Addressing poor consumer outcomes in home and travel insurance

Executive summary

Home and travel insurance products are widely held by UK consumers, and hugely important for society and the economy. In 2024, 32 million UK adults held contents insurance and 29 million held buildings insurance, whilst 15 million and 13 million UK adults held annual and single-trip travel insurance, respectively [1].

Yet these markets are failing consumers in many ways. Consumers are routinely treated poorly during the claims-handling process, in breach of Financial Conduct Authority (FCA) rules. Claims are often rejected, unlike many other insurance products. In some cases, the terms and conditions of policies are unfairly disadvantageous to consumers, either very obviously as drafted, or in the way in which they can be interpreted and applied.

These failures have caused consumers avoidable financial and emotional harm over many years – and continue to do so. They are also steadily eroding firms’ incentives to adhere to regulation, and consumer trust in insurance markets.

Why Which? is submitting this super-complaint

The FCA’s July 2025 claims-handling report highlighted ‘many areas where improvements need to be made’ across the 15 home insurance firms and 8 travel insurance firms reviewed. This included evidence of ‘ongoing customer harm’.

Despite these findings, the FCA reached no conclusions in the report on whether any of the reviewed firms had failed to comply with FCA rules, nor was a plan to determine this outlined. Little was said about what the FCA is doing to hold the hundreds of other firms across these markets to account on the issues they had identified. Worryingly, the FCA has identified many of these issues before, and failed to address them.

In its 2025 claims-handling report, the FCA acknowledged some issues with consumer understanding of cover for storm damage in home insurance and it has asked the industry to address this. However it failed to identify and address other issues, including the wider prevalence of low claims acceptance rates, poor consumer understanding of products, and the presence of terms which deviate from requirements under insurance and consumer law.

This amounts to a pattern of consistent failure by the FCA to meet its statutory consumer protection objective in these markets to secure ‘an appropriate degree of protection for consumers’. We are concerned insurers are being allowed to break the law – including FCA rules, and insurance and consumer legal requirements for the protection of consumers more generally. The FCA has also underestimated problems with how these markets are functioning, which are causing further consumer harm, and merit attention.

After careful consideration, Which? has decided, under its statutory powers, to submit a formal super-complaint regarding certain features of the consumer home and travel insurance markets that are significantly damaging the interests of consumers.

The relevant markets

There are two relevant markets for this super-complaint:

- The retail home insurance market which covers policies distributed to consumers in the UK, including contents-only, buildings-only and combined buildings and contents policies.

- The retail travel insurance market which covers policies distributed to consumers in the UK, including single-trip, European annual, and worldwide annual policies.

Features of the relevant markets significantly damaging the interests of consumers

There are three features of the home insurance and travel insurance markets significantly damaging the interests of consumers:

- poor claims handling;

- inappropriate sales processes; and

- a lack of application and enforcement of FCA rules and other relevant law.

We cite a wealth of evidence in support of these, from Which?, the FCA and other sources. This includes four reports we have published since we launched our public campaign calling on the FCA to End the Insurance Rip-off in Summer 2024. These cover:

- Financial Ombudsman Service (FOS) decisions involving delay, distress and inconvenience caused by insurers;

- consumer harm in the insurance claims process;

- consumer confusion around general insurance; and

- potentially unfair flood and storm definitions in home insurance policies.

We also include two new sources of evidence:

- Analysis of policy wordings conducted with Fairer Finance, exploring the possible factors leading to variation in claims acceptance rates between firms.

- Legal analysis of a sample of policies and product information documents, conducted by an expert external barrister. Details of this are contained within Annex B.

What action Which? wants

Which? wants this super-complaint to lead to a reset of the markets for home and travel insurance so that they properly serve the needs of consumers, who rely on these products and firms at some of the most difficult points in their lives.

We expect this to lead to consumers:

- purchasing insurance products that better meet their needs and reasonable expectations;

- better understanding relevant limitations of their insurance cover;

- experiencing fewer problems when making claims;

- receiving more appropriate support from their insurer, especially if they are in vulnerable circumstances; and

- having fewer claims rejected.

To deliver these outcomes, Which? wants action in three areas:

- Recommendation 1: The FCA should urgently intervene to tackle the failure of home and travel insurance firms to comply with their legal obligations, taking formal enforcement action where necessary to force action and act as a deterrent.

- Recommendation 2: The FCA should launch a market study to address the market dynamics driving poor consumer outcomes in the home and travel insurance markets.

- Recommendation 3: The FCA and the government should conduct a joint initiative to review consumer protection legal frameworks in insurance and how they are operating in practice, identifying key areas where these need strengthening.

pdf (2.19 MB)

There is a file available for download. (pdf — 2.19 MB). This file is available for download at .

1 Background and overview

Here we provide further background on:

- Which?’s longstanding concerns with the home and travel insurance markets;

- the FCA’s 2025 home and travel insurance claims-handling report;

- similar FCA findings from previous FCA reviews; and

- why Which? is submitting this super-complaint.

We also provide an overview of the super-complaint, which covers:

- the relevant markets;

- the features of the relevant markets significantly damaging the interests of consumers;

- key relevant areas of law; and

- evidence.

1.1 Which?’s longstanding concerns with the home and travel insurance markets

Insurance markets are critical to the functioning of a modern economy, enabling risk pooling and underpinning household financial resilience which ultimately facilitates economic growth. Buildings insurance, for example, is critical to the maintenance of the mortgage market, without which many consumers could never hope to own their own home.

Home and travel insurance products are widely held by UK consumers. However, these markets are not working well. Consumers are routinely treated poorly during the process, in breach of FCA rules. Claims are often rejected, unlike many other insurance products. In some cases, the terms and conditions of policies are unfair to consumers, either very obviously as drafted (See Annex B: Expert legal review of home and travel insurance policies), or in the way in which they are being interpreted and applied. These issues are causing avoidable financial and emotional harm for consumers. The harm arising includes financial losses, the time taken to pursue claims and complaints, and the emotional impact this can have on people. Rejected or badly-handled claims can wreak havoc on people’s lives in the aftermath of an event such as a fire, burglary or medical problem abroad – often when people are struggling with other practical and emotional challenges. The impact on people’s mental health is particularly concerning, with prolonged claims, unreasonable requests and unfair decisions causing frustration, distress and robbing people of sleep. There are even cases where people’s physical health is affected, such as where dampness is not properly remedied in a person’s home leading to respiratory illness.

For too long, substandard levels of service and customer outcomes have been tolerated, steadily eroding both firms’ incentives to adhere to regulation and consumer trust in insurance markets. Insurance has persistently registered the second lowest level of consumer trust of any major consumer-facing industry, according to Which?’s Consumer Insight Tracker survey. Only social media consistently scores lower. Consumer case studies demonstrate the poor regard in which the industry is held

Quotes from consumers about the insurance industry

They stand to profit by refusing to cover claims and frequently attempt to hide or minimise the extent to which certain items are excluded from coverage or the extent of deductions in the small print, knowing that people are likely to miss this information and thus purchase a policy expecting better coverage than it actually provides. Female, 26, London

My personal experience of them is when I’ve needed them they try and weasel out of their obligations and have ultimately cost me more in premiums through no fault of my own. Male, 43, East of England

It feels like I pay out a lot to insurance companies and any time I have a problem, which is rare, it becomes a fight to get what I think I deserve. Male, 44, East Midlands

Too much red tape and hard to understand all of the fine print and exclusions that you only become aware of when attempting to claim. Male, 45, North East

They always have loopholes to ensure they don't have to pay out, and then will put up the premium anyway. They just feel like scams. Female, 40, South East

Because I think they are legal scammers and rarely pay out and if they do they take a long time. Female, 38, London

They are often quick to take your money for an insurance policy, but when the claim actually comes and you really need their help it becomes very difficult to achieve anything. Male, 59, East of England

Lots of claims likely to be rejected due to fine-print details and technicalities that the average consumer shouldn’t have to be expected to read. Male, 32, North West

Source: Which? Consumer Insight Tracker survey, a nationally representative online poll of UK adults conducted on 10-12 November 2023.1.2 The FCA’s 2025 home and travel insurance claims-handling report

The most relevant recent piece of FCA work to this super-complaint is the FCA’s claims-handling arrangements report, published in July 2025. This review was launched with a sentence outlining its scope in the FCA’s 2024-25 business plan [2]:

‘Our multi-firm work will also look at how swiftly the insurance industry responds to claims, including where customers are more likely to show characteristics of vulnerability.'

