Make money make sense

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

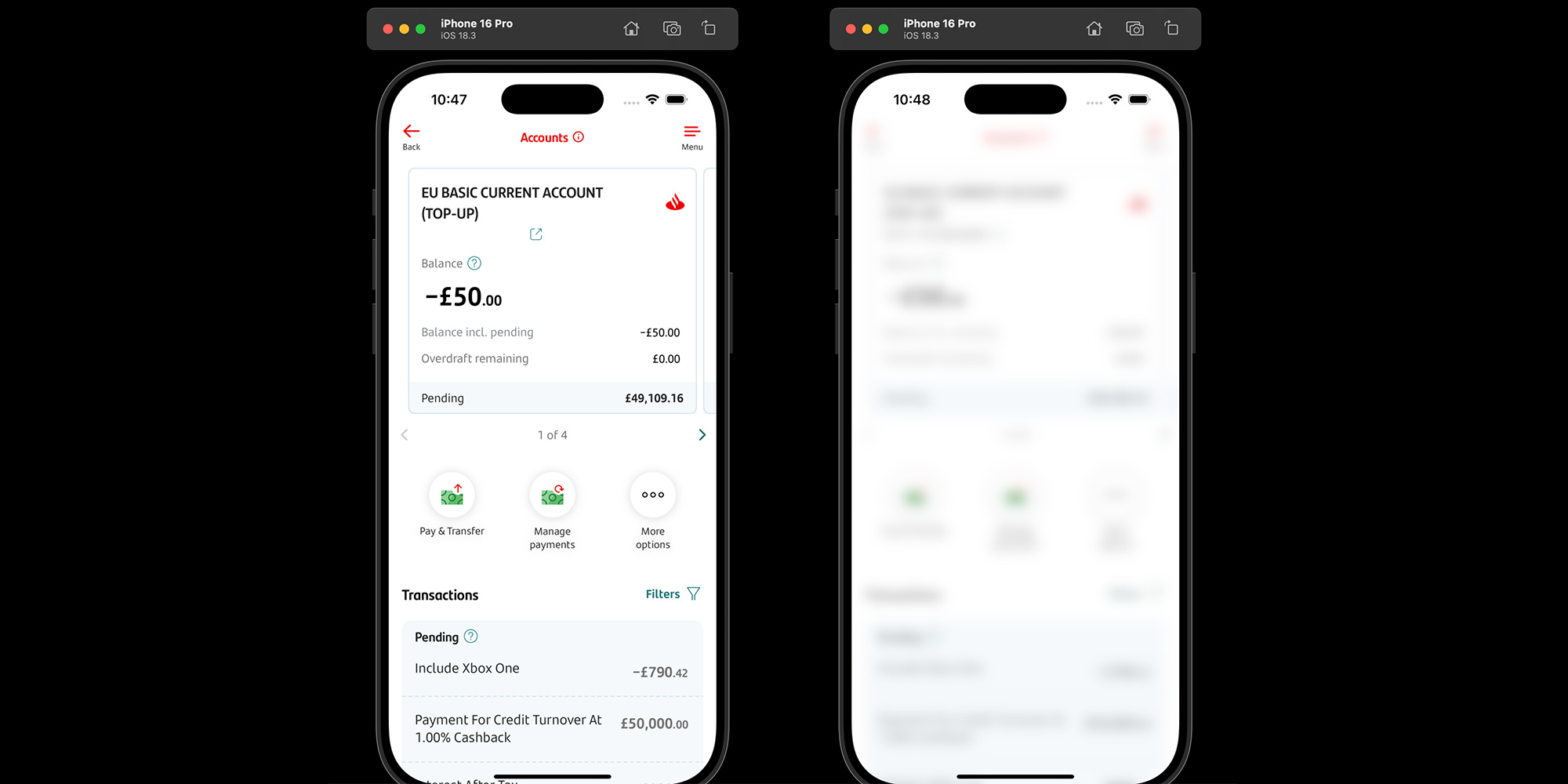

Santander’s latest app feature aims to protect customers from scams involving remote access or screen-sharing tools by blurring their screens when the software is detected.

Which? has issued many warnings about scammers using tools such as AnyDesk and TeamViewer to take control of victims' devices and steal their money or personal information over the years. And we've called on banks to step up to better protect customers.

Here, we take a look at how Santander's new app feature works and see what other banks are doing to combat fraud.

Santander’s own data shows that its customers lost more than £1.8m to scams involving screen sharing and remote access technology in 2024.

These tools let you use one device to access another from any location, entering a simple passcode to connect the two. They let someone access your computer over the internet, and are used by legitimate businesses such as the Which? Tech Support team and many other IT support firms.

But criminals posing as your bank, your telecom provider or perhaps a technical adviser from Microsoft, might also request that you download these programs, claiming that they will 'fix' a spurious problem or 'check your system' for non-existent viruses.

One of the worst cases we came across resulted in a Which? member losing £80,000 after a 'BT engineer' phoned about service problems in the area.

Santander previously showed customers a warning that screen-sharing technology had been detected on their device.

This latest update builds on this by making their banking app automatically blur, shielding their personal information. The bank says it will also block banking actions when it detects screen-sharing technology.

This feature is only available to customers using its OneApp banking app on Apple IOS18 and above at present, although the release will be live to Android customers in the near future.

Chris Ainsley, head of fraud strategy at Santander UK, said: ‘As technology advances, so do scammers. We have a range of specific warnings for customers, but these criminals are clever and will talk their way into accessing a customer’s personal information. Our latest development catches the social engineering in action, protecting customers who are often caught up in a moment of panic.’

Banks must continually adapt to keep up with the tactics of cyber criminals, so Which? has been encouraged to see more innovation in the past year.

One major driving force is banks becoming liable to reimburse customers who inadvertently send money to scammers.

Under the mandatory authorised push payment (APP) scheme, which came into force on 7 October 2024, both sending and receiving payment providers split the cost of reimbursement 50:50. Only UK bank transfers are covered, not payments to foreign accounts or other payment methods such as card payments.

All banks should be harnessing the latest technology, such as artificial intelligence (AI), to protect you behind the scenes, but some banks are taking additional steps to thwart scammers. For example:

Another anti-fraud initiative you should be aware is call 159 which puts you through to your bank’s fraud team if you wish to confirm that a caller is genuine and not a bank impersonation scammer.

Ask your bank what else it offers to help keep you safe. For example, the majority of banks let you temporarily block your card in-app without having to call or visit a branch.

If you bank with Barclays, Chase, Lloyds Banking Group, NatWest, Santander, Starling, or TSB, you can also block remote purchases made online, over the phone and by mail order.

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.