Make money make sense

Make every penny count with expert, impartial advice for just £49 a year

Join Which? Money

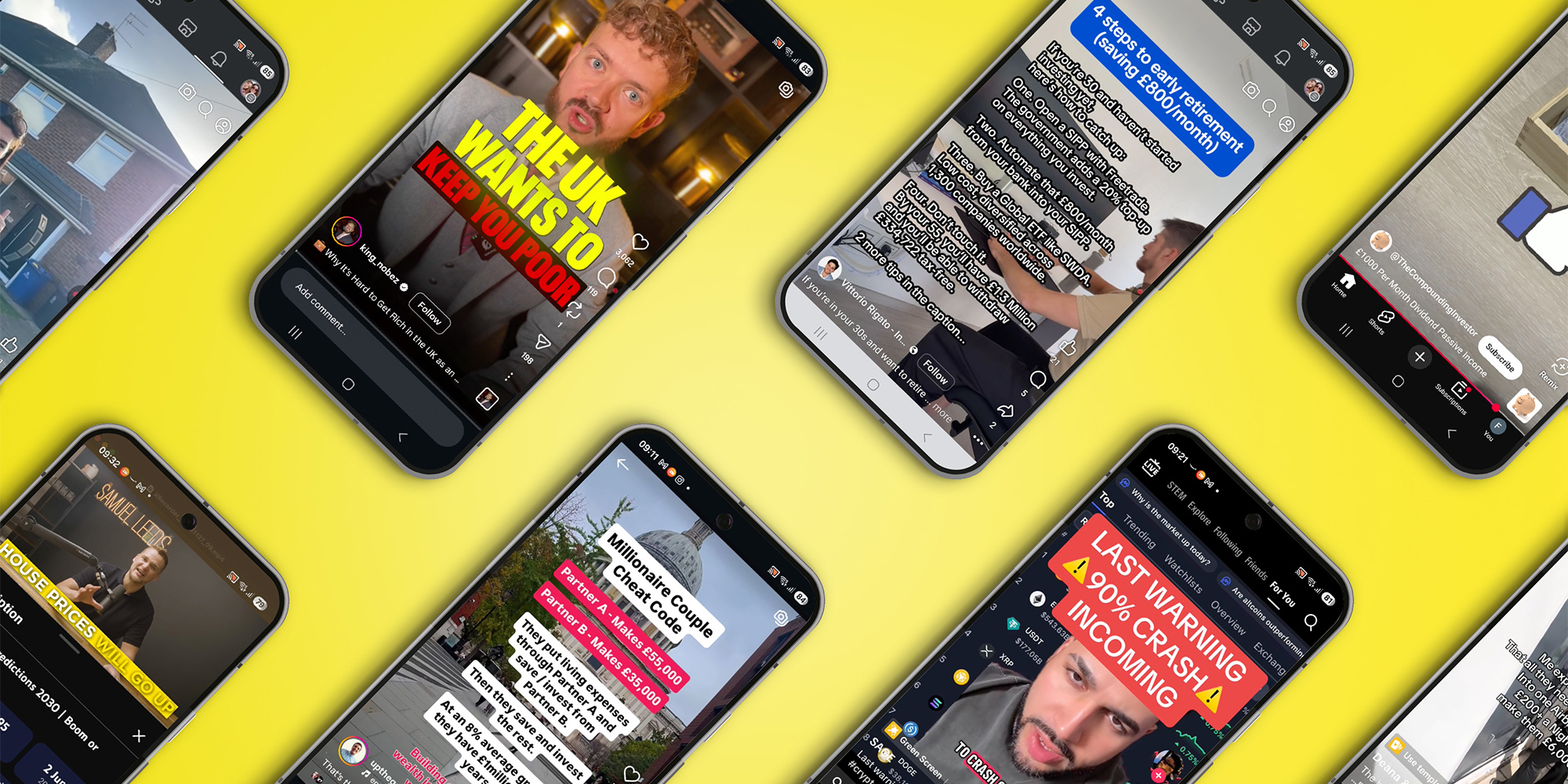

Think you’re safe from dodgy financial advice on social media, simply because you don’t seek it out? Think again. Research by TSB last year found that 83% of social media users had seen financial advice content they hadn’t even been searching for.