No terms of reference were published. The FCA published an update on the scope of the review in December 2024, which was broader than the original:

‘Understanding insurers’ claims handling arrangements and whether systems, controls, governance and oversight structures drive good consumer outcomes.’

We supported this broader scope. We made clear to the FCA that, in addition to claims-handling processes, its review should address issues with how products are designed and sold to consumers. These issues often contribute to difficulties experienced by consumers when they make claims. We highlighted that in order to meet Consumer Duty requirements to act to deliver good outcomes for retail customers, the FCA’s guidance says firms should identify and tackle the factors that are leading to poor outcomes. We also made clear to the FCA that this review should lead to robust action if the FCA found issues with non-compliance with FCA rules and wider law.

We engaged extensively with the FCA throughout this review. This included presenting to the FCA on the four policy research reports summarised in Annex A, covering: FOS decisions involving delay, distress and inconvenience caused by insurers; issues with claims-handling processes; how insurance sales are potentially contributing to rejected claims; and storm and flood definitions.

The FCA’s review was the first in-depth review of consumer general insurance claims-handling practices in over a decade, with the last published in 2014. It was just the third such review since the Financial Services Authority (FSA), the predecessor to the FCA, began regulating general insurance in 2005. Prior to this, voluntary codes were in place in these markets.

In July 2025 the FCA published the outcome of its claims-handling arrangements review. It found what appear to us to be actual and potential non-compliance with FCA rules across many of the 15 home insurance firms and eight travel insurance firms reviewed. The FCA grouped the ‘many areas where improvements need to be made’ into the following four key areas, under which we’ve cited some of the most notable findings – including the FCA’s concerns about ‘ongoing customer harm’:

Key excerpts from the FCA’s 2025 claims-handling report

1. Insurers’ oversight of outsourced claims handling providers

- ‘Some insurers had limited control over their outsourced claims handling arrangements.’

- ‘Where there is limited oversight, we have concerns about firms’ ability to ensure good consumer outcomes that are expected under the Consumer Duty.’

2. Availability and use of management information (MI)

- ‘Some firms produced poor quality MI, lacked comprehensive data and failed to use MI effectively to identify or assess customer outcomes, including for vulnerable customers.’

3. Claims handling arrangements, including storm claims and the use of cash settlements

- ‘We saw weaknesses in firms’ definitions, with firms failing to clearly define:

- What constitutes a ‘storm’.

- The specific conditions for storm damage coverage.

- ‘This, combined with poor communication, often leads to high claim rejection rates and poor customer outcomes. Only 32% of storm damage claims made to our sample of firms in 2024 resulted in a payment.’

- ‘Some firms lacked oversight and monitoring of cash settlements, failed to consider customer vulnerability, and promoted cash settlements without ensuring good customer outcomes.’

- ‘We were concerned that some firms may be choosing cash settlements primarily to contain costs without considering customers’ best interests.’

4. Claims governance

- ‘Firms were often less able to show how their governance arrangements were helping them oversee their claims handling arrangements effectively.’

- ‘We saw evidence of this resulting in poor customer outcomes, including where firms had identified an issue but taken too long to address and resolve it. We are concerned that this resulted in ongoing customer harm. This included examples where firms had identified a lack of customer understanding of the cover provided but not acted to address this.’

The FCA said in its claims-handling report that it would give feedback to the 15 home insurance providers and eight travel insurance providers covered by its 2024-25 claims-handling review. However, it did not publish any explicit conclusions on whether any of the reviewed firms had failed to comply with FCA rules, or set out a plan to determine this. Little was said about what the FCA is doing to hold the hundreds of other firms in these markets to account on the issues identified. The regulator simply said other firms should consider the findings and that regulatory tools will be used ‘as appropriate’.

The FCA acknowledged some issues with consumer understanding of cover for storm damage in home insurance and it has asked the industry to address this. However it failed to identify and address a range of other issues across these markets leading to poor customer outcomes, including the wider prevalence of low claims acceptance rates, generally poor consumer understanding of products, and the presence of terms which deviate from requirements under insurance and consumer law.

In response to a Freedom of Information (FOI) request we submitted in August 2025, the FCA confirmed it is ‘considering any actions and interventions that may be required’ and ‘assessing whether the use of any of our regulatory tools would be appropriate’. It also said that the claims-handling review concerned FCA rules only, not also wider consumer law. See Annex C for full details of the FOI request.

1.3 Similar findings from previous FCA reviews

Many of the failures identified in the 2025 claims-handling report were not new. The FCA’s last such in-depth review focused on claims-handling in consumer general insurance was published over a decade ago in 2014. As with the 2025 report, it focused on home and travel insurance. The 2014 review included surveys of consumers and industry professionals. It identified seven key issues, [3] which included consumers not being updated about the progress of their claims [4] and firms not providing sufficient oversight of outsourced claims and supply chains. Similar issues were raised in the FCA’s 2025 claims-handling report [5].

In 2023, the FCA reviewed how home and motor insurers were supporting customers in financial difficulty and handling claims. It found examples of good practice, but also areas where firms needed to improve. In particular, it concluded that:

- ‘The time taken to assess claims varies considerably and we saw examples where the time taken to resolve a claim was significant. We found too that the volume of complaints relating to claims handling and the number of rejected claims is increasing.’

- ‘We are concerned that a number of our firms were unable to provide data to demonstrate the number of vulnerable customers receiving support. We saw significant variation in how firms identified financially vulnerable customers. We also saw examples where policies were sold through chains of firms, where it was not clear how each firm had considered their own approach to vulnerability.’

- ‘Some firms were not yet able to demonstrate that they have effective information to monitor consumer outcomes. In particular, we noted that more work is needed to ensure good flows of information between intermediaries and manufacturers.’

The FCA’s 2024 multi-firm review of outcomes monitoring under the Consumer Duty covered 20 large firms in general and life insurance. It identified yet more related issues, including substandard service levels and poor monitoring of consumer outcomes, including for customers in vulnerable circumstances:

- ‘We continue to see substandard service levels across insurance sectors and therefore encourage firms to ensure the customer support targets and SLAs [service level agreements] they aspire to are appropriate to ensure their customers are supported.’

- ‘[…] many firms need to make improvements in their monitoring to enable them to determine whether they are delivering good outcomes for retail customers, as required by the [Consumer] Duty.’

- ‘Some firms showed limited monitoring of outcomes for different groups of customers, including a lack of monitoring of outcomes between customers with characteristics of vulnerability and other customers.’

As with the 2025 claims-handling report, in the 2014 claims-handling review [6], the 2023 cost of living review [7] and the 2024 Consumer Duty outcomes review [8], the FCA did not publish definitive conclusions as to whether any of the reviewed firms had failed to comply with FCA rules. The FCA also failed to make clear what it was doing to hold other firms to account. The findings of the most recent claims-handling review suggests that this action has, to date, been insufficient. The persistence of these issues over the course of four separate reviews, spanning more than a decade, points to an ongoing failure of the FCA to fulfil its statutory duty to ensure an appropriate degree of consumer protection in the home and travel insurance markets, as well as potentially cultural issues undermining its regulation of the wider insurance industry.

