I'm a scams expert and these are the scams that will be big in 2026

Fraudsters are experts at devising ways to make their schemes more persuasive, using technological advances and combining political, economic and cultural change to their advantage.

Each year in my work as a scams expert, I see variations of the same old tricks. But with further technological innovations, such as artificial intelligence (AI), and the introduction of new regulations that are designed to curb the volume of scams, we could see fraudsters pulling out all the stops to execute more complex scams in 2026.

Read on to see what could be in store for 2026 and how you can stay one step ahead of the scammers.

Long-winded job scams

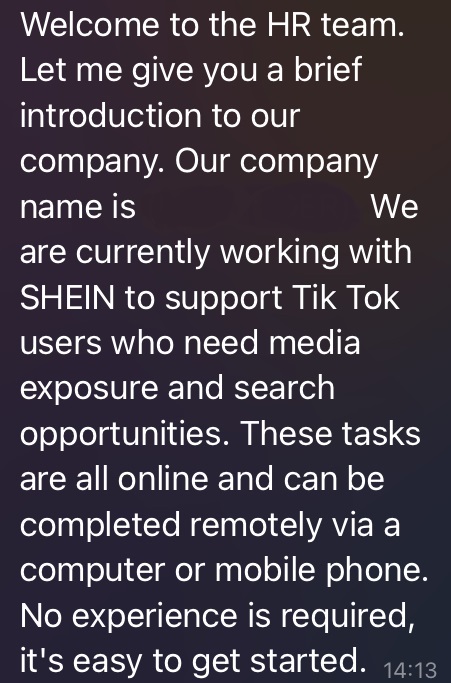

This year, we’ve seen a rise in task scams, where you’re asked to complete a simple task, such as liking posts on social media, in exchange for a fee.

Before that, we saw job scams where prospective employees were asked to pay for remote working equipment, only to never be reimbursed, or asked to present ID forms, such as passports, putting them at risk of identity theft.

As remote working continues and economic conditions make jobs with high returns for simple work attractive, we may see an increase in scam jobs that will have people actually 'working' for a long period of time before being defrauded.

Fraudulent jobs may recruit you under the guise of easy work-from-home roles, only to have you working for a fraudulent firm. This could go on for months with you none the wiser. At some point, you’ll be asked to invest money into the scheme for a made-up reason, which you’ll likely never see again.

AI influencers

Deepfake videos use AI to digitally alter footage, sometimes by blending real visuals with fake audio to make it appear as if the person in the video is saying something they never said. However, this is increasingly being used to create completely AI-generated videos featuring people, places and sounds that never existed.

Scammers will likely capitalise on the ease of AI text generators to create completely fictional financial and legal advisors, paired with deepfake footage to create persuasive professional personalities.

These advisors could become social media influencers, amassing large followings for their financial and legal advice, striving to build trust in their perceived expertise. This will lay the foundation to devise and promote scams that their followers will be more likely to trust, invest in and pay for.

Seen or been affected by a scam? Help us protect others

Sharing details of the scam helps us to protect others as well as inform our scams content, research and policy work. We will collect information relating to your experience of a scam, but we won't be able to identify your responses unless you choose to provide your contact details.

Share scam detailsSpear-phishing

Spear phishing is when fraudsters use any information they already have about you – such as your date of birth or place of work – to make scams targeting you much more effective.

This year, we’ve seen large-scale data breaches at popular retailers and brands, with fraudsters getting their hands on a lot of information, including emails and passwords for accounts at the brands they have targeted.

We’ll most likely continue to see data breaches like this, as hackers sharpen their methods to infiltrate systems. With these attacks, we could see more sophisticated spear-phishing attempts that include much more data about you.

Which? has previously warned about one-time passcode scams, where fraudsters used personal data to attempt to access people’s O2 accounts before calling them and conning them into revealing one-time passcodes.

Those convinced by the fraudsters to state their one-time passcodes unknowingly gave away full access to their accounts.

More data breaches will enable scammers to use the information gleaned from these break-ins to carry out more versions of this scam, attempting to access your accounts with some data on you, before tricking you into handing over the rest.

Number spoofing voice cloning

Almost every scam call you get will be the work of number spoofing. This is when scammers manipulate the real number they’re calling you from, usually to make it look like you’re being called from a more local, and therefore more trusted, number.

Phone networks recently agreed to roll out upgrades to prevent foreign callers from spoofing UK numbers. Sadly, scammers always adapt to changes and developments, and it's likely they will find loopholes. They may even ramp up efforts in voice cloning technology to make calls sound more official, convincing and trustworthy, so the number they appear to be calling from doesn't matter.

Fraudsters may clone the voices of professional figures, such as bank staff, HMRC employees and tech support staff, to appear legitimate. This is especially likely as AI content generators, including voice and vocal creators, become more accessible.