Some of this content can be helpful in educating the public about their finances, but not all of it is harmless.

The strategies promoted by financial influencers, or ‘finfluencers’, seep into wider culture in the form of mantras lacking in nuance, repeated by well-meaning friends and loved ones: ‘We need to create more passive income.’ ‘You should invest in cryptocurrency.’ ‘Have you considered a side hustle?’

TSB found that 90% had seen an investment ‘opportunity’ on social media, with over 43% considering investing as a result. Of the 31% who acted on financial advice from social media, more than half (55%) had lost money.

Which? recently analysed widely available finfluencer content with the help of a leading financial expert. What we found caused us serious concern.

The eight examples we selected for this investigation were either served to us by the platform (Facebook, Instagram, TikTok or YouTube) or easily found using common search terms relating to investments, tax, property and passive income.

We felt that all eight displayed one or more troubling features such as oversimplifying a complex subject, making guarantees of returns, not citing sources for data or including disclaimers, and creating a sense of urgency.

We shared them with Dr Robin Keyte, a chartered financial planner who has worked with the Financial Conduct Authority (FCA) in various roles over 20 years, including the Smaller Business Practitioner Panel, Financial Advice Market Review Expert Panel and Advisers Sustainability Group.

When Dr Keyte shared his analysis with us, several common themes emerged.

Two videos – one by ‘property expert’ Abi Hookway on Facebook and another by ‘property entrepreneur, investor, mentor and bestselling author’ Samuel Leeds on YouTube – make similar claims about house price growth.

Leeds says house prices have doubled every decade for the past century, while Hookway claims a buy-to-let house she has bought will double in value ‘every 10 years til I’m 100’.

Dr Keyte describes Hookway’s statement as ‘very misleading’ and says the data doesn’t bear out claims about doubling, either in the future or the past: ‘To achieve that, the house would have to increase in value by 7.18% a year, on average. The Nationwide House Price Index indicates the average UK house price increase over the last 10 years to Q3 2025 is 3.38% per annum, and the 10 years prior to that 2.19% per annum.’

He adds: ‘If we look at the average UK house price increase over the last 50 years to Q3 2025, that is 6.64% per annum.’

But Leeds and Hookway weren’t the only ones who got their facts wrong. Dr Keyte identified a simple error in a Facebook clip by ‘investing coach’ Vittorio Rigato, which urged young people to open self-invested personal pensions (Sipps).

Rigato stated that the money can be accessed at 55, but that won’t be the case for younger savers as the minimum age is due to rise to 57 from April 2028.

For complex financial decisions, such as pensions, investments, inheritance planning or mortgages, consulting an independent, FCA-regulated financial adviser (IFA) or chartered financial planner is ideal.

You can use a comparison site such as unbiased.co.uk or vouchedfor.co.uk and filter the results based on expertise and customer reviews.

Charges will vary. With investments, it’s common to be charged a percentage of the investment. The average fee is 2.4%. With advice on other products (such as insurance or mortgages) you may be charged a flat fee or an hourly fee for the IFA’s time.

If you can’t afford an IFA, or for simpler financial decisions, impartial free guidance can be a good alternative. Instead of recommending a specific product, it gives you general information to help you narrow down your choices yourself. MoneyHelper and Pension Wise (both at moneyhelper.org.uk) and Citizens Advice all provide guidance. Which? Money members also have access to 1-to-1 appointments with our money experts.

Some of the clips made suggestions that were likely to be inappropriate for the consumers they were targeted at.

