Make money make sense

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

Whether it’s totting up tax bills or dealing with disputes over a will, being the executor of someone’s estate can be a thankless task. And that’s assuming you have the basic tools to manage the money.

While not a legal requirement, executor accounts separate the estate’s funds from the executor’s personal finances, making it easy to manage payments and keep transparent records.

But when we surveyed 11 major providers based on market share, five didn’t offer this service.

Here, Which? explores which major banks offer executor accounts – and the lengths you might have to go to to open one.

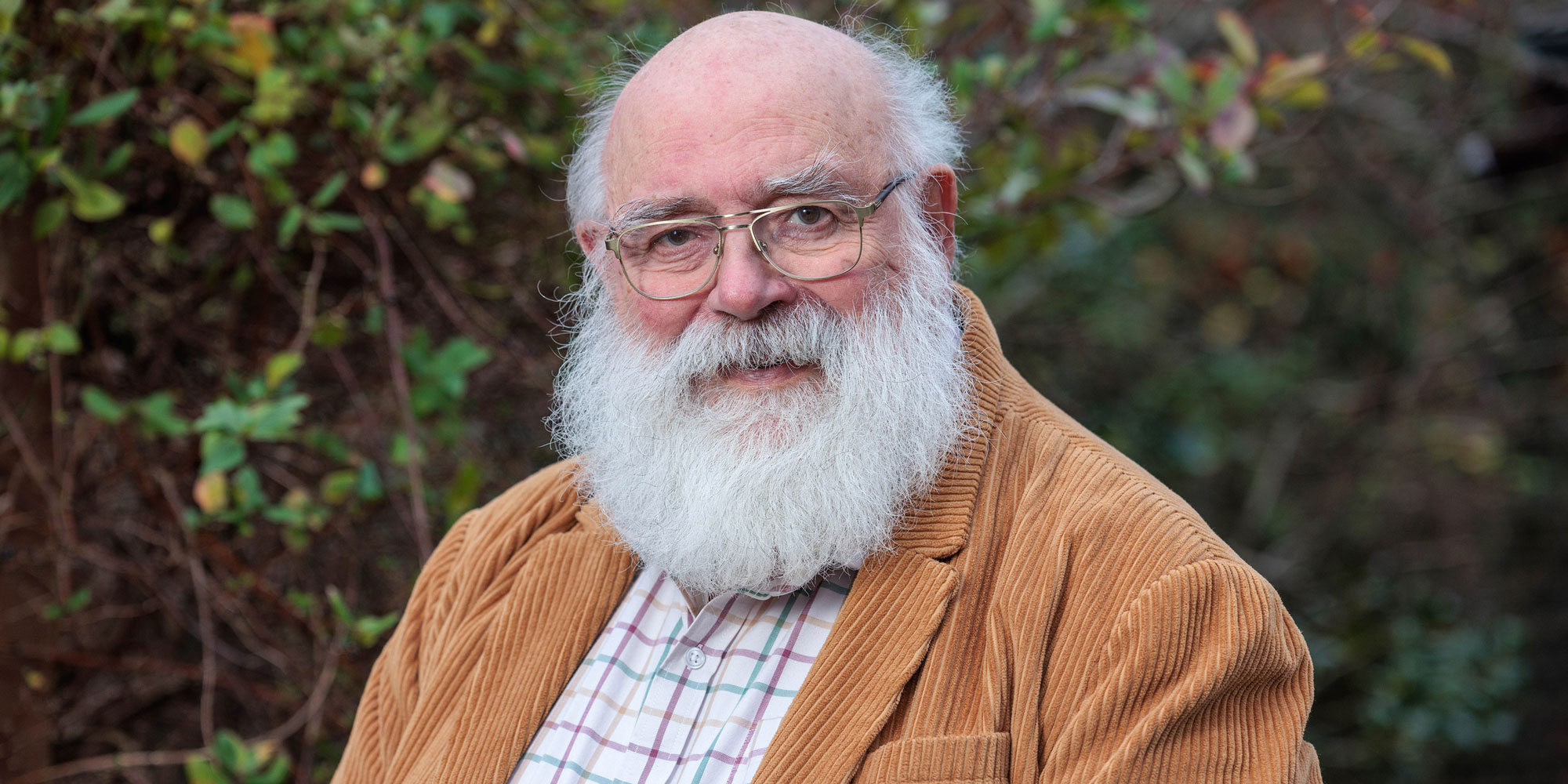

Ron Barker felt let down by banks after his wife's death

Ron Barker, from Merseyside, told us that he was turned away by both Nationwide and TSB when he tried to open an executor bank account to administer his late wife’s estate last year.