Yet in some other parts of insurance, particularly on the fair value of products, the FCA has been more willing to address issues with firms’ compliance and the resulting consumer harm. For example:

- It agreed a pause in the sale of guaranteed asset protection products with many providers, which was followed by subsequent improvements in the value of these products, albeit this was a decade after the FCA first found similarly low levels of payouts as a share of premiums [9].

- Its 2024 thematic review of product oversight and governance found ‘Many firms were not fully meeting the requirements under PROD 4 and could not ensure and evidence that their products are delivering fair value’. In response the FCA said: ‘We are requiring firms to take remedial actions supported by attestations from senior management and using our skilled person review tool, where appropriate. Where we have more material concerns about product value, we are intervening including getting firms to withdraw products from the market. In the event we identify significant harm to customers, we will ensure that firms and their senior managers are held accountable for these failings and remediate the harm, including providing any customer redress necessary.’

We are unclear why the FCA has not used these measures, including agreeing undertakings by firms, or requiring firms to take remedial action and provide redress, for the repeated issues it has found with firms’ claims-handling governance and practices, and the poor treatment of customers.

1.4 Why Which? is submitting this super-complaint

This persistent evidence of ongoing consumer harm in the home and travel insurance markets led us to campaign to address this, and to engage regularly with the FCA and other stakeholders on our concerns in these markets. Despite this engagement and the coming into force of the FCA Consumer Duty rules, we have not seen significant improvements for consumers in these markets.

Our engagement with the FCA following its 2025 claims-handling report has not made sufficiently clear to us what its plans are to fix the issues it has identified. The FCA could have specified actions for firms to undertake or taken enforcement action. While we appreciate the sensitivities around naming firms at early stages of enforcement investigations, the FCA did not need to name firms to announce that this was happening. Where necessary, the FCA could have launched further investigations, such as a call for input or a market study. None of this was set out by the FCA.

Other issues we have identified in these markets were not considered at all. Wider legal obligations (such as those listed in section 1.7 below) were not mentioned, despite the FCA having the remit to enforce these in relevant markets. Which? remains of the view that the FCA’s response to its 2025 claims-handling review, and a series of previous regulatory reviews, has been insufficient. The FCA has missed or underestimated many important issues that we have persistently raised. Where it has identified issues, its response has not been commensurate with the scale and nature of harm in these markets.

On the basis of our research and investigations, we are concerned that a significant number of insurance firms are not complying with relevant consumer and insurance laws and FCA rules, including the Consumer Duty. Allowing firms to behave in this way penalises firms that have done the right thing, by giving their competitors an unfair advantage. This will further erode firms’ incentives to adhere to regulation and consumer trust in insurance markets, preventing these markets from working effectively.

Despite raising these concerns repeatedly with the FCA, we are not clear how the FCA is addressing them. In response to the recent Freedom of Information (FOI) request we submitted to the FCA in August 2025, the FCA refused to give overall numbers of open enforcement investigations either across the general insurance sector or specifically in relation to home and travel insurance. The FCA’s FOI response also made it clear that very few firms were under investigation, and that its 2025 claims-handling review concerned FCA rules only – not wider consumer law (See Annex C: The FCA’s response to Which?’s Freedom of Information request). We do not regard this approach as sufficient in the circumstances.

Which? has therefore reached the view that the FCA is failing in relation to the home and travel insurance markets to meet its statutory consumer protection objective to secure ‘an appropriate degree of protection for consumers’. After careful consideration, Which? has decided to submit a formal super-complaint regarding certain features of the consumer home and travel insurance markets under Section 234C of the Financial Services and Markets Act 2000.

While it is the FCA’s responsibility to ensure that the regulations and consumer law it is responsible for are adequately enforced in these markets, responsibility for ensuring these markets function does not sit with the regulator alone, but also with the government. As such, our recommendations reflect the fact that a wider range of solutions may be necessary.

Which? also acknowledges that the FCA may be reluctant to use its consumer law enforcement powers as, unlike the Competition and Markets Authority [10], it does not have direct fining powers for the relevant legal breaches. Such fining powers could be used by the FCA, for example, for breach of unfair commercial practices prohibitions (including misleading actions or omissions in insurance selling) or unfair terms non-compliance in policies. For this reason, Which? believes consideration should be given to granting the FCA such powers (see Recommendation 3, section 5.3).

It also appears from our research and investigations, including our own legal analysis, that the existing consumer and insurance law frameworks may well not be effective or clear enough, for example:

- in deterring unfair commercial practices, as prohibited by the Digital Markets, Competition and Consumers Act 2024 (DMCC Act), in relation to claims-handling, such as unreasonable consumer documentation requirements; or

- in how claims are wrongly assessed or refused in breach of the Consumer Insurance (Disclosure and Representations) Act 2012 (CIDRA 2012) or the Insurance Act 2015.

Which? expects that a wider assessment of issues in the insurance industry will be needed alongside the FCA’s response to this super-complaint to fully address these systemic issues.

1.5 The relevant markets

There are two relevant product markets for this super-complaint:

- The retail home insurance market which covers policies distributed to consumers in the UK, including contents-only, buildings-only and combined buildings and contents policies.

- The retail travel insurance market which covers policies distributed to consumers in the UK, including single-trip, European annual and worldwide annual policies.

Insurance markets are complex, with a wide range of policy types which can involve multiple stakeholders at various levels. This can make defining product markets a complicated exercise. The definitions above align with a consumer perspective. They also align with the pragmatic approach the FCA has taken in relation to insurance markets in its previous work. For example, in the FCA’s recent review of claims handling, it focuses on ‘home and travel products’ without going into additional detail. For the avoidance of doubt, however, we believe there are issues with the conduct of both manufacturers and distributors of insurance in these markets.

Home insurance is the second most commonly-held general insurance product in the UK. In 2024, 32 million (60%) adults held a home insurance policy that included contents cover, and 29 million adults (53%) held a policy that included buildings cover. The number of people who benefit from these policies at a household level is likely to be considerably higher.

The home insurance market is also extremely large in terms of value. According to FCA data from 2023, gross written premiums across the three relevant types of home insurance policy were just under £6 billion. For combined buildings and contents home insurance, the most popular by some distance, average premiums were £340.

Travel insurance is a smaller market both in terms of customers and average premiums. Gross written premiums totalled £980 million in 2023, with average premiums ranging from £73 to £159 across the three main types of travel insurance. Nevertheless, millions of UK consumers purchase travel insurance every year. In 2024, 14.5m UK adults held an annual travel insurance policy, whilst 12.7m held a single-trip policy in the 12 months prior.

1.6 Features of the relevant markets significantly damaging the interests of consumers

This super-complaint to the FCA raises three features of the consumer home and travel insurance markets that are significantly damaging the interests of consumers:

- Poor claims handling

- Inappropriate sales processes

- A lack of application and enforcement of FCA rules and other relevant law

1.6.1 Poor claims handling

The FCA’s recent findings in its 2025 claims-handling report have identified ‘many areas where improvements need to be made’ but where, in our view, it has failed to take appropriate action. These include:

- poor claims and supplier management, including oversight of outsourced claims-handling providers;

- ineffective communication with customers on expectations, progress and claims outcomes;

- failing to identify customers in vulnerable circumstances and support them appropriately; and

- insufficient claims governance, including the availability and use of management information.

In each case, Which? thinks that the FCA has outlined insufficient action, and is concerned that this will result in ongoing consumer harm. We point to an array of evidence that these problems exist at a greater scale across the industry than the FCA has grasped in its recent review, and to the fact that similar issues were also identified by the FCA in 2014 or in more recent related reviews, and yet little change has been made as a result. This leaves us with little confidence that the limited steps the FCA has publicly announced it is taking in response to the recent review will lead to the satisfactory resolution of these issues.

