By clicking a retailer link you consent to third-party cookies that track your onward journey. This enables W? to receive an affiliate commission if you make a purchase, which supports our mission to be the UK's consumer champion.

Online shoppers bombarded with 'buy now, pay later' schemes

Online shoppers face a barrage of 'buy now, pay later' (BNPL) options at the checkout, with more than half (62 out of 111) of fashion, baby and child, and homeware retailers offering at least one BNPL scheme, Which? research has found.

BNPL schemes - such as Clearpay, Klarna and Laybuy - are rapidly rising in popularity, allowing shoppers to spread the cost of a purchase over 30 days or a few weeks interest-free. But these schemes don't just benefit shoppers. BNPL providers boast that retailers can benefit from an increased average basket value and conversion rates by using a BNPL scheme at their checkout.

However, Which? research looking at 111 of the biggest fashion, baby and child, and homeware retailers found that shoppers who are bombarded with BNPL while shopping might not be getting all the information they need to make informed decisions. Despite many online retailers promoting BNPL schemes across their sites, our analysis found there is often sparse detail on how these schemes differ in terms of late fees, credit checks and how repayments work.

Which? believes there must be no further delay to the regulation of the BNPL market to ensure greater transparency on fees, credit checks and repayments on retailers' websites.

You can navigate this article using the links below:

Retailers with multiple schemes

Which? research earlier this year found that shoppers are more likely to use BNPL schemes if they have children and have experienced a significant life event such as moving home, having a baby, or getting married.

With this in mind, we looked at 111 of the biggest online retailers in the fashion, baby and child, and homeware sectors to find out how these retailers present BNPL options on the customer journey through to the checkout.

More than half of the online retailers offered at least one scheme, and nearly 70% (43 out of 62) of those that offered a pay later option had more than one option available.

The average number of schemes per retailer was two, although many big household brands offered more than this. offered the most schemes, listing six options at the checkout including Clearpay, Klarna pay in 3, Klarna pay in 30 days, Laybuy, Openpay and Zip.

Asos, Boohoo, M&M Direct, Yours Clothing, Nasty Gal, Baby and Child Store, Cosatto, and The Hut offer four schemes, while PrettyLittleThing, Missguided, Scandibu00f8rn, Huggle, Kiddies Kingdom and Natural Baby Shower offer three.

Which? spoke to Janina Steinmetz, senior lecturer in marketing at Cass Business School, about what impact retailers offering multiple BNPL schemes might have on our shopping behaviour.

'I think offering multiple schemes creates a perceived social norm,' she told us. 'Consumers might believe that if so many schemes exist, it must be very common among other consumers to use them. This perceived social norm might further normalise the use of BNPL schemes.'

Have you ever had an issue with a BNPL scheme? Tell us about it using our new BNPL complaints form.

Chaotic checkouts

The Financial Conduct Authority's (FCA) Woolard Review, published earlier this year, expressed concerns around how BNPL schemes are presented at checkouts. It said that in some instances BNPL offers are presented 'in a long-list of indistinguishable options' at the checkout without clear information on how each option differs.

Our research found a lack of consistency across retailers' checkout pages.

Some retailers clearly communicated key information on late fees, credit checks, and repayments, while others made it near impossible for customers to know the differences between each provider, either asking customers to click on links to learn more, or taking customers straight through to the BNPL provider's page to set up an account.

Below are some examples of inconsistent checkout experiences we found when selecting Klarna as the payment option.

The FCA also found concerns that sometimes retailers use BNPL as the default payment method, which could encourage shoppers to take out credit without fully understanding the risks.

Sweden, in response to retailers prioritising credit payments at the checkout, introduced a law in July 2020 that prohibits credit options from being presented before debit options on online retail platforms, so that BNPL is never the first choice.

We found that QVC defaulted the payment option to its BNPL offer, Easy Pay, on eligible items. No information on late fees or credit checks were given at the checkout.

While not the default option, Bella Baby positioned Laybuy as the first option above any debit payment methods.

- Find out more:BNPL schemes to be regulated

Three in 10 promote BNPL on homepages

Our research found three in 10 retailers that offered at least one BNPL scheme advertised it on their homepage.

In some cases, the BNPL banners were featured pride of place as soon as we clicked onto the retailers' sites.

M&M Direct and QVC had large banners promoting their BNPL schemes, while JD Sports included two banners on the homepage promoting free express delivery for customers who pay using Laybuy.

These banners, featured so prominently on retailers' homepages, could encourage people to take out credit without fully understanding how the schemes work.

