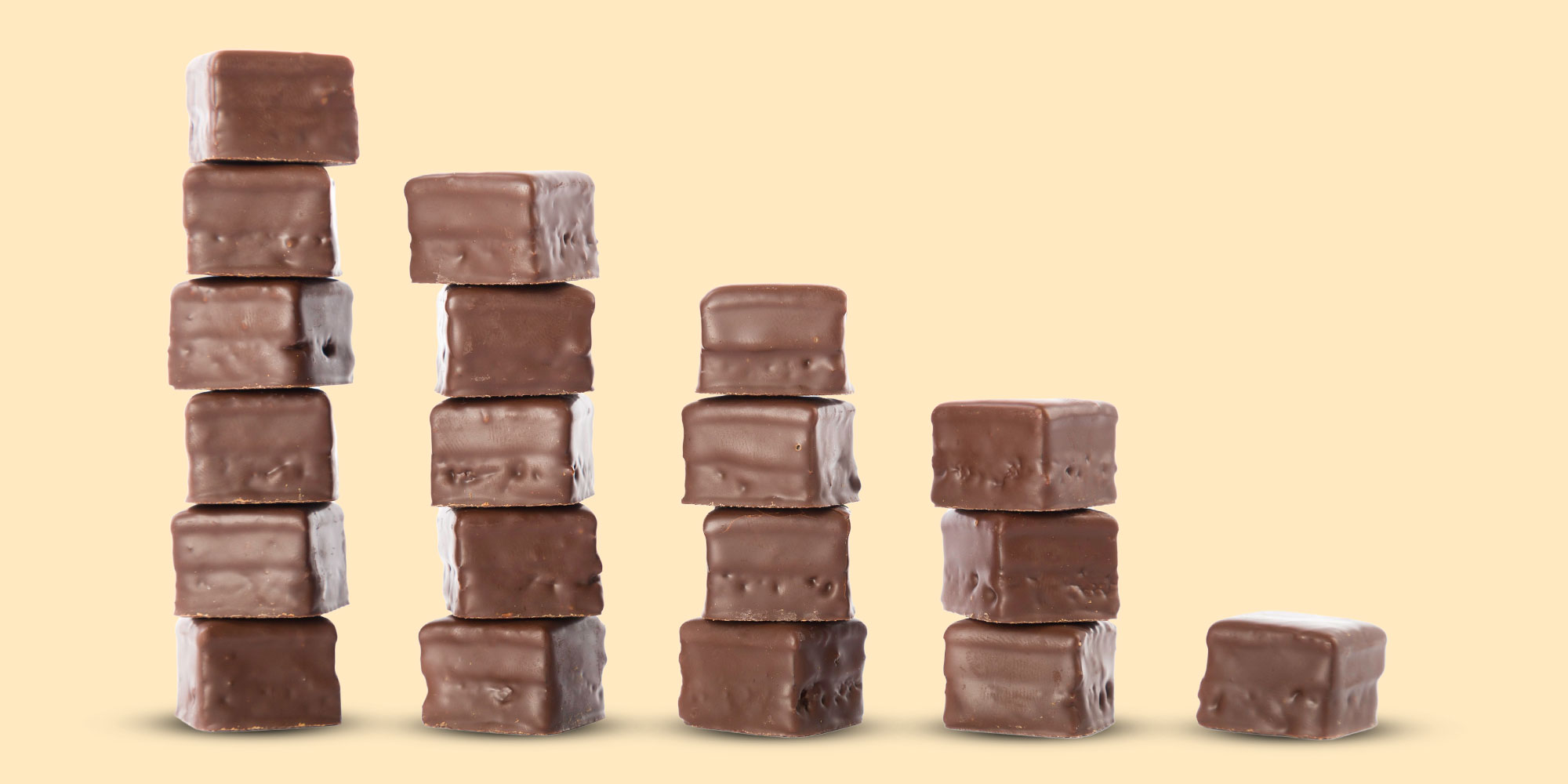

Shrinkflation: the brands charging you more for less

Are there fewer chocolates rattling around in your festive tub? Or less toothpaste in your tube? What about a flavoured coating instead of real chocolate on your favourite treat?

Shrinkflation and skimpflation, where the size or quality of products reduces without a drop in price, are two of the sneakiest ways we get hit by inflation.

Often, the changes are so subtle we don't even notice. But the percentage extra we pay can be pretty jaw-dropping.

Here Which? reveals the latest groceries to be hit by shrinkflation and skimpflation and explains what you can do to help keep your grocery bill down.

Which groceries have shrunk?

When inflation is high, manufacturers often look at the most expensive products or ingredients to cut.

This year, chocolate has seen soaring inflation, mainly due to global rises in the price of cocoa after poor harvests in West Africa, and many sweet treats are now shrinking in size.

And with Christmas not too far away, it’s bad news for fans of the traditional festive tubs of chocolates. Quality Street tubs have shrunk from 600g to 550g this year. Yet at Morrisons the price rose from £6 to £7 – that's a 27% rise per 100g.

Meanwhile, multipacks of Cadbury Dairy Milk Freddo chocolate bars – so often used as a tongue-in-cheek barometer of inflation – have been cut this year from five frogs to four. At Tesco, Morrisons and Ocado, the price stayed the same.

Packs of Cadbury Fudge bars have shrunk from five bars to four. But at Tesco, Morrisons and Ocado, the price didn’t change – making it a 25% rise per finger of fudge.

