fraud and losing money.

What can Firm Checker do?

In the UK, almost all financial firms must be authorised or registered by the FCA.

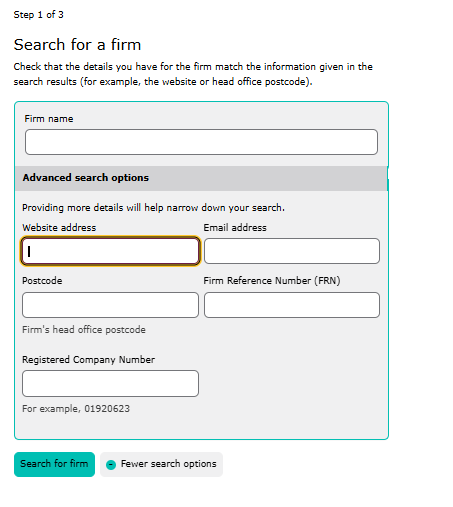

With Firm Checker, consumers can quickly input the name of a company to check two key things:

- whether the provider is authorised by the FCA

- whether it has permission to offer the specific services you want.

The tool also allows you to input other information you may have, such as the company number, postcode, website or Firm Reference Number to help you narrow down your search.

If a firm doesn't show up, it may not be safe to deal with.

It could also mean that the FCA doesn't regulate or supervise the products and services a firm offers. You can check what the FCA does and doesn't regulate on the FCA website.

What about cloned firms?

Fraudsters might also clone firms authorised by the FCA to try to convince people that their firm is genuine.

The tool can help you unpick its claims by checking whether a brand is actually allowed to offer a service.

Firm Checker will also list firms it's aware of as unauthorised, which may be trying to commit fraud. When you search for HSBC, for example, 16 firms come up, of which five are classified as 'unauthorised'.

The FCA says that in addition to checking if a financial services firm is authorised for the services being offered, you should also confirm that the contact details you've been given match those listed on the Firm Checker, such as the phone number and website.

What can't the new tool do?

The latest innovation by the regulator is valuable for consumers, but it is also important that you understand its limitations.

The tool can't:

- Confirm whether the Financial Services Compensation Scheme or the Financial Ombudsman Service will definitely apply if something goes wrong.

- Check whether the service offered by the company meets your needs. You will need to do your own research on this.

- Give details of individuals connected to the firm (these are available on the full Financial Services Register).

- Give you all the information the FCA holds on a firm. For example, the tool won't show you published restrictions relating to crypto activities, historic fines, their right to approve financial promotions, and their ability to handle client money. You can find this information on the Financial Services Register.

- Display information about financial products not regulated by the FCA.

- Guarantee completely up-to-date or fully accurate information, as updates may take up to 24 hours, and some data is supplied by firms.

'A genuine caller shouldn't mind waiting'

Faye Lipson, Which? Scams expert says: 'It's great to see a new way for people to stay safe from scams. You can use the FCA's firm checker to verify out-of-the-blue contact claiming to come from a well-known financial firm or a brand you've never heard of.

'If it exists, the firm checker should show the financial firm's genuine contact details and website, so you can verify what you've been told and/or see.

'We would always encourage people to verify they're dealing with the genuine firm before divulging personal details or moving money. A genuine caller shouldn't mind waiting while you hang up to do this.'

How to stay safe from scams

Firm Checker is just one way consumers can fight back against scams.

It can also help to get into the habit of ignoring unsolicited contact about financial products such as investments or pensions, and checking the authenticity of emails, messages or calls before sharing personal information.

You can also sign up for our Scam Alert emails. These offer free weekly updates on the scams you need to be aware of. In just five years, Which? Scam Alerts has helped subscribers to avoid almost £5.5m in scam losses.

- Find out more: the latest scams