Investment fraud: crypto scams are on the rise

Crypto scams are up 23% this year, warns Lloyds Bank, with victims losing £10,741 on average and two thirds of investment scams originating on social media.

High street bank Lloyds has published new data on scams involving cryptocurrencies, such as Bitcoin and Ethereum.

Which? has previously revealed that one in five fraud victims send money to criminals via cryptocurrency.

Here we take a closer look at the Lloyds data and explain the latest investment scam tactics to be aware of.

How big are crypto scams?

The number of cryptocurrency investment scams reported by Lloyds Banking Group customers (including Lloyds Bank, Halifax and Bank of Scotland) so far this year has increased by 23%, when comparing January to September 2023 with the equivalent period last year.

The bank said that 66% of all investment scams start on social media – with Instagram and Facebook the most common sources - and increasingly target 25-34-year-olds, who make up a quarter of all cases.

It also highlighted Revolut, an e-money firm, as the most common recipient of crypto investment scam money, although it noted that this may not be the end destination of the funds (which may be then sent on elsewhere).

Victims typically make an average of three payments before they realise they've been scammed, by which point the money is usually long gone.

In the UK, crypto scams have become such a big problem that many banks have resorted to blocking transfers to cryptocurrency trading platforms. In September, Chase by JPMorgan became the latest bank to tell customers they can no longer purchase crypto assets with their Chase debit card or by bank transfer.

- Find out more: banks ban crypto payments over fraud spike

The cost of crypto scams

The average amount lost by each victim of a crypto investment scam according to Lloyds data is £10,741 (up from £7,010 last year) and outweighs losses to any other type of consumer fraud, such as romance scams or purchase scams.

To get an idea of the total cost of these scams, Which? asked City of London Police for data on crypto scam losses reported to Action Fraud in 2022 and 2023 to date.

Its data revealed a total of 9,709 reports of crypto scams and a total financial loss of £329,199,179 in 2022. So far in 2023, there have been 7,559 reports and a total loss of £136,468,004.

This is only the tip of the iceberg as Action Fraud is a self-reporting tool and many scams go unreported. This also excludes scams reported to Police Scotland (which is responsible for the gathering and enforcement of fraudulent activity affecting Scottish victims).

| Report volume 2022 | Financial loss 2022 | Report volume 2023 | Financial loss 2023 | |

|---|---|---|---|---|

January | 1,040 | £19,158,977 | 669 | £14,698,348 |

February | 900 | £15,225,636 | 691 | £13,355,512 |

March | 936 | £37,698,663 | 859 | £20,786,407 |

April | 892 | £12,908,057 | 781 | £12,518,080 |

May | 911 | £33,024,379 | 914 | £14,494,617 |

June | 802 | £12,713,677 | 839 | £13,408,733 |

July | 720 | £15,769,822 | 994 | £16,934,425 |

August | 754 | £14,156,296 | 982 | £17,861,912 |

September | 669 | £17,475,970 | 830 | £12,409,970 |

October | 692 | £20,957,088 |

|

|

November | 710 | £115,651,853 |

|

|

December | 683 | £14,458,760 |

|

|

Table note: Action Fraud reports may not have been verified by law enforcement or interrogated for authenticity or accuracy and may be subject to discrepancies. The data included within this report only relates to Action Fraud crime reports.

The hallmarks of a crypto scam

Investment in cryptocurrencies is inherently volatile and unregulated, so even if you're dealing with a genuine company you could lose all of your money. But at the criminal end, you could be tricked into investing in an entirely fictitious cryptocurrency, sending money directly to a scammer who will disappear with it.

Or, you could be duped into setting up a digital wallet with a genuine trading platform such as Coinbase and Binance before being convinced to either transfer the money to the fraudster yourself or pass control of your account over to the fraudster.

Cryptocurrencies often feature in other scams such as romance fraud where scammers target potential victims on dating apps and social media to build up trust before they pitch an ‘easy’ investment ‘opportunity’ or offer investment and trading 'tips'.

- Find out more: romance fraud losses soar by 73%, warns Which?

A typical fake crypto advert

Scammers will often target victims online, using fake adverts, bogus celebrity endorsements, and by sending direct messages about ‘get rich quick’ schemes. They may set up convincing websites and social media profiles featuring bogus reviews and slick brochures to appear legitimate.

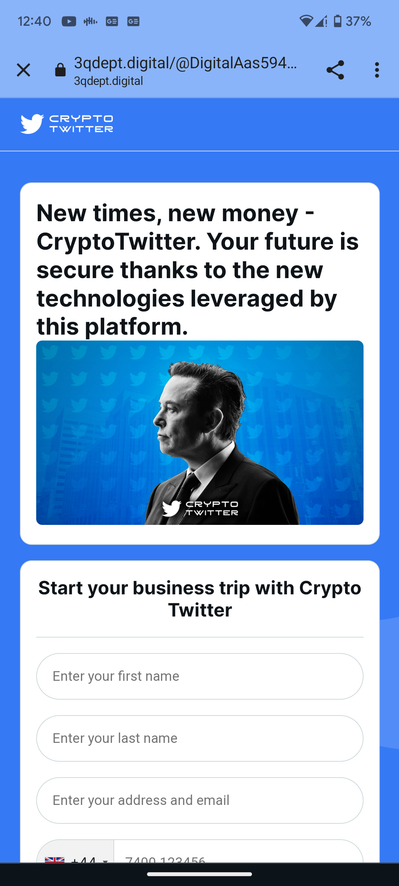

Below is an example of a fake BBC news story hosted at a website called 3qdept.digital, supposedly endorsed by actor Stephen Graham, who is currently starring in TV show 'Bodies'.

This 'article' links to a webpage promoting 'Crypto Twitter' featuring an image of Elon Musk and asking for your contact details.

We saw this scam being advertised on x.com (formerly Twitter) and have reported this to the platform.

How to avoid crypto investment scams

Here are five tips from Lloyds on how to guard against the scourge of crypto scams.

1. Beware of social media

Fraudsters often put adverts for scam crypto investments on social media. They can also send offers by direct message. They will promise returns that you can't get elsewhere or make claims about ‘guaranteed’ profits. If you’re contacted out of the blue about an investment, it’s likely a scam.

2. Make sure it’s genuine

Fraudsters can easily set up fake companies, social media profiles and websites to clone real firms. Use the FCA website to find genuine contact details for a company and check for warnings about fake firms. Always do your own research or seek professional financial advice.

3. Check for warnings

Marketing of crypto is now regulated, which should make it easier to spot genuine crypto ads. According to the FCA, whenever you invest in crypto you should see prominent warnings about the risk of losing your money, and you shouldn’t be offered any free gifts to join or refer a friend bonuses.

4. Keep it to yourself

Never share the login details for your investment account or your private cryptocurrency keys with anyone else. A legitimate firm would never ask you for this. Remember if you transfer funds to another account that isn’t in your name, you have lost control of your money.

5. Protect how you pay

If you pay by bank transfer and it’s a scam, it’s very hard to get your money back. Fraudsters might ask you to pay an account in a different name to the company you are meant to invest with. If the names don’t match, it’s a sign of a scam. Paying by card always offers the greatest protection.