And Ron's experience appears to be part of a wider trend. We surveyed 11 of the biggest providers in December 2025, and five don't offer executor accounts: First Direct, Monzo, Nationwide, Santander and TSB.

When we asked why, Nationwide told us it supports executors by enabling them to manage the estate through established bereavement procedures and services. First Direct, Monzo, Santander and TSB didn’t comment.

Six of the banks we surveyed told us they offer executor accounts (see table). Bank of Scotland, Barclays, Halifax and Lloyds also offer savings accounts for executors, albeit with below-inflation interest rates.

All the providers that offer executor accounts said they support online banking, and funds can be transferred online and via the app, by phone, in branch or by cheque. Restrictions may apply in the case of multiple executors.

| Provider | Ways to apply | Existing customers only? | Online banking supported? | Offers accounts that pay interest? |

|---|---|---|---|---|

| Barclays | In branch only | No | Yes | Yes |

| HSBC | Branch or banking hub | No (a) | Yes | No |

| Lloyds, Halifax and Bank of Scotland | Branch, online, phone, app | Yes - executor or deceased | Yes | Yes |

| NatWest and RBS (b) | In branch only | No | Yes | No |

Source: Which? provider survey December 2025. (a) Account can be opened only by executors acting in a personal capacity. (b) RBS isn't among the biggest providers we surveyed for this story, but we have confirmed it offers executor accounts.

Even when dedicated accounts are available, applying for one can prove an uphill struggle. And it could be about to get harder.

Ron said he went to a Barclays Local (which provides banking support in community spaces) after being turned away by Nationwide and TSB, but discovered that an executor account must be opened in a branch.

Barclays has closed Ron’s local branches in Formby and Great Crosby, so this would mean a 20-mile round trip to Southport, along with his co-executor.

Barclays, HSBC and NatWest all require executor accounts to be opened in person.

Two thirds of the UK’s bank branch network has closed in just over a decade.

Barclays told us this is because customers must provide an original copy of probate or letters of administration, while HSBC pointed to the complexity of the process and review of legal documentation. NatWest said it’s looking at how it streamlines and digitises its executor account process where possible.

Yet banks’ insistence on in-person applications for executors contrasts with their record of closing branches.

Two thirds of the UK’s network has closed in just over a decade. Since 2015, Barclays has shut 1,236 branches, NatWest 1,009 and HSBC 743 (HSBC has said it won’t close any branches this year).

Community banking hubs have been touted as an alternative, but they don’t always offer the same services as a traditional bank.

Of the providers we surveyed, only HSBC allows customers to open executor accounts in a hub. Bank of Scotland, Halifax and Lloyds allow executors to open an account online (with help in a hub if needed), but either the executor or deceased must be (or have been) a customer.

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

Ron told us it took a couple of weeks for the account to be opened at Barclays, and at first, it seemed there was no way to make online payments.

He said that all the staff he dealt with were excellent, but the bank’s systems let them down. He said: ‘It felt like the bereavement department were the only people who understood how this type of account works… the staff member who helped me in the branch confessed it was the first executor account she’d ever dealt with.’

Barclays told us it’s sorry for the inconvenience Ron experienced and appreciates how important it is to make this process as smooth as possible: ‘As executor accounts are specialist, they require additional steps for security and legal reasons. We were pleased to resolve [Ron’s] online banking issue promptly and are committed to improving clarity and support for customers in similar circumstances.’

You can use our table to see which major banks offer executor accounts. The process may be easier if you choose your own bank – for example, banks that are part of the Lloyds group allow existing customers to open executor accounts online – but it’s not necessarily the case.

You may need to make an appointment if your bank requires you to visit a branch.

If you’re opening an account with a joint executor(s), check whether you will need to attend at the same time, or if you’ll be able to verify your documents at separate visits (for example, if you live far away from each other).

You’ll generally need proof of probate or confirmation to open an executor account, as well as ID. Some banks also require the deceased’s death certificate and an original or certified copy of the will.

You might be able to open an executor account while you’re waiting for probate, but there will usually be restrictions on the account until it’s granted. For example, NatWest will allow you to receive payments and pay funeral expenses only until probate is granted.

Which? lawyer James Buchan says a dedicated executor account is the best option, but there are alternatives if you’re having trouble opening one.

‘Open a new current or savings account, so there’s no chance of the money accidentally being used for other things and any interest earned can be easily identified.

'If you’re able to, name the account, so you can identify it easily. Also, use a specific reference when making payments to beneficiaries, so they know where the money has come from.'