The FCA has missed or overlooked many important issues altogether. This is, in part, because its 2025 claims-handling report did not include a significant piece of research with consumers or industry professionals. Instead it relied on data collected by providers which is acknowledged to be substandard in places. This appears to have limited the FCA’s visibility of wider issues across these markets. The overlooked issues where the FCA has identified some indicators of harm, but does not appear to have a plan to take action to deal with issues, are:

- customers having to repeatedly provide information and evidence;

- comparatively low claims acceptance rates; and

- firms not addressing systemic issues identified from relevant Financial Ombudsman Service (FOS) decisions.

Overall, these persistent problems show that many firms are not sufficiently focused on consumer outcomes, and that there are major issues with firms’ governance, processes and culture.

Various FCA rules and wider legal obligations are applicable, including:

- ICOBs 8.1.1.R obligations that claims must be handled promptly and fairly;

- the Consumer Duty principles to secure good outcomes for consumer; and

- the implied term under Section 49 of the Consumer Rights Act 2015 (CRA 2015) that services must be provided with reasonable care and skill.

However, even if currently investigating these matters further, the FCA has also failed to properly consider the implications of more general relevant law such as that on unfair terms, unfair commercial practices and insurance legislation.

The FCA’s response is insufficient. Further action is needed urgently for the FCA to fulfil its obligations to ensure adequate consumer protection.

1.6.2 Inappropriate sales processes

Unfair claims decisions and poor claims governance appear to be partially responsible for low claims acceptance rates in the home and travel insurance markets. However, it is also widely accepted among both the insurance industry [11] and the FCA [12] that poor consumer understanding of insurance products causes a significant number of claims rejections.

FCA regulations require insurers to take action to enable consumers to make informed decisions when purchasing products and to ensure that a proposed insurance contract is consistent with the customer’s demands and needs. However, Which?’s research shows that consumers frequently misunderstand the coverage offered by insurance products. In testing a range of scenarios across both home and travel insurance, we found a significant minority of consumers expect to be covered for things typically excluded from home or travel insurance policies, like storm damage to fences or connecting flights. Consumers also commonly expect they will be covered for any event that is not ‘their fault’, and have little understanding of what would constitute wear and tear or negligence, which could impede their ability to successfully make a claim [13].

In these cases, policies may be applied in line with their terms by insurers, but consumers still experience both time and psychological harm when they are unable to make a claim for something they expected to be covered.

Consumer misunderstanding in this market is partially a result of inherent characteristics of insurance products. Unlike most things consumers buy, they hope never to have to use an insurance policy. Many consumers will never make a claim, or do so only rarely, offering little opportunity to learn about products in the market through experience. Consumers also expect a degree of standardisation and the presence of minimum standards across the industry as a result of regulation.

The common use of comparison tools to compare and purchase home and travel insurance policies limits the variation in policies visible to consumers at the point of choosing products. While the simplified view of products offered by a comparison tool facilitates consumer comparison, the limited number of elements of cover surfaced through a comparison interface further reinforces consumers’ perceptions that insurance products are largely similar.

Driven by this perception that there is little to choose between products beyond price, consumers rationally limit the time they spend searching for insurance and the extent to which they actively engage in the detail of the product they are purchasing.

The poor consumer understanding of insurance products which results from this process is challenging, but not inevitable. We find that prompts in the sales process, for example those used to flag the availability of add-on cover options, can improve consumer understanding of what is covered.

However, at present, not enough is being done by either firms or the regulator to address poor customer understanding. Firms’ processes are often insufficient to assess the nature of a consumer’s demands and needs, and the extent to which coverage matches this. For example, to understand whether a potential travel insurance customer plans to take a connecting flight, and would expect this to be covered. Details of coverage are generally only available to consumers through detailed terms and conditions and in Insurance Policy Information Documents (IPIDs), both of which are largely unintelligible to consumers, and underused.

The industry and FCA should take further action, drawing on behavioural science, to improve consumer understanding of insurance products and reduce the avoidable harm associated with rejected claims. This should include the FCA launching a market study which would enable it to better understand why home and travel insurance markets are not currently addressing these consumer understanding issues and the regulatory interventions required to remedy this.

1.6.3 A lack of application and enforcement of FCA rules and other relevant law

In addition to the compliance issues uncovered by the FCA and Which?’s own previous findings, here we cite evidence from recent external legal analysis showing that leading providers continue to have policy terms and conditions that are not in line with FCA rules, or wider consumer and insurance law.

In summary, our legal analysis found:

- With the disclaimer that terms may not in fact always be applied strictly, various terms examined improperly deviate from regulatory and statutory standards offering key protections and rights for consumers.

- Some of the terms were, in practice, likely to operate harshly or unexpectedly against consumers’ interests.

We cite examples where:

- Policy terms and conditions deviate from statutory and regulatory requirements for the protection of consumers in the insurance market.

- There is a lack of transparency and/or clarity as to terms and exclusions.

- There are unfair terms under Part 2 of the Consumer Rights Act 2015.

Many of these points identified do not feature in the FCA’s 2025 claims-handling report, although there may be some overlap, for example in relation to policy terms on storms.

More generally, more than two years on since the implementation of the Consumer Duty rules for new products, the FCA has repeatedly found potential issues with non-compliance with FCA rules by insurers, but in our view is not conducting sufficient enforcement activity as a result. This view is also supported by the FCA’s response to our recent Freedom of Information request, which suggested that only ‘low numbers’ of firms were being investigated in this sector and that the recent claims-handling review only focused on possible FCA rule breaches, not wider legal obligations (See Annex B: Expert legal review of home and travel insurance policies).

Which? is particularly concerned that:

- Many of the issues identified in the claims-handling report echo those identified by the FCA’s last such in-depth review focused on claims-handling in consumer general insurance published over a decade ago, with little evidence the FCA has taken sufficient action in the interim period to ensure consumer protections are rigorously applied.

- Despite the evidence of issues leading to harm found in consecutive reviews, there is little evidence the FCA is addressing these through firm level interventions. There were just six enforcement investigations that remained open across the general insurance and protection sectors in October 2024 [14], and no enforcement investigations were opened in the year to October 2024 [15].

- The FCA’s Unfair Contract Terms Library shows that the FCA has agreed just one undertaking with an insurance firm to address unfair contract terms in the last six years. It has agreed on just three undertakings with insurance firms since September 2013.

Which? is concerned that if the FCA’s previous, current and future actions in relation to the issues raised in this super-complaint are concentrated on informal, supervisory or settled enforcement actions which aren’t publicised sufficiently or at all, then any deterrent effect will be minimal. We also know that firms are keen to understand more clearly what they should do to comply with the Consumer Duty. Clearer communication about actions taken would help to set precedent around the standards expected in these markets, supporting firms that want to comply.

1.7 Key relevant areas of law

The FCA has been clear that the Consumer Duty marked a ‘significant shift in our expectations of firms’. The FCA also said that the general insurance sector should already have been meeting the products and services outcome, and the price and value outcome, of the Consumer Duty, under the PROD requirements introduced following the FCA’s 2020 market study on general insurance [16].

Various other sections of the FCA Handbook are applicable, and in some cases will give rise to a private right of action in the courts by a consumer if they are breached. The Insurance Conduct of Business Sourcebook (ICOBS) and DISP (dealing with disputes) rules are particularly relevant.

Other key relevant areas of law include:

- Unfair contract terms provisions in Part 2 of the Consumer Rights Act 2015. These apply a test of fairness to contract terms used by traders in transactions with consumers, taking into account various factors. There is also a separate and distinct requirement that written terms of consumer contracts should be transparent, which primarily means intelligible to consumers. A term or notice that is unfair is not legally binding on consumers.

- The supply of services provisions of Chapter 4 of Part 1 of the Consumer Rights Act 2015, including the implied term under Section 49 that services must be provided with reasonable care and skill, and under Section 52 that a service must be provided within a reasonable time. This right does not replace any stricter rules in other legislation or FCA rules, but may provide useful additional rights and remedies for consumers in individual cases.