Age verification scams

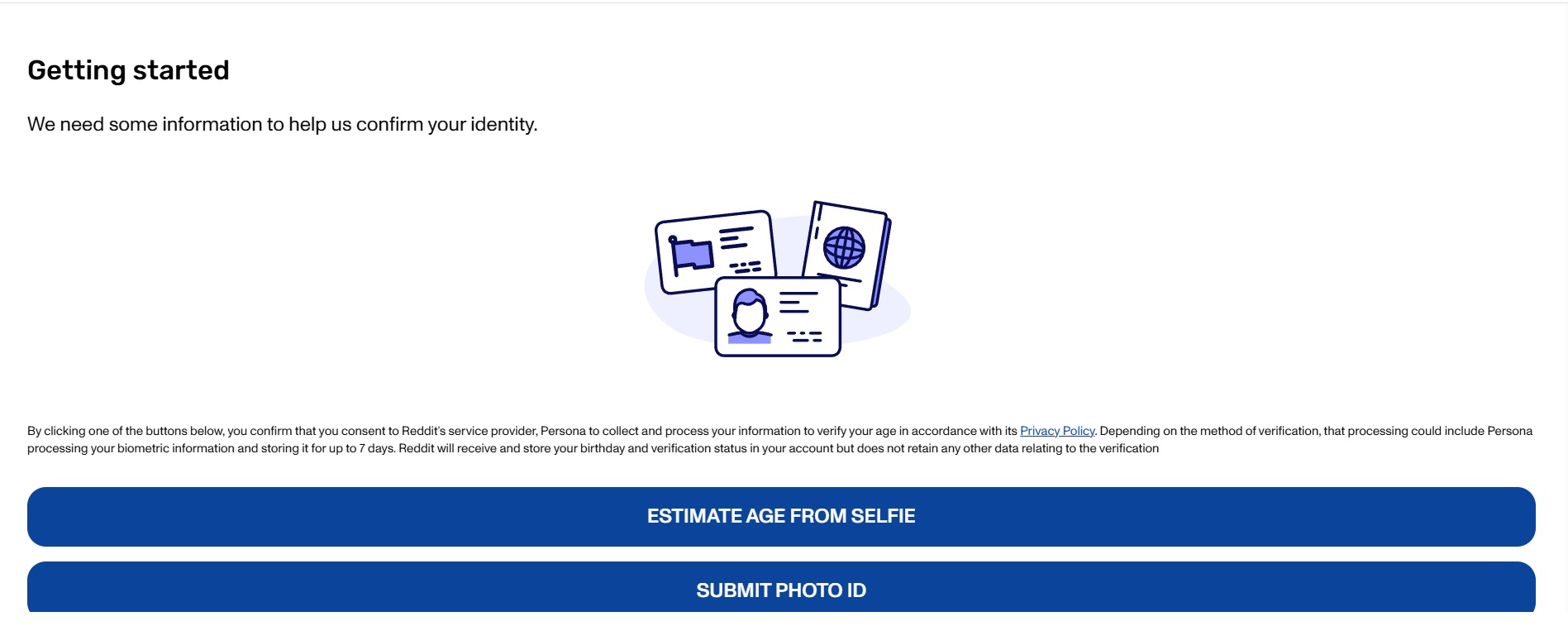

Under the Online Safety Act (OSA), new regulations for online content, tech platforms had to ensure that they had robust age verification systems in place this year.

In many cases, we saw companies asking users to verify their age by uploading images of themselves to third-party verification sites. Some users felt worried about handing over their biometric data to companies they had never heard of, which caused a surge in the use of virtual private networks (VPNs).

VPNs disguise your IP address, which is the geographical location you're accessing your device from, allowing you to circumvent verifying your age by making it appear as if you’re browsing from a country where the OSA doesn’t apply.

As companies continue to implement this legislation next year, scammers could capitalise on this communications opportunity and send texts and emails that lead to malicious websites, asking for your personal and biometric data to verify your age.

They may also create dodgy VPNs that access your browsing history and steal your personal information, such as your login details for various sites.

Stay ahead of the scammers

While scams evolve with the times, the methods for spotting and avoiding them often remain the same. Taking time to think before you act on any request for money or information is crucial in avoiding scams.

You can also take these steps to protect yourself from scams:

- Verify all unsolicited messages and calls with the company that they’re claiming to be from before proceeding.

- Don’t enter any personal information into websites you’ve clicked on from emails and texts without first verifying that the message is legitimate.

- Always be suspicious of offers which seem too good to be true. If you're tempted to buy from an online retailer you have never heard of, always research them and check a few review platforms before you part with any money.

- Check the Financial Conduct Authority’s (FCA) register to see if a firm is registered before making an investment and check the Solicitors Register to see if someone offering legal services is legit.

- Never pay your employer or put money into a system as instructed by them at any point in the employment process.

- Only trust age verification systems that you’re led to while on the platform that requires it, and read our guide on how to select a reputable VPN.

If you lose any money to a scam, call your bank immediately using the number on the back of your bank card and report it to Report Fraud (formerly known as Action Fraud) or call the police on 101 if you’re in Scotland.