Debt collection scams warning

Letters and calls claiming that you have unpaid debts are circulating as scammers attempt to get you to part with your cash and data quickly.

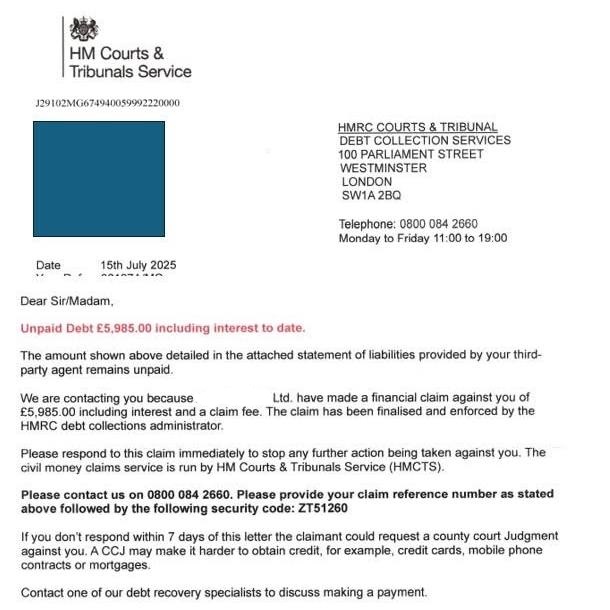

Reports of dodgy debt collection letters claiming to be from HM Courts & Tribunals Service (HMCTS), the government agency managing courts and tribunals in England and Wales, have spiked in recent weeks, along with cold calls claiming to help with debts.

Below, we tell you what to look out for and how to verify a genuine debt collection letter.

Sign up for scam alerts

Our emails will alert you to scams doing the rounds, and provide practical advice to keep you one step ahead of fraudsters.

Sign up for scam alerts

Debt collection scams

Scam letters that state you have unpaid debts and are being summoned to court as a result have triggered warnings from both HMCTS and a branch of Scotland’s Citizens Advice Bureau.

A copy of the letter that Which? has seen says that you have an unpaid debt of £5,985, including interest, which you owe to a financial firm.

It includes a number to call to avoid ‘any further action being taken against you’. This number will put you through to a fraudster intent on getting you to part with your money and personal details.

You’re also warned that if you don’t respond within seven days of the letter, a county court judgment could be made against you, affecting your credit file.

The number included in the letter has been reported as a scam. One recipient of the letter reported that the caller asked them to put money in an envelope and post it. Another report said the fraudsters claimed to be from the Financial Ombudsman Service (FOS).

In addition to fake letters, there have also been numerous reports about debt management scam calls. Reports detailed on Who Called Me?, the scam-call database, include unexpected calls claiming to be from debt advice companies, impersonations of Citizens Advice and calls from a debt management company called ‘Debt Solutions’.

Other debt collection scam calls involved callers attempting to sell a product that could help pay off your debts, and fraudsters claiming to help with tax and loan repayments.

- Find out more: what to do if you get a debt demand

How to check if a debt is legitimate

Debt demands can be alarming, which is what makes them an effective scam. If you're not sure about the demand, don't pay it. You should always verify the information first.

If you receive a message, call or letter about an unpaid debt and are concerned that it could be genuine, contact the organisation the debt is supposedly owed to directly using a number found on its official website. If the letter or call claims to be from an HMCTS bailiff, you can call your local county court to verify the information.

If you're called by someone claiming to be able to write off your debts or asked to call a number to pay your debt, look up the number on Who Called Me? to see if there have been any scam reports associated with it.

If a financial firm contacts you claiming that you owe it money, always check that it’s registered on the Financial Conduct Authority’s register; if it's not, then you should steer clear of it.

Reporting scams

If you receive a letter that you think might be from fraudsters, you can report it to Royal Mail.

Scam calls received on your iPhone can be reported by texting the word ‘call’ followed by the phone number to 7726. If you have an Android phone, text the word ‘call’ to 7726. You’ll then receive a message asking you for the scam number.

For scam calls received on WhatsApp, open the WhatsApp chat with the dodgy phone number and tap 'block'. You can report the contact by tapping 'report contact' and 'block'.

If you lose any money to a scam, call your bank immediately using the number on the back of your bank card. Also report it to Action Fraud, or call the police on 101 if you’re in Scotland.