BNPL ads prolific on product pages

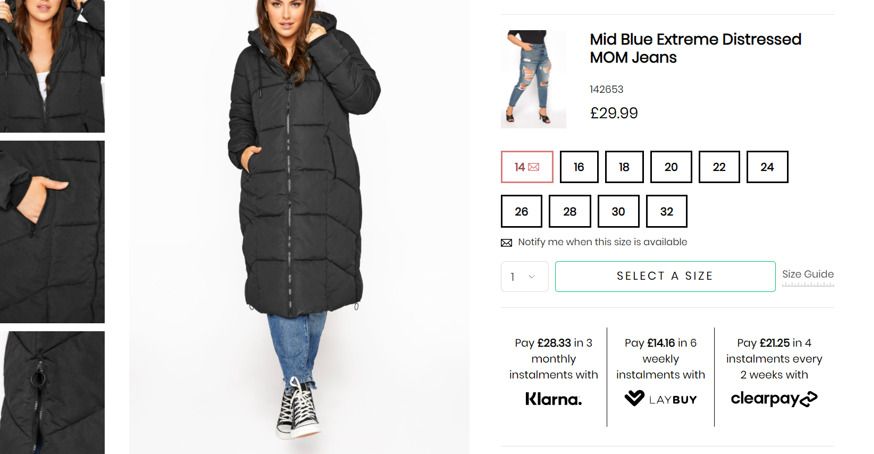

More than four in five of the retailers that offered a BNPL option (87%) promoted it on product listing pages where you view more information about items when shopping online.

More often than not, these ads on product listing pages did not include key information on late fees or credit checks, making it difficult for shoppers to understand the nuances between each BNPL provider.

While some retailers, such as Boohoo and Nasty Gal, included 'learn more' links that provide more information, others such as Pretty Little Thing and Yours Clothing provided no onward journeys for customers to find out more.

Boohoo told us that its websites provide detailed information on BNPL options including late fees, what happens if customers are struggling with repayments and where they can find further help.

Irene Scopelliti, Professor of marketing and behavioural sciences at Bayes Business School, explained how these promotions might encourage us to buy more.

'The focus of these promotions is often on the postponement of the painful act of paying, which would normally act as an inner self-control device,' she told us. 'Consumers may focus their attention on the cost of the monthly instalment rather than on the full price, falling into the trap of thinking that the item is only £x per month, rather than £x in total.'

By reframing the full amount into smaller instalments, these ads could distort how we understand the cost of a product.

- Find out more:how BNPL firms encourage impulse buying

No information on late fees

A number of BNPL providers, including Clearpay and Laybuy, charge late fees if repayments are missed. Each provider has a different policy on how much you'll have to pay and when fees will be capped.

Which? found nine retailers, the majority of which sell baby and child products, that did not include any information at all about late fees on their checkout, product listing or BNPL explainer pages for certain BNPL providers.

These retailers include , Bella Baby, , Footasylum, Huggle, , , Office Outlet and .

Failing to clearly communicate the risks of using a BNPL scheme could land customers with unexpected fees. It could also leave them unaware of some of the potential consequences of failing to keep up payments, which can mark your credit report, impact your credit score, or even see you referred to a debt collector.

Scopelliti says reading terms and conditions that include details on late fees and credit checks can get in the way of the immediate gratification of using a BNPL scheme, and this is complicated even further if the information isn't immediately accessible at the checkout.

'People don't want to look at information they expect to be unpleasant and to affect them negatively even if they might benefit from it,' Scopelliti told us.

'I believe interventions and regulation are necessary to make sure not only the information is presented in a very accessible way, but also to nudge consumers to actually read it, for example by requiring them to understand what the terms and conditions imply before being able to access the BNPL option,' she explained.

- Read more:BNPL fees and conditions compared

Retailers not always following BNPL guidelines

Klarna, Laybuy and Clearpay - the three biggest BNPL providers - have guidelines they share with retailers on how their products should be presented. We found some retailers aren't adhering to these rules.

Laybuy advises retailers to include a standalone page and pop-up explaining how the scheme works as simply as possible, while Clearpay suggests retailers should make it clear who Clearpay is which could be done by referring to an information page.

We found that Office Outlet, Baby and Child Store, Cosatto, Bella Baby, Huggle, Kiddies Kingdom, Natural Baby Shower, Scandibu00f8rn and Direct4baby, who all offer either Laybuy or Clearpay, do not include standalone information pages for customers to learn more about the schemes.

At the time of research, Klarna's advertising guidelines said the following risk warning should always be used: 'Please spend responsibly. Borrowing more than you can afford could seriously affect your financial status. Make sure you can afford your monthly repayments on time.'

We could not find this exact wording on the sites of 23 retailers including , Wayfair, Halfords, Gymshark, Nike and Footasylum. Though some retailers, including Asos, used similar warnings, others only warned that missing repayments could affect your ability to use Klarna again.

Klarna has since updated the risk warning in its guidelines with different wording and is in the process of communicating this to retailers.

- Find out more:how to pay off your debts

'It shocks me how predominant the BNPL message is'

With an increasing number of online retailers not only offering BNPL schemes but actively promoting them on their sites, it's easy to feel overwhelmed when deciding what to buy and how to pay for it.

Dan Holden describes feeling bombarded with different BNPL options when shopping for even low-cost items.

'I felt I was being pushed into using a BNPL scheme with Wayfair,' he told us. 'I can see why people end up struggling. It shocks me how predominant the BNPL message is.'

