Are we there yet? The long road to ‘buy now, pay later’ regulation

Once a niche way to pay, ‘buy now, pay later’ or BNPL schemes from the likes of Klarna, Clearpay and PayPal Pay in 3 are now regularly used by millions of shoppers. They typically offer instant short-term interest-free credit at the click of a button for everything from fashion to food. But the regulation needed to protect consumers using these new ways to pay has been slow to catch up.

It's been more than four years since the government set out to regulate BNPL as a 'matter of priority' and in the meantime the market has boomed: lending has grown from £60m in 2017 to more than £13bn in 2024, according to figures from the Financial Conduct Authority (FCA).

Last month, the FCA finally published its proposals for the regulation of BNPL schemes, bringing us one step closer to protections that should prevent consumer harm and unaffordable debt — and hold BNPL firms to the same standards as other lenders. But regulation still won’t be here until July 2026.

Here, Which? charts the rise of BNPL, investigates the frustrating impact of regulation delays and digs into what options those who rely on short-term interest-free credit will have once the sector becomes regulated.

The BNPL boom

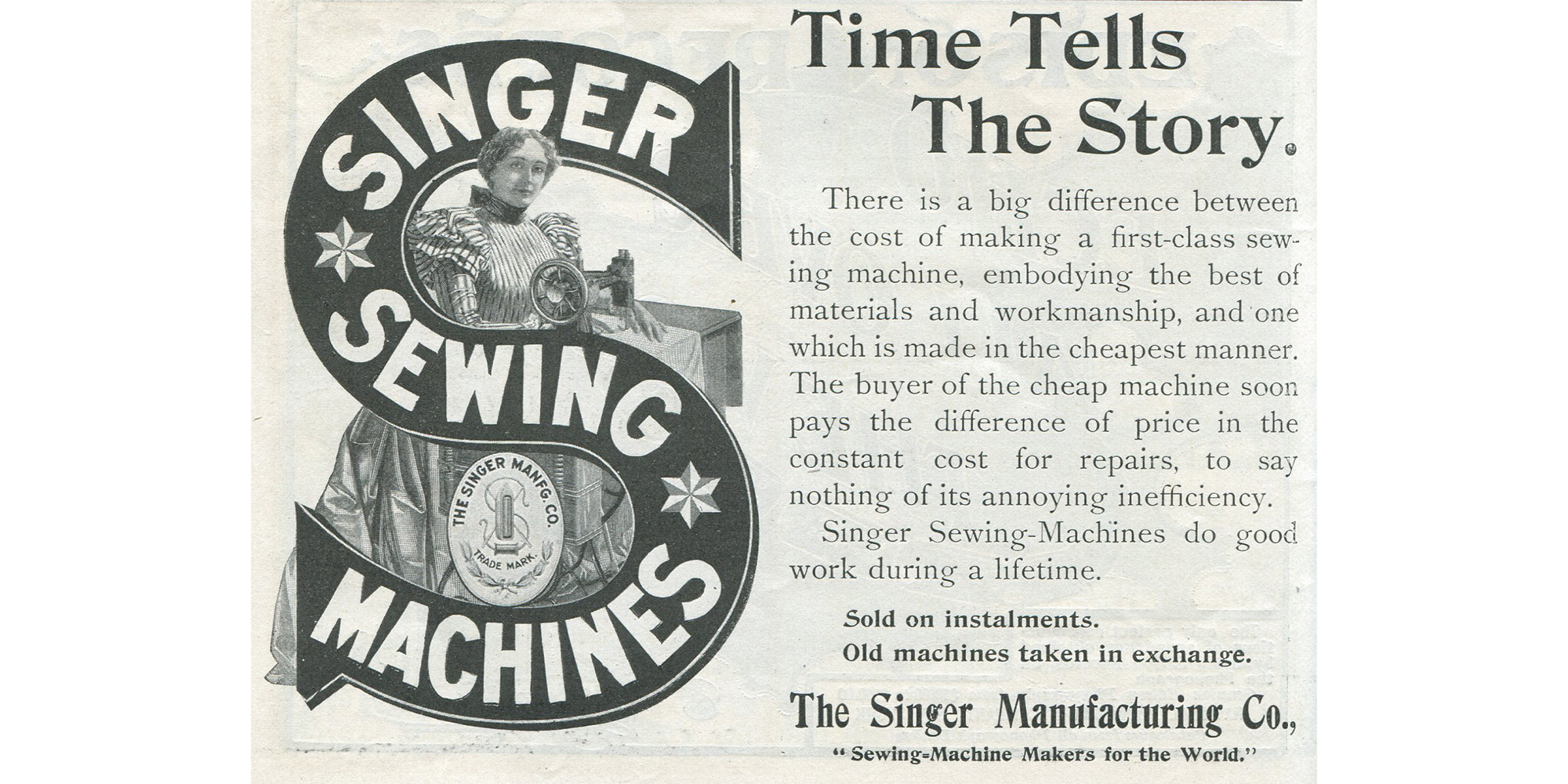

The term ‘buy now, pay later’ has come to refer to a distinctly 21st-century product - you’ll often see three or four BNPL loans offered at online checkouts, and payments are managed via pastel-coloured apps. But paying in instalments isn’t new. Singer sewing machines were advertised as being ‘sold on instalments’ back in the 1850s, and in the 1980s and 90s, shops would offer plans to help shoppers spread the cost of expensive items.

Since the mid-1970s, most borrowing has been covered by the Consumer Credit Act (CCA): the law which regulates the credit industry and provides rights and protections to consumers. But thanks to a small gap in the CCA, BNPL loans aren't subject to the same regulations: interest-free credit deals that last no more than 12 months are exempt.

One in five adults - nearly 11 million people - used BNPL in the 12 months to May 2024, according to the FCA’s most recent Financial Lives survey, the UK’s largest nationally representative tracking survey of financial behaviour.

The remarkable rise of BNPL in recent years has been fuelled in part by tech: providers such as Klarna, Clearpay and PayPal provide credit options that are seamlessly integrated into online checkouts and allow users to manage repayments via their smartphone. Shoppers are able to pay in 30 days or split the cost of items, typically over three to six payments, interest-free, with some charging late fees for missed payments.

The cost of living crisis

But that’s only part of the story. The use of BNPL has more than doubled since 2020, according to figures from the FCA, and use is particularly high among those living in the most deprived areas of the UK and those with low financial resilience.

