MEMBER EXCLUSIVE

Members can use GoSimpleTax to file to HMRC at a great price and avoid costly accountant fees.

Get startedBy clicking a retailer link you consent to third-party cookies that track your onward journey. This enables W? to receive an affiliate commission if you make a purchase, which supports our mission to be the UK's consumer champion.

Child benefit is a monthly government payment to anyone who is responsible for a child to help pay for anything they need and boost your household budget. It can only be paid to one person, and you don't necessarily need to be the child's parent to receive it, but you must be responsible for a child.

Depending on your income, you may not benefit financially from receiving child benefit payments. But it's always worth signing up – even if you choose to opt out of receiving the payments – as the benefit is linked with National Insurance contributions, and could affect your eligibility to claim the state pension.

This guide explains how child benefit works, who is eligible to receive it and what the rates are.

Eligibility for child benefit is not means-tested, although households in which someone earns £60,000 or more will have to pay some or all of it back. The payments you receive are based on how many children you're responsible for.

There's a higher rate for the eldest (or only) child, and then additional lower rates for any younger children.

In the 2025-26 tax year, you'll receive £26.05 a week for your eldest or only child and £17.25 for each additional child.

There is no upper limit to the number of children you can claim for.

| Number of children | Weekly child benefit | Annual child benefit |

|---|---|---|

| 1 | £26.05 | £1,354.60 |

| 2 | £43.30 | £2,251.60 |

| 3 | £60.55 | £3,148.60 |

| 4 | £77.80 | £4045.60 |

| 5 | £95.05 | £4,942.60 |

Members can use GoSimpleTax to file to HMRC at a great price and avoid costly accountant fees.

Get startedUse our child benefit calculator to find out how much you'll be paid based on how many children you're responsible for, how much you earn and, if you have a partner, how much they earn.

This calculator has been updated for the current 2025-26 tax year and the upcoming 2026-27 tax year. Just use the dropdown menu to select the year.

While child benefit isn't means-tested, you'll pay an additional tax known as the 'high-income child benefit charge' (HICBC) if you or your partner has an annual income over £60,000 (in the 2025-26 tax year).

The tax charge equates to 1% of the child benefit paid for every £200 of income between £60,000 and £80,000. If either you or your partner earns more than £80,000, the tax means you'll pay back your entire child benefit entitlement.

HMRC defines a partner in this case to be someone you're not permanently separated from who you're married to or in a civil partnership with, or living together as if you were.

The threshold is currently based on the individual income of the highest earner. The tax charge must be paid by whoever earns the high salary via a self-assessment tax return.

If your income is £66,000 and you have one child, you will be paid £26.05 a week, or £1,354.60 a year.

Your income over £60,000 is £6,000, so you will be required to pay tax of 1% for every £200 over £60,000.

£6,000/200 is 30, so you will need to pay 30% of your child benefit back as a tax charge.

£1354.60 x 30% = £406.38

If you receive child benefit and aren't working, you will automatically qualify for National Insurance credits. These can build up your entitlement to the state pension.

For this reason, it is worth at least signing up for child benefit if you're staying home to care for children, even if your partner earns more than £80,000.

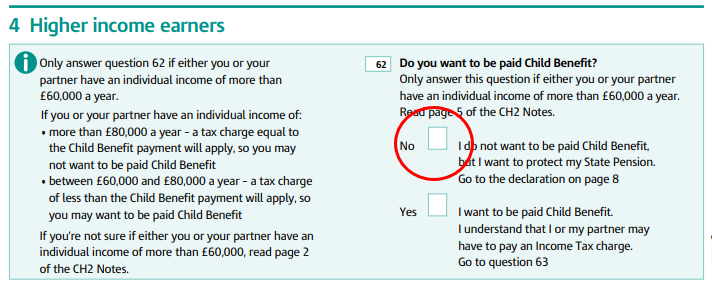

When you submit the claim, you can mark a tick box and choose not to receive payments. This will ensure you receive National Insurance credits, but won't receive or be taxed on any money.

You just need to tick the 'No' box (circled), found in section 4 of the child benefit claim form to receive National Insurance credits, to opt out of payments.

If you've missed out on National Insurance contributions as a result of not claiming child benefit, you can still fix the gaps in your record by making voluntary Class 3 contributions.

Anyone who is responsible for a child under 16, or under 20 and in an approved form of education or training, is eligible for child benefit.

Approved forms of education include A-Levels, Scottish Highers and NVQs, but not university degrees or BTEC Higher Nations Certificates. If the child is in education or training, they must have been accepted onto the course before they turn 19.

You're usually considered responsible for a child if you live with them or you're paying at least the same amount as child benefit (or the equivalent in kind) towards looking after them.

If your child lives with someone else, you'll usually get child benefit for eight weeks after they move away, if no one else claims within that time.

Payments can continue for longer if you make contributions towards the child's upkeep, but you should contact the child benefit office to let them know that your circumstances have changed.

If your child goes into hospital for more than 12 weeks, or into care for more than eight weeks, then your child benefit payments may be stopped.

There are exceptions to this, such as if:

You can claim child benefit online via Gov.uk any time from 48 hours after you've registered your child's birth. HMRC says payments could arrive in as little as three days, and payments can be backdated for up to three months.

You can also claim using the old paper form, but it can take up to 16 weeks to process a claim this way.

When you claim with the paper form, you need to send your child's original birth or adoption certificate in with it.

If it's taking a while to receive the birth or adoption certificate, you should still send in the claim form and then send the certificate separately when you have it.

If you've lost the birth or adoption certificate, you can order a new one online.

There is a way for high earners to pay less tax on their child benefit payments.

When calculating how much child benefit must be repaid via the tax charge, your 'net-adjusted income' is taken into account. The net-adjusted income is what you have left after other deductions from your salary, such as pension contributions.

By making higher deductions, such as pension contributions, you can reduce your net-adjusted income and increase the amount of child benefit you'll receive.

Say you have one child and earn £65,000 a year, but you make pension contributions of 3%. Your net-adjusted salary is £63,050 (£65,000 - £1,950).

On a salary of £65,000, you'd pay a tax charge of £338.65, leaving you with £1015.95 in child benefit.

But with your adjusted salary of £63,050, you'd pay a tax charge of £206.58, leaving you with £1,148.02 from the benefit.

If you earn more than £60,000 you could, therefore, consider increasing your pension contributions in order to lower your adjusted net income and increase the amount of child benefit you're entitled to.

It is also possible to reduce your adjusted net income by making charitable donations through Gift Aid, or by offsetting dividend losses you've made in the stock market.

If there are changes to your family life, you need to tell the child benefit office as they could affect your child benefit payments.

Failing to do so may mean you don't get all the money you're entitled to, or you may be overpaid and will have to pay your money back at a later date.

You should contact the child benefit office if:

You should include the date that the change took place.

Use the jargon-free calculator provided by GoSimpleTax to complete and securely submit your tax return direct to HMRC.

Calculate your tax bill