Analysing Rigato’s clip about Sipps, Dr Keyte told us its ‘presumption that a 30-year-old should be investing’ was ‘not necessarily correct’, as many people that age would have higher-priority goals such as building savings for an emergency fund or to use as a deposit for their first home.

And if they have an existing mortgage, making overpayments to the mortgage might take precedent over investing.

He points out that employees ‘would normally be well served by making additional personal contributions to their employer’s pension scheme.’

Rigato’s clip told viewers to open their Sipp with a provider called Freetrade and invest in a global exchange-traded fund (ETF – a type of collective investment in which investors pool money) ‘like SWDA’.

Dr Keyte believes both of these suggestions are inappropriate, even if a Sipp isn’t: ‘The Sipp being promoted is likely to be a more expensive product [than a workplace scheme, as it has] an annual subscription fee of £11.99 per month plus the underlying investment fund charges.’

Of the recommended ETF, he points out: ‘An Ireland-domiciled exchange traded fund will not have any protection under the Financial Services Compensation Scheme (FSCS), unlike UK-registered investments.

‘Secondly, many consumers may not be comfortable with taking such a high degree of risk. It would have been better to refer to a range of funds that cater to different risk levels.’

On Instagram, ‘financial educator’ Sammie Ellard-King (using the handle @upthegainsmoney) suggests a way couples can divvy up their finances, which he labels the ‘Millionaire Couple Cheat Code’.

In the example, Partner A earns £55k while Partner B makes £35k. Ellard-King recommends they ‘put living expenses through partner A and save/invest from partner B’, adding: ‘At an 8% average growth they have £1m in 25 years.’

Dr Keyte said that ‘to generate £1m in 25 years at 8% per annum, an annual investment of £12,666 per annum would be required.

‘The assumed return of 8% per annum is at the upper limit of the FCA’s approved return assumptions for illustrations and does not appear to allow for product or service charges, which would have the effect of reducing the return rate.

‘Aiming for this return would likely require a high degree of ongoing exposure to investment risk, which many consumers may find unsuitable. The future performance of any investment cannot be guaranteed.'

It’s against the law for any person or firm to provide regulated financial advice or promotions without FCA authorisation. However, unregulated general financial commentary and training materials are freely available online.

That’s in contrast to high-quality, independent financial advice, which is often only available to those with larger pots to save or invest.

This means social media wealth-creation tips and courses can appeal to people looking to boost their finances.

UK enforcement against finfluencers soared by 7,300% between 2023 and 2025, rising from just 1 action in 2023 to 74 in 2025, according to a recent FOI by BrokerChooser.

But in a separate FOI, the firm found that 29% of banned crypto and forex adverts remained online, suggesting that 'illegal promotions remain widespread online.'

Many people will be familiar with warnings on investment promotions which state that you may get back less than you put in, and that past performance isn’t a guide to the future.

Yet several of the finfluencers we looked at claim or imply quite the opposite – that they know what will happen in the future, or that their predictions are always accurate.

In Samuel Leeds’s video, which includes claims about house prices doubling each decade, he also asserts: ‘I have made many predictions videos in the past, on YouTube, over the last 10 years and I have always seemed to be right.’

However, the most extreme example came from TikToker @cryptosageverified, who states: ‘There is going to be a 90% crash and it’s going to happen in 2026. And the most money that you’re going to be able to make is from right now all the way to the end of December [2025].’

Dr Keyte’s assessment? ‘This is awful. Nobody has a crystal ball that can predict a crash, or for that matter, when people should be investing, or that they will make millions.’

Make every penny count with expert, impartial advice for just £49 a year

Join Which? Money

By law, promotions for investments can usually only be undertaken by FCA-authorised firms or individuals. None of the finfluencers we looked at have this authorisation.