In the context of rising costs, an increasing number of people rely on BNPL to make ends meet. More than one in 10 UK adults now use it to buy essentials like food and fuel, according to a survey carried out by credit score company Loqbox earlier this year.

There are also concerns about how some BNPL offers are presented to customers. A 2021 Which? Investigation explored how firms encourage impulse buying, and the FCA highlighted the practices of obscuring information, anchoring and benefit framing (emphasising the potential benefits and downplaying the risks) in some BNPL customer journeys.

- Find out more: BNPL schemes explained

Why has regulation taken so long?

‘Regulation of BNPL has been a long time coming’ said Tony Herbert, senior policy advisor, money at Which?. ‘Way back in February 2021, the independent Woolard Review concluded it should be regulated as a matter of urgency to guard against consumer harms. Government ministers agreed.’

The review found that the booming and unregulated BNPL market posed significant potential harm to consumers; customers were at risk of unaffordable borrowing due to the lack of affordability checks, and many didn’t fully understand the nature of the product or the lack of protections associated with these types of purchases. But why, more than four years later, are shoppers still waiting for these plans to come to fruition?

‘Creating new regulation and legislation takes time’, Herbert said. ‘The case of BNPL is quite complicated, so it took a while to consider and consult on the approach and come to a consensus on some of the finer details - for example, how to approach merchant-provided BNPL offers’.

And there were fears it might never come to fruition.

In 2023, two years after the government announced its intention to regulate BNPL, there were reports that the Treasury was considering delaying plans amid speculation that providers would leave the market. This prompted a coalition of charities and consumer groups, including Which?, to write an open letter to then Chancellor Jeremy Hunt, urging him not to delay regulation — one of many efforts charities and consumer advocates have made in the long push for protections.

Herbert added: ‘Which? has campaigned in the intervening years for consumers to be protected when opting for this increasingly popular form of credit. We’ve responded to government consultations, participated in roundtables, and published research to highlight the risks posed by unregulated BNPL offers.’

After years of campaigning, the end is nearly in sight.

- 2020 Early concerns: Which? and other consumer groups call for urgent regulation of BNPL amid growing evidence of the risks to shoppers, including tactics to encourage impulse buying and issues with returns. Which? feeds into the Woolard Review of the unsecured credit market.