- Unfair commercial practices prohibitions, as now updated in Chapter 1 of Part 4 of the Digital Markets, Competition and Consumers Act 2024 (DMCCA 2024). These include prohibiting the omission of material information that the average consumer needs to take a transactional decision.

- The Consumer Insurance (Disclosure and Representations) Act 2012 (CIDRA 2012) which requires insurers to prove before denying claims that a consumer has failed to take reasonable care regarding representations they have made when taking out insurance.

- The Insurance Act 2015 (IA 2015), which requires that insurers cannot rely upon breaches of terms in an insurance policy to limit or refuse claims unless the loss relates to those terms, as well as providing for an implied term that insurers must pay agreed claims within a reasonable time.

1.8 Evidence

Since summer 2024 when Which? launched its public campaign calling on the FCA to End the Insurance Rip-off, which targets poor value and treatment, we have published four reports (see Annex A for executive summaries) and a series of investigations. The four reports cover:

- FOS decisions involving delay, distress and inconvenience caused by insurers. We examined the text of over 8,500 decisions related to motor, home, travel and pet insurance. In each case, we examined an ombudsman’s reasoning for why a complaint was upheld, looking in particular at cases where an ombudsman found that an insurer had caused unnecessary distress and inconvenience, or an unfair delay.

- Consumer harm in the insurance claims process. 24 in-depth interviews with people who had recently made a claim, and an online survey of 3,322 recent insurance claimants.

- Consumer confusion around general insurance. Detailed qualitative work with 24 participants, followed by a depth interview to explore their experiences and perceptions in greater detail. This was followed by an online poll with a nationally representative sample of 4,000 UK adults.

- Potentially unfair flood and storm definitions in home insurance policies. We examined 133 recent policy documents from 67 providers; conducted a review of expert, industry, regulatory and ombudsman guidance on defining flood and storm; and conducted a nationally representative survey of 2,103 UK adults to establish consumer expectations around what constitutes flood and storm.

We have found compelling evidence of potential non-compliance with FCA rules, insurance law and consumer law. Key evidence that concerns us includes:

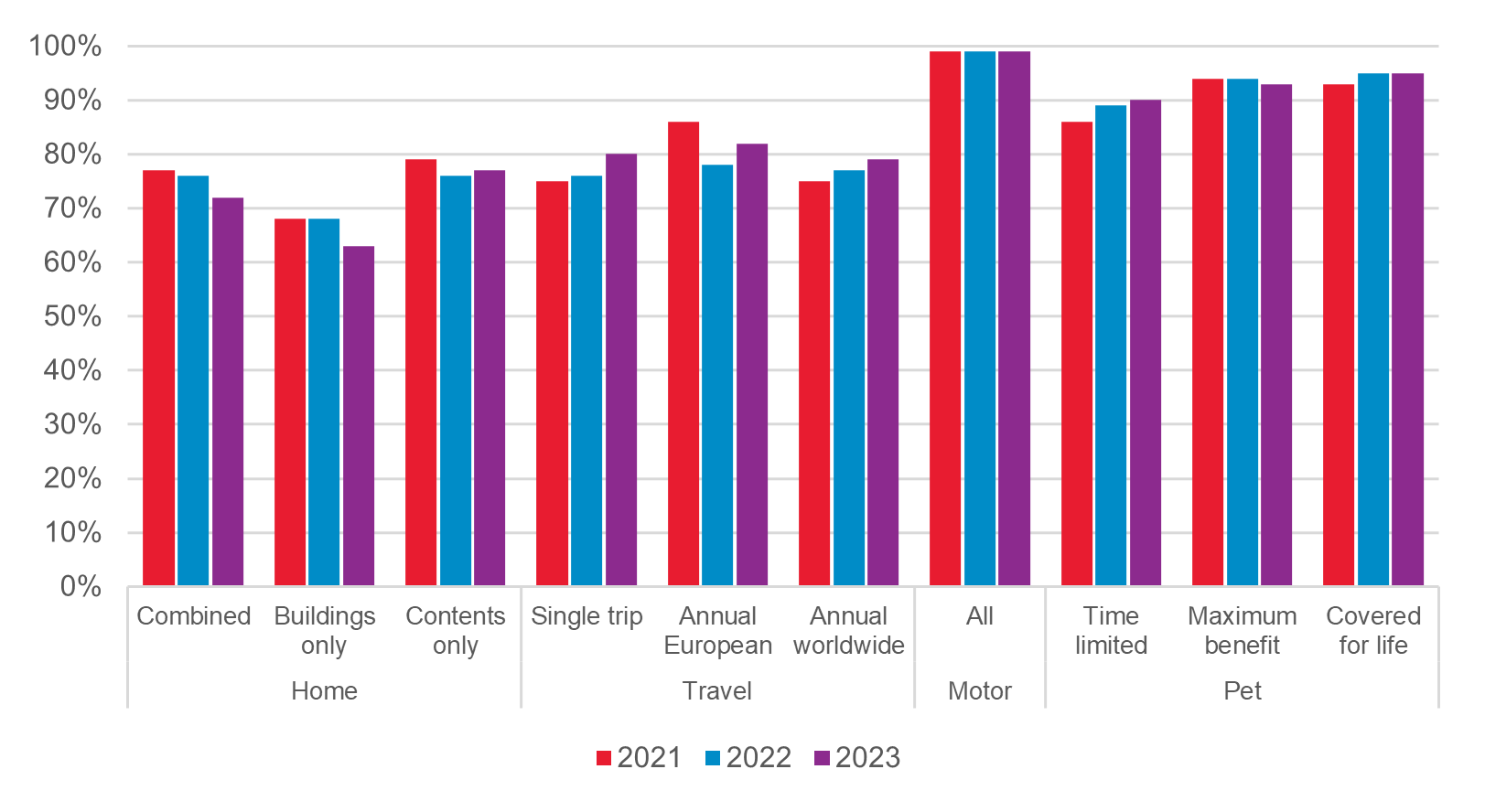

- Persistently low claims acceptance rates. The FCA’s data shows that, in 2023, less than two thirds (63%) of buildings insurance claims, three quarters (77%) of contents only claims, and seven in 10 (72%) buildings and contents combined claims were accepted. For travel insurance, around 8 in 10 (81%) claims were accepted [17]. This compares, for example, to motor insurance where 99% of claims were accepted.

- High rates of reported problems in claims processes. Over half (54%) of all people making a home or travel insurance claim experienced at least one problem in their claim journey [18].

- Worse reported claims experiences for people in vulnerable circumstances.People surveyed who were in vulnerable circumstances due to the event that led to their home or travel insurance claim, which included dealing with fires in their home or serious medical injuries when on holiday, were significantly more likely to experience a problem with their claim (69% compared to 39% of people surveyed not severely impacted).

- Claims-handling practices leading to negative impacts on mental health for those in vulnerable circumstances. Half (51%) of consumers surveyed who were severely impacted by their incident said their insurer’s actions negatively impacted their mental health.

- Levels and rates of upheld FOS decisions citing distress and inconvenience or delay hitting a five year high in 2023.Our analysis found that FOS decisions cited distress and inconvenience caused to consumers 1,321 times in 2023, with this harm appearing in 64% of upheld complaints. This was the highest number and proportion of harm cited in upheld complaints since 2019.

This super-complaint also includes new analysis providing further evidence of issues in these markets:

- New analysis conducted with Fairer Finance, exploring the possible factors leading to variation in claims acceptance rates between firms. It identified a handful of coverage areas, including connecting flights in travel insurance and storms coverage in home insurance, in which more restrictive policy wordings appeared to align with low claims acceptance rates. However, more interestingly, in many cases very similar or identical policy wordings were leading to vastly different claims acceptance rates. This suggests that the culture and behaviour of firms, particularly in claims handling, may be a significant cause of low claims acceptance rates.

- Legal analysis of a sample of policies and product information documents, conducted by an expert external barrister on our behalf. This identified a significant number of terms which are arguably unfair under the Consumer Rights Act 2015, not compliant with specific insurance legislation or in breach of FCA rules.