Those hoping a Nestlé Kit Kat might help them take a break from inflation will also be disappointed. Multipacks of the Kit Kat two-finger milk chocolate bar shrank from 21 bars to 18 bars. At Ocado, the price soared from £3.60 to £5.50 – a jump of 53%, meaning each Kit Kat had gone up from 17p to 31p.

And while the Terry’s Chocolate Orange Ball Toffee Crunch price of £2 has not changed, the size has gone down from 152g to 145g at Tesco – a 5% increase.

- Find out more: which is the cheapest supermarket?

Other examples of shrinkflation

And it’s not just chocolate. We’ve heard of shrinkflation in everything from chicken to crumpets and cleaning products.

Aquafresh Complete Care Original Toothpaste shrank from 100ml to 75ml earlier this year. The price went up at most supermarkets from £1.30 to £2 – a rise of 105% per 100ml.

Gaviscon Liquid Aniseed for heartburn and indigestion also shrank, from 600ml to 500ml. At Sainsbury’s, the price stayed at £14. That’s a 20% rise.

We also found Sainsbury's Scottish Oats have shrunk from 1kg to 500g, while the price increased from £1.25 to £2.10 – a whopping 236% rise per 100g.

And it gets worse for those who like a cup of coffee with their porridge. Which? found Nescafé Original Instant Coffee had shrunk from 200g to 190g at Tesco, Morrisons and Asda – a rise of 5% per 100g.

What about skimpflation?

As well as products getting smaller, we also received reports of some of the nation’s favourite treats missing key ingredients as manufacturers find ways to cut costs.

A reduced amount of cocoa butter (less than 20%) in White Kit Kats means they can no longer be marketed as a white chocolate product.

Similar issues were found with McVitie’s favourites, including Penguin and Club bars, that can no longer be lawfully sold as a chocolate biscuit because they contain more palm oil and shea oil than cocoa.

And McVitie’s White Digestives do not contain any cocoa butter at all, and so can also not be marketed as a white chocolate biscuit.

What's happening to food inflation?

Our Which? supermarket food and drink inflation tracker shows overall grocery inflation rose by 5.2% in the year to August 2025.

The latest rises come after years of soaring prices. Chocolate has seen particularly high inflation – 14.6% in the year to August 2025, which was the highest across all the food and drink categories we looked at.

Biscuits have also seen some of the highest inflation, at 8.4%. And cakes and cookies were close behind, at 7.2%. But some individual products saw much higher inflation.

- Find out more: Which? food price inflation tracker

How to spend less at the supermarket

Shrinkflation is notoriously hard to spot. Unless you have a forensic memory for size and weights, it’s hard to be sure if anything has changed.

But there are things you can do. One good tip is to be suspicious of anything labelled ‘new’. ‘This can mean a new size or a new formulation, but it's sadly unlikely to mean better value. If you shop online, often the product listing will have changed and may have dropped out of your favourites list.

You can also keep an eye on the unit price (the price per 100g or 100ml) to see if anything has changed.

Which? believes that any changes, whether to the size of a product or to the recipe, should be clear so that consumers can make an informed choice about whether a product is right for them or if they should seek an alternative.

Reena Sewraz, Which? Retail Editor, said: 'Households are already under immense financial pressure with food bills inching up and the expense of Christmas looming on the horizon, so it can feel especially sneaky when manufacturers quietly reduce pack sizes or downgrade key ingredients.

'Supermarkets must be more upfront about their prices so that it’s easy to see what the best value is. This includes ensuring that their unit pricing is prominent, legible and consistent in-store and online to help customers easily compare costs across different brands and sizes of packaging – that way shoppers can be more confident they’re getting the best value.'

- Find out more: how to spend less at the supermarket

What does the food industry say?

Mondelez International (which makes Cadbury products) said: 'We understand the economic pressures that consumers continue to face, and any changes to our product sizes is a last resort for our business.

'However, as a food producer, we are continuing to experience significantly higher input costs across our supply chain, with ingredients such as cocoa and dairy, which are widely used in our products, costing far more than they have done previously. Meanwhile, other costs, like energy and transport, also remain high. This means that our products continue to be much more expensive to make, and while we have absorbed these costs where possible, we still face considerable challenges.

'As a result of this difficult environment, we have had to make the decision to slightly reduce the weight of our Cadbury Fudge and Cadbury Dairy Milk Freddo multipacks so that we can continue to provide consumers with the brands they love, without compromising on the great taste and quality they expect.'

A spokesman for Nestlé said: 'Like every manufacturer, we have seen significant increases in the cost of coffee, making it much more expensive to manufacture our products. As always, we continue to be more efficient and absorb increasing costs where possible. To maintain the same high quality and delicious taste that consumers know and love, it has sometimes been necessary to make adjustments to the weight or size of some of our products. Retail pricing is always at the discretion of individual retailers.'

In relation to the Kit Kat recipe it added it regularly reviewed recipes to balance quality, affordability and sustainability, adding significant increases in the cost of cocoa over the past few years had made its manufacturing much more expensive.

A spokesperson for the Food & Drink Federation said: 'Cocoa prices rose sharply last year, reaching a 45-year high. Alongside other rising costs – such as national insurance increases and a new packaging tax – manufacturers are paying nearly 40% more for ingredients and energy than they were in January 2020.

'As a result, in some cases food manufacturers will have had to make changes to products to continue offering shoppers the food and drink they love at reasonable price points.'