- 2021 The Woolard Review: In February, The Woolard Review recommends BNPL products be brought under FCA regulation ‘as soon as possible’ and Boris Johnson’s Conservative government announces plans to regulate the sector. In June, Which? releases the largest-ever survey on BNPL users in the UK, revealing one third of the population had used BNPL and dispelling perceptions of typical users of the schemes. In October, Which? finds online shoppers are bombarded with BNPL schemes at the checkout as the government launches a consultation on policy options for the regulation of BNPL.

- 2022 Which? applies pressure: Which? publishes the findings of in-depth interviews with BNPL users which reveal a lack of understanding of the risks of BNPL. In March, another Which? investigation finds retailers incentivising the use of BNPL schemes, and Zilch comes under fire for suggesting people use BNPL to pay for groceries and takeaways.

- 2023 BNPL plans in jeopardy: In February, Rishi Sunak’s Conservative government launched a consultation on draft legislation. But by July, Which? and five other organisations sign an open letter to Chancellor Jeremy Hunt, urging the government to bring in regulation as soon as possible, following reports that plans are to be shelved.

- 2024 More consulting: In October 2024, Keir Starmer’s Labour government launches a consultation on draft legislation.

- 2025 BNPL legislation: In July, the Financial Services and Markets Act 2000 (Regulated Activities etc.) (Amendment) Order 2025 is made. It is the legislation that will bring BNPL products under the FCA's remit to create and enforce rules for the sector. Shortly after, the FCA published its proposal for BNPL regulation, which is expected to come into effect mid-2026.

The cost of delays for shoppers

While plenty of people have positive experiences using BNPL, for some, the ease with which they can access unregulated credit can come at a cost.

The risk of unaffordable borrowing

Unlike when you apply for a credit card or loan, BNPL providers currently have no responsibility to check that you can manage the repayments, which could mean consumers take on harmful debts, although some such as Klarna have started doing this.

Indeed, shoppers could spend more than they would otherwise: brands using Klarna, for example, see a 40% increase in average order value, according to figures published on its website.

Citizens Advice, the UK’s largest advice provider, has seen the number of clients seeking advice for BNPL debts skyrocket since the intention to regulate was first announced in 2021.

The charity advised 5,534 people with BNPL debt issues in 2024, more than three times the number of people supported in 2022. Up until the end of June, the charity has helped 3,798 people, and dealing with repayments is the main issue for more than 80% of their clients this year.

‘Buy now, pay later' has existed for a long time, but we really saw a gear change when firms offering third-party options for retailers that were free to customers joined the market in the past five years or so’, said Adam Butler, Public Policy Manager at debt advice charity StepChange.

One of the key concerns is that the lack of affordability checks leaves BNPL users vulnerable to harmful debt - especially in the context of an ongoing cost of living crisis, where many are forced to rely on credit to make ends meet. Polling carried out by the charity in 2024 revealed that 17% of UK adults rely on credit to keep up with essentials, with BNPL one of the top three products used.

‘When you look at who uses BNPL, there’s a skew towards those who are likely to be more financially vulnerable. Polling we carried out in 2024 found that more than a third of BNPL debt meets StepChange’s definition of problem debt, which is much higher than for other credit products, Butler told us.

The FCA’s 2024 Financial Lives survey tells a similar story: it found that use of BNPL was particularly high among those with low financial resilience (30%) and those living in the most deprived areas of the UK (29%).

The lack of friction on taking out a credit agreement at the checkout can make it easier for consumers to take on more debt than they can manage, and Butler said there are concerns around products that exploit customer vulnerability and bias. ‘In the context of those struggling financially, people are often motivated to borrow by an urgent need and make short-term decisions that aren’t necessarily the right ones in the long term’.

The lack of affordability checks also means it’s easy to take out multiple agreements at once. A Which? member told us: ‘The only real concern is that I find I can do two or three at the same time if I’m not careful.’

Unprotected purchases

Currently, BNPL purchases aren’t covered by Section 75 protection, and shoppers can’t escalate complaints to the Financial Ombudsman Service (FOS) if things go wrong.

Research published by Which? in 2023 found that many aren’t aware they lack these crucial protections, and too often shoppers realise when it’s too late.