2 Poor claims-handling

The FCA’s recent findings in its 2025 claims-handling report have identified ‘many areas where improvements need to be made’ but where, in Which?’s view, it has failed to take appropriate action. These include:

- poor claims and supplier management, including oversight of outsourced claims-handling providers;

- ineffective communication with customers on expectations, progress and claims outcomes;

- failing to identify customers in vulnerable circumstances and support them appropriately; and

- insufficient claims governance, including the availability and use of management information.

In each case, Which? thinks the FCA has outlined insufficient action, and we are concerned this will result in ongoing consumer harm. We point to an array of evidence that these issues exist at a greater scale across the industry than the FCA has grasped in its recent review, and to the fact that similar issues were also identified by the FCA in 2014 or in more recent related reviews, and yet little change has been made as a result. This leaves us with little confidence that the limited steps the FCA has publicly announced that it is taking in response to the recent review will lead to the satisfactory resolution of these issues.

The FCA has missed or overlooked many important issues altogether. This is, in part, because its 2025 claims-handling report did not include a significant piece of research with consumers or industry professionals. Instead it relied instead on data collected by providers which is acknowledged to be substandard in places. This appears to have limited the FCA’s visibility of wider issues across these markets. The overlooked issues where the FCA has identified some indicators of harm, but does not appear to have a plan to take action to deal with issues, are:

- customers having to repeatedly provide information and evidence;

- comparatively low claims acceptance rates; and

- firms not addressing systemic issues identified from relevant Financial Ombudsman Service decisions.

Overall, these persistent problems show that many firms are not sufficiently focused on consumer outcomes, and there are major issues with governance, processes and culture.

Various FCA rules and wider legal obligations are applicable, including ICOBs 8.1.1.R obligations that claims must be handled promptly and fairly, the Consumer Duty principles to secure good outcomes for consumers, and the implied term under Section 49 of the Consumer Rights Act 2015 that services must be provided with reasonable care and skill. However, even if currently investigating these matters further, the FCA has also failed to properly consider the implications of more general relevant law such as on unfair terms, unfair commercial practices and insurance legislation.

The FCA’s response is insufficient. Further action is needed urgently for the FCA to fulfil its obligations to ensure adequate consumer protection.

2.1 The ‘many areas where improvements need to be made’ identified by the FCA where proposed actions are insufficient

The FCA’s 2025 claims-handling review identified ‘many areas where improvements need to be made’. Many of these showed evidence of persistent failings identified in previous FCA reviews as well as more recent research by Which?.

In each case, Which? thinks the minimal action taken by the FCA in response to the issues identified is inadequate, and will result in ongoing consumer harm. This is particularly the case where our evidence points to wider prevalence across the industry or where previous FCA reviews identified similar issues, including its last in-depth review of consumer general insurance claims-handling in 2014, which also focused on home and travel insurance.

2.1.1 Poor claims and supplier management, including oversight of outsourced claims-handling providers

Where firms are outsourcing or using a third-party provider, they are responsible and accountable for all the regulatory responsibilities applying to outsourcing and third-party arrangements (Section 9.40). This includes ensuring that the support provided by a third party meets the Consumer Duty standard, with firms having systems and controls in place to monitor this and provide assurance that it is meeting its regulatory obligations (Section 9.41).

The FCA’s Consumer Duty guidance specifically cites interactions with third parties as a potential source of detriment to consumers. It says firms should therefore consider the impact the use of third parties has on customer outcomes (Section 4.19), including poor hand-off processes and a lack of clarity for customers about how or where to access support (Section 9.10). The FCA also wrote to insurance firms prior to the introduction of the Consumer Duty to raise ‘working with other firms’ as one of the three key areas where firms should particularly focus their attention and ‘accelerate their work on this important aspect of implementation’.

All of the firms included in the FCA’s 2025 claims-handling review outsourced some part of their claims-handling. Across these firms, the FCA found that:

‘Some insurers had limited control over their outsourced claims handling arrangements [...] Where there is limited oversight, we have concerns about firms’ ability to ensure good consumer outcomes that are expected under the Consumer Duty.’

These findings are similar to those of the FCA’s 2014 claims-handling review, in which it found numerous instances of incorrect instructions being sent to suppliers, suppliers missing appointments to visit consumers in their property, and consumer dissatisfaction with workmanship or replacement goods. Only a third of Chartered Institute of Insurance respondents agreed that third party household suppliers were proactively managed. The FCA also reached the following conclusion about outsourced claims-handling:

‘At the moment it does not appear that insurers that delegate claims handling have the information, or the means to collect it, to show that consumer outcomes are being delivered which are comparable to those where claims are handled directly by the insurer.’

Our own research suggests little has changed over the last decade, and this is causing consumer harm. People surveyed who had made home or travel insurance claims which involved third parties – which can include other firms involved in claims beyond outsourced claims-handling providers – were significantly more likely to report problems (62%) than those without them (40%). These people were also significantly more likely to report having an overall negative insurance claim experience (26% compared to 16% amongst claims with no third parties). Often these problems were directly related to the third party’s involvement. Amongst claims involving third parties:

- 18% said there was poor communication between their insurer and third parties;

- 17% of consumers surveyed said it was not clear what their insurer’s and third parties’ roles were in their claim;

- 15% received conflicting information from their insurer and the third party; and

- 14% were not told why the third party was involved in their claim.

These issues can cause delays in resolving claims for consumers, and contribute to psychological harm, as in Karen’s case.

Karen’s experience with a third party exacerbated her anxiety

When Karen first contacted her insurer to make a claim for water damage stemming from a leak, she told them about her mental health problems. At first her insurer accounted for this, progressing the claim straight away.

However, as her claim progressed, she found it difficult to find out what was happening. Meanwhile, the assessor, charged with looking at the water damage, was not responding to her. Her insurer also failed to respond in a timely fashion.

'I was getting so anxious because no one was responding to my calls, my emails, like nothing. Why give me the mobile contact number and tell [me] to speak directly to your assessor if they don't pick up the phone or answer messages?'

'It was really stressful to even connect and speak to somebody. It caused an immense amount of stress and anxiety to me.'

Considering our own findings together with the FCA’s findings on outsourced claims in its 2025 claims-handling report, it seems that some firms may not be complying with their obligations to ensure that outsourced claims-handling providers are meeting regulatory requirements including the Consumer Duty. In our view, further investigation – and where required, enforcement – by the FCA is warranted.

2.1.2 Ineffective communication with customers on expectations, progress and claims outcomes

The FCA’s ICOBS rules (8.1.1R) include requirements for insurers to handle claims promptly and fairly, and provide appropriate information on its progress. The FCA acknowledges in its Consumer Duty guidance that ‘some claims may take longer to settle than others’, but it nonetheless makes clear that ‘firms should ensure they manage customers’ expectations throughout the claim journey by providing timely and appropriate communications.’

Despite these requirements, the FCA concluded in its 2025 claims-handling report that: ‘While many firms in the sample treated their customers correctly, we’ve found too many examples of customers not receiving the service they’re entitled to.’ Specifically, the FCA’s review found ‘issues relating to the ineffective management of customer expectations, particularly relating to timescales, and not making sure customers are kept updated on their claim’s progress.’

This followed the FCA’s 2014 claims-handling review where a significant share of consumer and industry respondents cited issues with customers being kept updated on their claims [19]. In its 2024 report on outcomes monitoring, the FCA subsequently said they ‘continue to see substandard service levels across insurance sectors’.

Unlike its 2014 claims-handling review which included research with consumers, as well as with industry professionals, the FCA did not conduct consumer research as part of its 2025 claims-handling report to understand the prevalence of these issues and the impact they are having on consumers. Instead, its recent work primarily focused on FCA data, firm’s internal data and case files, and reviews of firms’ processes.