Despite this, Dan did find himself paying with Klarna when purchasing a desk from Wayfair during lockdown.

'Afterwards I thought to myself, why did I bother selecting Klarna?. It wasn't an affordability issue - I could have paid the full amount, job done,' he explained.

After he'd paid, Dan realised he hadn't read the T&Cs properly and was concerned about his credit score: 'I suddenly wondered what it would do to my credit rating. Paying with Klarna was definitely an impulse decision when clicking through the checkout.'

Em, in a comment on our Which? Conversation post, shares a similar point of view and believes BNPL users should be presented with key information before reaching the checkout.

'What is particularly poor is when I've already decided to make a purchase, I head for the checkout and I am then presented with the distraction of using a BNPL option to pay for goods,' she explained.

'If entering into a purchase with the intention of using BNPL, presumably in the knowledge that you cannot afford to pay in full, it must only be offered to registered customers that have pre-selected the option and confirmed they have read all the terms and conditions, before reaching the checkout.'

Klarna told us it applies strict eligibility assessments on every purchase a customer makes to ensure it only lends to those who can afford to pay it back. If customers miss a repayment it will not impact their credit score, but Klarna will freeze their account to prevent them from accumulating debt.

What do the BNPL providers say?

Clearpay told Which? that Clearpay enables responsible spending and encourages transparency at the checkout with clear guidelines and support for retailers. Clearpay's integration team reviews every retailer website to ensure compliance with FSMA and FCA rules on financial promotions. A disclaimer about late fees is clearly displayed at checkout before a transaction is completed and it does not report to credit agencies, so customer credit scores are not impacted. It will be looking into the retailers it has flagged concerns about to make sure the correct information is presented.

Klarna says it upholds the highest standards with regards to transparency with customers through straightforward terms and conditions, presented each time a customer selects Klarna at the checkout, and by working closely with retailers to explain payment options. It provides retailers with clear marketing and product guidelines as well as a dedicated team to ensure these guidelines are met.

Laybuy welcomes our findings and says it's important all providers set high standards of transparency and responsibility. It say it has always made it clear that BNPL is a credit product and is the only provider to conduct hard credit checks on customers. It works closely with retailers to make sure they have the correct information, but it's unable to strictly enforce information. It says it's important that customers ensure they're happy with a retailer's T&Cs before purchasing.

PayPal told us it works closely with retailers to ensure services are used in line with existing regulations. As a responsible and trusted provider, PayPal complies with all Advertising Standards Authority guidelines and has a strong history of doing so.

What do the retailers say?

Asos

Asos told us it takes its responsibility to its customers incredibly seriously and puts a lot of work into explaining the differences between payment options. It has detailed FAQs for each payment method and includes wording encouraging customers to spend responsibly, which it's had in place since before Klarna advised retailers to include such wording. Where it has banners promoting a BNPL service, it always links through to landing pages explaining more about the BNPL scheme.

Baby and Child Store

Baby and Child Store told us it's only ever received positive feedback about its payment options, but that it will take Which?'s feedback on board and add information about late fees to its site.

Cosatto

Cosatto said all payment options have been added in accordance with the guidelines of each provider. It says providing clear information on payment schemes is important and is working on improving this. It will take Which?'s comments on board.

JD Sports

JD Sports told us it lists all payment options clearly with a prominent link to terms and conditions, as well as providing extensive information on each payment provider and contact info if customers have further questions.

Kiddies Kingdom

Kiddies Kingdom said its product pages include links to pop-ups with more information, as well as links to detailed FAQs on the providers' sites. It is in the process of launching a new site where improvements will be made, including further clarity on BNPL options.

Natural Baby Shower

Following our research, Natural Baby Shower launched its own investigation and found its site complies with Klarna's onboarding guidelines. While it agrees more information could be convenient to the customer, it runs the risk of this information becoming outdated and inaccurate. It believes it is operating within Laybuy's recommendations and will continue to look at how the customer experience can be improved.

Scandibu00f8rn

Grace Tindall, founder of Scandibu00f8rn, said the firm will be reviewing its processes and making changes to be more transparent in its communication of payment options.

How to shop safely with BNPL

Always read the T&Cs carefully before deciding which scheme to use. With some retailers, you might have to dig around to find out more information about late fees, repayments and credit checks.

Set up alerts for repayments in your diary or on your phone so you know exactly what to pay back and when. This is particularly useful if you have a number of different repayment plans with different BNPL providers. Make sure to note down whether the payments will come out automatically or if you need to manually pay them.

Draw up a budget so you know how much money you're paying back each month, and how much money you can spend. Again, this might be handy if you've got various different repayments to make with different BNPL firms. A budget should keep you on track to meet your payments.

Make any returns promptly so you don't end up making repayments for something that you want to send back. We've heard anecdotally from BNPL users that refunds can take longer to process if you've paid with a pay later scheme - so it's worth sending your items back asap.

Contact the BNPL provider if you think you might miss a repayment. Honesty is the best policy in this situation, and you might be able to come to an agreement on how to fulfil the rest of your instalments.