'I was ping-ponged between Wayfair and Klarna'

Back in February James, a Which? journalist, was buying a bookcase online from Wayfair and didn’t have his debit card to hand. Since he already had an account set up, he thought it would be easy to pay with Klarna.

A timeout error at the checkout meant that James got charged £130.98 twice. He contacted Klarna and Wayfair immediately, and both informed him that it was a hold charge and would be released in seven days. But eight days later, the charge was still showing in his Klarna account.

James told us he spent the next week being ping-ponged between Wayfair and Klarna’s customer service as he tried to get the charge cleared.

Eventually, he disputed the charge via the Klarna app, as advised by its customer service, but his case was closed a few weeks later, meaning he was liable for the payment again.

This struck James as odd — he told us that staff at both Wayfair and Klarna had acknowledged the charge was incorrect, but Klarna wasn't able to remove it unless the merchant cancelled the payment. ‘How come I was able to get in touch with Wayfair, but Klarna couldn’t?’

Nowhere to turn

At this point, James decided to go to the FOS. But as 'buy now, pay later' isn’t yet regulated, the Ombudsman wasn’t able to investigate the case. ‘I didn’t realise at the time that I wasn’t covered by that kind of protection.'

Klarna advised him to reopen the dispute, only to close it again almost immediately — even though he had sent evidence of his correspondence with Wayfair confirming the charge was incorrect. ‘I felt like I had done everything I was supposed to but the people I was talking to just didn't know how to resolve it.'

This left James to try to fix the issue on his own. ‘I’m a stubborn person’ he said, ‘so I kept contacting Wayfair until I got through to someone who would fix it’. At one point, he was calling the firm twice a day.

Eventually, over a month after making the initial purchase, James managed to speak to someone at Wayfair who could help and in an instant, the charge was cleared. But the ordeal had been all-consuming. James just felt lucky that he could afford to pay the duplicate charge if it had come to that: ‘I can’t imagine how stressful something like that would be if you couldn’t afford it.’

Klarna told Which?: ‘We should have been able to sort this out much quicker than we did. We’ve apologised for that and made changes in our processes.’

Carey Pearson, head of brand at Wayfair UK, said: ‘While this appears to have been an isolated technical issue at checkout, we recognise the frustration it caused and are reviewing the case internally to understand how this could have been avoided.’

How is the FOS preparing for regulation?

By next summer, shoppers like James will hopefully be able to take their cases to the Ombudsman. But is the Financial Ombudsman Service (FOS) ready for regulation, and the increased caseload it’s likely to bring with it?

Due to the timeline of regulation, the FOS hasn't made any provision for complaints in its 2025-26 budget: the authority states that work will take place over the next year to better understand how regulation will affect the demand for its service.

A spokesperson for the Financial Ombudsman Service told us it is familiar with and ready to respond to the types of complaints it's likely to receive when BNPL becomes regulated, and it expects fewer than 10,000 complaints per year.

‘We welcome the FCA consultation into BNPL and look forward to the results, which will give our organisation a clear steer on how BNPL products will be regulated. We have set up a project group to consider how we can transform how we process and respond to complaints in this area, and are in communication with the FCA and the Treasury about their plans.'

Confusion around credit

The Woolard Review found that many don’t understand BNPL as a form of credit, and the seamless shopping experience may be in part to blame for the confusion.

Research carried out by Which? in 2023 found that many BNPL users think of it as a payment mechanism - a misperception that stems in part from the speed and simplicity of the lending process at the checkout.

This confusion can have harmful consequences. Shoppers may not consider the consequences of failing to repay and the potential for BNPL debt to affect their future borrowing.

A 2021 Which? Money investigation found that some mortgage lenders consider BNPL debts in their assessments, and using BNPL can affect your credit score.

One Which? member told us that they found BNPL convenient, but the lack of clear information at the checkout was her main concern: 'My only criticism is that the accompanying paperwork can be quite confusing and difficult to follow…Each provider seems to have different criteria and procedures which can lead to further confusion.'

Butler looks forward to the clarity and consistency that regulation is likely to bring for the debt-advice sector, as well as consumers: 'It should make it easier to support clients with BNPL debt, as there’ll be greater consistency with other types of credit products in how firms support borrowers in difficulty’.

What will regulation mean for you?