Our consumer research with consumers who had recent experience of making a home or travel insurance claim further found that more than half (54%) of customers experienced a problem in their claims process. Two in 10 (22%) people making a claim in these markets had to chase for information on the status of their claim. Three in 10 people making a claim said that their initial contact did not leave them feeling clearer or more certain of their situation (29%). This uncertainty creates ongoing anxiety, and can worsen perceptions of the whole claims process: half (49%) of consumers surveyed who did not have a good initial contact ended up rating their whole claims experience as poor [20].

These issues result in widespread frustration and consumers having to invest a lot of time and energy in managing their claim. This evidence suggests that some firms may not be complying with their obligations under ICOBS 8.1.1R. It is also potentially indicative of non-compliance with legal obligations such as the Consumer Rights Act 2015 requirement to provide services with reasonable care and skill.

When a claim decision finally is reached, our consumer research with people who had made a home or travel insurance claim found that insurers are not consistently ensuring that their customers understand the reasons why a claim is being denied or only settled in part. One in four people surveyed whose claim was either only partially accepted or rejected said they were not given a reason why (24%); many of this group left feeling the decision was unfair [21].

This can reduce someone’s ability to challenge the fairness of a decision, to complain and to enforce their rights. Importantly, the Consumer Duty’s retail customer outcome on consumer understanding requires firms to meet customers’ information needs and support their understanding.

Which? research suggests that on a host of issues, requirements are not always being met. But we remain unclear what the FCA’s plans are to address these issues, both among the firms involved in its 2025 claims-handling report and in the wider home and travel insurance markets.

While the FCA has identified issues with some firms, by assuming that most firms treated their customers entirely correctly, without undertaking any consumer research to properly evidence this, the FCA is overlooking the prevalence of issues and scale of harm. This is especially concerning given the concerns the FCA has raised about firms’ use of management information to understand consumer outcomes. These limitations constrain what the FCA can understand about these markets, and require the regulator to find other ways to investigate firms’ compliance.

2.1.3 Failing to identify customers in vulnerable circumstances and support them appropriately

In some of the issues the FCA identified, it raised concerns about the potential impact on customers in vulnerable circumstances. It specifically cited concerns about some firms’ inappropriate use of cash settlements, which failed to consider customer vulnerability:

‘Some firms lacked oversight and monitoring of cash settlements, failed to consider customer vulnerability, and promoted cash settlements without ensuring good customer outcomes [...] We were concerned that some firms may be choosing cash settlements primarily to contain costs without considering customers’ best interests.’

This could leave people significantly out of pocket, and add further stress managing complex repairs to their home. Which? is unclear why urgent sector-wide action has not been taken by the FCA on the inappropriate use of cash settlements to prevent this ongoing harm from arising. The behaviour that the FCA is concerned about would clearly be in breach of various FCA rules such as the obligation to act in good faith towards customers.

Which? believes the FCA also missed many other systematic failings in firms meeting their obligations to customers in vulnerable circumstances. This is, in part, due to the FCA not conducting consumer research which is needed to better understand the challenges faced by consumers in different circumstances. We therefore believe that the FCA has not properly understood the significant harm being caused to consumers.

Firms are required under the Consumer Duty to support customers in vulnerable circumstances, and ensure they experience outcomes at least as good as other customers. ICOBS rules also specifically make clear for insurers that the level of support needed for customers who have characteristics of vulnerability may be different from that for others, so they should take particular care to ensure they act to deliver good outcomes for those customers. Under the FCA’s vulnerability guidance, firms should also ensure that they have systems and processes that allow customer service staff to record and access information that will be required in the future to respond to vulnerable consumers’ needs.

Our consumer research has found that many firms’ claims-handling processes are disproportionately impacting people in vulnerable circumstances due to the impact of the event that led to their claim. People we surveyed who were severely impacted by the event leading to their home or travel insurance claim were significantly more likely to report problems (69% compared to 39% of people not severely impacted) [22]. This includes people who have suffered medical emergencies on holiday or a fire in their home. Insurers should not have issues identifying this vulnerability and they should clearly be providing additional support in such circumstances.

Firms may argue that claims where customers were severely impacted by their incident are by their nature more likely to have problems because of their complexity. However, the FCA is explicit that ‘Firms should take additional care to ensure they meet the needs of consumers at the greatest risk of harm.’

While most consumers have a positive experience of the initial step of reporting their incident to their insurer, too often the chance to identify vulnerability and offer appropriate support is being missed. In particular, Which? research has identified that insurers are regularly failing to identify and respond appropriately to consumers experiencing low emotional resilience because of the incident which led to their claim. This is despite the FCA’s vulnerability guidance making clear that firms should understand what characteristics of vulnerability are likely to be present in their customer base, and take additional care where necessary.

These issues are having a significant impact on people who are often already struggling with the event that led to their home or travel insurance claim. Half (51%) of consumers surveyed who were severely impacted by their incident said their insurer’s actions negatively impacted their mental health, compared to just 11% amongst those not severely impacted by their incident. And four in 10 (42%) consumers surveyed with pre-existing mental health problems felt their insurer’s actions negatively impacted their mental health [23].

One example of poor processes directly causing harm is whereby customers have to unnecessarily repeat traumatic details of events, causing emotional distress. A quarter (26%) of people severely impacted by the incident that led to their travel or home insurance claim said they experienced emotional distress having to repeat traumatic details, compared to just 3% amongst those not severely impacted by their incident [24]. This is clearly at odds with the FCA’s vulnerability guidance which says that ‘consumers should not have to repeat information’. Tara’s case illustrates the harm this can cause:

Tara’s insurer did not record important case details

Shortly after her husband’s death, Tara was burgled and many items with sentimental value, including her husband’s expensive road bike, fishing equipment and gardening tools, were stolen.

Tara's insurer failed to record the information she gave about her husband’s death and act appropriately. On multiple occasions Tara had to repeat herself.

'I was just having to keep explaining myself. And I'm like, I’ve already told you all this once. It's horrible because I didn’t feel like I was getting anywhere and I don't want to keep reminding myself of what's happened. It's enough going through a death without having to think I've got to talk about all that [again and again].'

At one point Tara was asked by the insurer for receipts for the items stolen. When she said she did not have them, her insurer asked 'where’s your husband?', despite their knowledge of his death.

These interactions caused Tara significant distress, and she eventually accepted a reduced settlement of her claim just to find closure.

These findings show significant harm being caused to customers in vulnerable circumstances. Which? is particularly concerned by the impact that firms’ treatment of customers is having on their mental health. The FCA’s Consumer Duty expectation that firms should provide outcomes at least as good for customers in vulnerable circumstances is clearly not being met. Tackling the scale and severity of harm, and non-compliance, should be an urgent priority for the FCA but its current conclusions and plans are far from sufficient.

2.1.4 Insufficient claims governance, including the availability and use of management information

The FCA’s 2025 claims-handling report found that ‘firms were often less able to show how their governance arrangements were helping them oversee their claims handling arrangements effectively.’ The FCA saw evidence of this ‘resulting in poor customer outcomes’ and ‘ongoing customer harm’. This included examples where firms had identified a lack of customer understanding of the cover provided but not acted to address this.

The FCA’s report found that one cause of this was that some firms produced poor quality management information and failed to use it properly to assess customer outcomes, including for vulnerable customers. This followed a 2024 FCA report looking across 20 large insurance firms which found that ‘many firms’ needed to make improvements in their monitoring of consumer outcomes.

These issues can have wide-ranging consequences for firms’ ability to meet their regulatory and legal obligations in a variety of areas, including claims-handling arrangements, product governance, sales processes and customer support – which the FCA expects firms to alter to address poor outcomes.

On firms’ approaches to claims, the FCA’s 2025 claims-handling report found that over a quarter of firms reviewed lacked a documented oversight framework or policy to ensure consistency in their claims oversight [25]. Without these frameworks or policies, firms are much more likely to handle claims unfairly and to fail to spot poor customer outcomes. The FCA seemed to underestimate how much harm this may be causing.