Samuel Leeds, Abi Hookway, Sammie Ellard-King and Vittorio Rigato are selling education and training courses or materials that purport to tell you how to pick your own investments to build wealth. This activity isn’t regulated by the FCA, but Which? believes these content creators still have a duty to avoid causing harm and to be accurate, nuanced and honest. Dr Keyte’s analysis suggests they are falling short of this.

In 2020, the BBC reported that a soldier, Danny Butcher, ‘killed himself after paying £13,000 for training’ with Samuel Leeds’s company Property Investors. A fellow attendee at one of Leeds’ crash courses was reported as saying: ‘It felt like brainwashing, like a religious cult kind of thing but done on a much smaller scale.’

Which? is concerned that by promoting a specific Sipp provider and ETF, Vittorio Rigato strays close to regulated activity. We flagged our concerns about this and the other content to the FCA – it said: ‘We’re committed to fighting crime and are continuing to act against finfluencers who promote financial products they’re not allowed to. They must check they’re not breaking the law or putting their followers’ livelihoods or savings at risk. If you take financial advice from an unauthorised person, you’re unlikely to be protected if something goes wrong.’

Dr Robin Keyte, chartered financial planner

Authorised financial advice (where a personalised recommendation is provided based on your specific situation from a qualified financial adviser) and promotions (where someone is induced into financial activity, such as taking out a loan or investing) are rightly required to conform to high standards.

The law requires that promotions must be ‘fair, clear and not misleading’ and include risk warnings.

Unregulated finfluencers who steer clear of financial promotions aren’t held to the same requirements but they should be encouraged to be as rigorous and accurate as possible, and must avoid straying into regulated activity.

For example, finfluencers’ comments on property returns should be based on the Nationwide House Price Index. They should be encouraged to familiarise themselves with the FCA’s regulations on financial promotions and to limit any future projection of an investment pot to FCA assumptions. They should also include an adjustment for inflation to make their figures more relevant.

A good outcome from this investigation would be the establishment of guidance or a code of conduct for finfluencers who are engaged in general education or commentary, to ensure their clips are also fair, clear and not misleading, and to reduce the probability that they lead to poor outcomes for consumers. This would give social media platforms, and organisations such as Trading Standards, something to use to assess whether they need to take action against finfluencers.

Samuel Leeds told us that the statistic about house prices doubling each decade is ‘a broad rule of thumb’ and ‘not a prediction or guaranteed outcome’. He said his intention was to explain long-term patterns in simple terms ‘rather than to present a technical calculation of annualised growth’.

He added: ‘I do not claim certainty and I do not offer guarantees. The content is educational commentary about property, not personalised financial advice.

‘My training events and online materials explain property concepts at an introductory level. They help people understand ideas and risks, and they encourage individuals to seek independent legal advice before entering into any property strategy. Many people only use the free resources and do not pursue further training. No viewer is encouraged to take action without research or due diligence.’

Referring to Mr Butcher’s death, he said the inquest ‘did not find any link between his training with my company and his death. Reporting at the time also noted significant pre-existing financial and mental health difficulties.’ We were unable to independently verify the coroner’s conclusions.

Sammie Ellard-King said his content is intended as ‘general financial education’. He added: ‘I do not provide personalised advice or make investment recommendations, solely education. I regularly signpost followers towards regulated financial advisers for decisions requiring personalised guidance – something I am careful not to give.’

He said the clip was ‘not intended as a prescriptive plan or a guarantee of future returns. The investment growth figure used was a broad, illustrative assumption commonly used in educational contexts, rather than a projection tailored to UK tax rules or to any individual.’

He said he is careful ‘not to encourage high-risk or speculative behaviour’ and regularly reviews content ‘to ensure it remains clear, responsible and aligned with FCA expectations’.

Rigato said that ‘although financial education is not an FCA-regulated activity, accuracy remains important… In response [to Which?’s investigation], the decision was taken to temporarily remove the post, as part of an overall review of the accuracy of all our educational content.’

Hookway declined to comment; @cryptosageverified didn’t respond to our request for comment.