Under the plans put forward by the FCA last month, consumers are likely to gain the following protections on 15 July 2026:

- Affordability checks will add friction - checks will ensure that borrowers can afford the debt they’re taking on, and could be applied to even the smallest loans (currently, lenders don’t have to carry out checks for loans of £50 or less). The checks could mean you won’t always be successful when you choose to pay with a BNPL scheme.

- Better protection when things go wrong - BNPL will be brought under the Consumer Credit Act, meaning that shoppers will have access to Section 75 protections, which means your BNPL credit provider is liable along with the retailer if something goes wrong with a purchase costing more than £100 and up to £30,000.

- More help with complaints - BNPL users will also be able to escalate complaints to the Financial Ombudsman Service, and firms will have to comply with the FCA’s rules for handling complaints.

- Clearer information on late payment consequences - Firms will need to provide certain information to shoppers before they can take out a BNPL agreement, including information about the consequences of missing repayments. They will also need to communicate with customers if they miss a repayment, or if they intend to take certain action against them.

- Support if you get into financial difficulty - the FCA wants providers to offer more support to borrowers who are in financial difficulty. This includes informing customers as soon as possible when they miss a payment, signposting borrowers to free debt advice, and adhering to rules on forbearance (where loan payments are temporarily paused to help borrowers manage their debts).

The FCA will now work with lenders, consumer groups and stakeholders to consult on its plans, and the final rules are expected early next year.

The future of short-term credit

The FCA expects that BNPL providers’ profits will drop by £1.2bn over 10 years as a result of regulation: some shoppers will choose not to or be unable to use BNPL, resulting in fewer transactions.

So what alternatives could fill the gap for people who need it?

Crisis grants

‘The use of BNPL shows that there’s a real appetite for affordable credit, and is signalling something about what’s useful for people - flexible access to small amounts of credit at low cost, repaid quickly so there is less risk of expensive long-term debt’, said Butler.

StepChange is urging the government to invest in a range of provisions, from credit alternatives such as crisis support and grants, to no-cost and affordable credit.

Research published by the charity last month found that there's a mismatch between the number of adults in the UK who are unable to repay any form of credit, and the extremely limited provision of crisis grants and support available to help people with unexpected costs, especially in England.

No-interest loan schemes

Where people can afford small repayments, no-interest loan schemes have delivered some promising outcomes for those who might otherwise be unable to access commercial credit.

Fair4All Finance, working with Fair By Design, Toynbee Hall, JP Morgan, the Treasury and the Scottish and Welsh Devolved Administrations, have been piloting a national No Interest Loan Scheme since 2022, offering £100-£2,000 loans to borrowers to meet costs for things like household items, bills and financial emergencies.

So far, the results have been encouraging: an interim report published in 2024 found that nine in 10 borrowers had no problems repaying their loans, and the same proportion were satisfied with their loan provider and the process.

A full review is expected next year, and StepChange is urging the government to consider committing to a national scheme.

How to shop safely with BNPL

The countdown is on, but with just under a year until regulation comes into effect, you should continue to take precautions when shopping with BNPL. Here's what Consumer Rights expert Hannah Downes advises:

- Make sure you can afford the repayments: Before you hit ‘buy now’, it’s important you’re confident you’ll be able to meet the repayments. It’s worth drawing up a budget so that you know exactly how much you can afford to pay back each month.

- Check the T&Cs: BNPL schemes have different terms and conditions, and you should check the T&Cs carefully to understand what you’re agreeing to, what the consequences are of missing a payment and how the loan might impact your credit score.

- Set payment reminders: Some providers take payment automatically, but others require you to pay manually, and you may be charged fees for late or missed payments. Set up a reminder on your phone or calendar - or make use of notifications in the provider's app - so that you know exactly what you need to pay back and when.

- Make returns quickly: It’s worth returning any unwanted purchases as quickly as possible, so that you don’t end up making repayments for something you’re planning to send back.

- Contact the BNPL provider: If you think you might miss a repayment, contact the provider as soon as possible, as they may be able to extend your payment deadline or offer an alternative payment plan.

- Get help if you need it: If you’re struggling with BNPL debt, organisations like StepChange and Citizens Advice are able to help. Professional debt advisers provide free, non-judgemental support and will help you get your finances back on track.

This article was updated on 19th August 2025. We clarified that Klarna carries out affordability checks.