The FCA cited an example of good practice being: ‘We saw a small subset of firms encouraging claims handlers to look for ways to pay rather than reject a claim'. However there was no corresponding conclusion reached about the vast majority of firms that were not doing this. The FCA should have raised concerns about these other firms’ approaches to paying claims, with the clear implication being that most firms looked for reasons to reject claims. This is despite the expectation of FCA rules that claims must not be rejected unreasonably (ICOBS 8.1.1R), firms must act honestly, fairly and professionally in accordance with the best interests of customers (ICOBS 2.5.-1R), and that firms must act to deliver good outcomes for consumers (PRIN 2.1.1R).

While the FCA specifically raised concerns about low claims acceptance rates for storm claims, in its report it primarily proposed action with the industry on improving consumer understanding of policy terms. The FCA found weaknesses in firms’ storm definitions, with firms failing to clearly define what constitutes a ‘storm’ and the specific conditions for storm damage coverage. It said firms should ‘consider whether their policies are meeting customer needs and whether action is needed to improve consumer understanding of policy wording'. It specifically cited ‘the lack of clarity around wear and tear and storm damage’. This followed similar findings published by Which? earlier in 2025.

Despite the FCA finding that around half (49%) of storm claims were rejected outright and five firms accepted less than 30% of claims, it concluded that ‘in most cases, claims that were rejected or not continued by the customer had valid reasons for not being successful under the policy terms'. However, as this review only included a small number of firms, the observation that only ‘most’ claims for storm damage were rejected for valid reasons is a major concern. If, as the FCA’s comment suggests, there are cases where firms have unreasonably rejected a claim, those firms will have fallen foul of the FCA’s rules including ICOBS 8.1.1R.

We sought further details of what the FCA was doing to address issues with claims-handling via a Freedom of Information request in August 2025. In response, the FCA said that on storm damage claims there were ‘widespread issues around consumer understanding and specific issues around claims handling in a smaller number of firms’. It also said ‘we believe these issues are best addressed through a combination of wider industry recommendations and actions allied to individual firm feedback and actions' [26]. However, we are currently uncertain as to what action the FCA will take to address unfair storm claim decisions, both in those firms where specific issues were identified in the recent review, and across the industry more widely.

For other types of claims, the FCA’s claims-handling report said that generally where it has found poor practices affecting customer outcomes, firms will be required to take corrective action. However, commitments to specific actions were lacking. This is despite the FCA’s findings on claims governance which suggests that issues with claims handling could be much more widespread than claims for storm damage that the FCA has chosen to focus on, and be due to broader issues with firms’ practices, and how firms monitor and review claims outcomes.

2.2 The issues the FCA has overlooked

In addition to the issues described above, where the FCA has identified problems but failed to take adequate action to protect consumers from harm across the home and travel insurance markets, Which? has also identified a number of issues. In some cases, the FCA has either acknowledged a problem amongst firms reviewed, but failed to identify any planned actions as a result, and in others, it seemingly overlooked evidence of problems.

2.2.1 Repeated requests for information and evidence

An issue identified in our consumer research, but not by the FCA in its July 2025 claims-handling report, is consumers experiencing repetitive or sequential requests for similar information and evidence when making a claim. This can be hugely frustrating for consumers and it can erode their trust and confidence in their insurer and its agents’ abilities to properly carry out a task. One in four (25%) people making a home or travel insurance claim had to repeat information or repeatedly share documentation and evidence multiple times during their claims process. People making a home or travel insurance claim also reported evidence requests coming in dribs and drabs, resulting in them spending more time gathering this information. 20% of those surveyed who were asked to submit evidence were asked to provide additional evidence following their initial submission. One in four (27%) people said that going through their claim took up a lot of their time and effort and a third (34%) felt their insurer’s actions negatively impacted their time available to do other things [27].

That is when they just want me to repeat again exactly what happened. It makes you feel like how long is this going to go on for if they keep asking the same questions? Obviously I expected to be questioned because again, it's a financial service, so they needed to get the details and I sent everything I had. I expected to send paperwork… But having the same conversation three times I thought was well over the top.

Source - Which? claims handling research

These findings echoed similar results from the FCA’s research in 2014, where both consumers and insurance professionals identified the need to reduce the number of times that consumers were required to repeat themselves while making a claim.

Sam’s case demonstrates the emotional harm this poor claims-handling practice can cause. One in three (34%) consumers with home or travel insurance claims surveyed who had to repeatedly share documentation and evidence said they experienced emotional distress having to repeat traumatic details surrounding their claims.

Sam’s experience of repetition

Sam and his family were in a particularly stressful and vulnerable position after a major life event. Sam’s dad had a major stroke shortly before their planned holiday abroad. Following the stroke the family decided they had to cancel their holiday and contacted firstly their holiday provider and then their insurer. They experienced repetition throughout their contact with their insurer:

'Every time you phone you get put on hold and then you have to speak to somebody and every time you speak to them, you have to tell the story [of your dad’s stroke]. And then I have to read the notes and this is all going on while my dad is in recovery'.

On multiple occasions, Sam had to supply evidence he had already given but what he found most frustrating was that additional requests came in dribs and drabs.

'10 days after submitting some evidence we got another email to say we just need a copy of this and a copy of that. It was very much us reacting to them. We kept getting emails saying we need further kind of evidence and further'.

Sam said he thought, 'Fine, if you need further evidence, but it would be much better to be clear upfront of what the criteria is and what they need'.

Diane experienced similar delays in processing her claim, which led to a deterioration in her physical health.

Diane’s experience of repeated evidence requests

'They said we need more photos… I think [the carpet] was already starting to smell. It was days after the photos came through, and then they wanted more photos, you know, a couple of days elapsed in between'.

'We'd send them photos, hear nothing. So then we chased them up again. And I think because two or three different people were dealing with it, they obviously weren't communicating. It just took forever'

'Everything was reactive [from the insurer]... I felt like they were just playing for time… what we sent them was good enough'.

'They took so long to get somebody over to us. I went to the doctor and was diagnosed with aggravated asthma. The doctor said it was from the mould spores'

Our research also identified that some evidence requests were unreasonable, intrusive or disproportionate, further delaying claims processing. Collecting evidence can often be very time consuming for people, requiring a trip to the doctors, or digging through years’ worth of receipts, for example. Lydia’s case study illustrates the issues.

Lydia experienced unreasonable evidence requests

Lydia needed to claim on her travel insurance after her father-in-law had a heart attack which meant they needed to cancel a family holiday. More than three months into the process of making her claim, she was asked to provide two years’ worth of medical records for her father-in-law. This was emotionally draining for Lydia. She was also hugely frustrated as the request felt intrusive and excessive as they had already paid for and supplied a doctor's note weeks prior.

'[Two months into the claim, after hearing nothing for a month] they call me saying we haven't got everything we need to complete your claim. So I said, well, what could you possibly need now? They were asking for two years’ worth of medical history for my father-in-law'

'I think it's intrusive to ask somebody to look at their medical records for two years. It felt like a smokescreen for another delay. It was so blatant and it tipped me over the edge emotionally… I felt like it was a trick'.

She remembers saying to her partner 'I can’t believe they’re doing this…I just can't believe this is happening. And he said, ‘well, you know what insurance companies are like'. And I'm like, no, they're regulated, this shouldn't be allowed to happen'.

Lydia was right that this further request was unreasonable.

'I phoned and told them it was intrusive and asked them to explain why they [needed that information]. They couldn't explain why. They asked if I wanted to make a complaint, and then they came back and I spoke to a lovely lady who apologised to me and said the claim should have been paid out already. She admitted that they've done it all wrong'.

For this ordeal Lydia was given £150 compensation. Lydia estimated that she had over 20 phone calls with her insurer during her whole claim and these calls took over 25 hours in total.