By clicking a retailer link you consent to third-party cookies that track your onward journey. This enables W? to receive an affiliate commission if you make a purchase, which supports our mission to be the UK's consumer champion.

5 budgeting apps to help you save money in 2019

Today (13 January) marks the one year anniversary of Open Banking, an initiative introduced to help make managing our financial lives easier. But how much have things changed?

The Competitions and Markets Authority (CMA) forced the nine largest banks (Allied Irish Bank, Bank of Ireland, Barclays, Danske, HSBC, Lloyds Banking Group, Nationwide, RBS Group, Santander) to open up their data by 13th January 2018.

This was so that approved third parties, such as budgeting and savings apps, could access this data, in a secure and standardised way, to help you manage your finances better.

Despite having to grant an extension to six of the nine big banks, the Open Banking rollout was completed by 17 April 2018.

Here, take a look at how far Open Banking has come and round up the best budgeting apps that could help you save money.

Five budgeting apps to try in 2019

If you want help taking control of your finances in 2019, the following apps let you view all of your income, outgoings and spending habits in one place to identify the best ways to save.

The apps mentioned are registered with the FCA. Most are already on the Open Banking directoryand others plan to join in the future.

We've highlighted the unique selling point (USP), fee charges and operating systems (OS) of each one, to help you see if they're right for you.

- Find out more:Open Banking: sharing your financial data

Money Dashboard

- USP: See all of your accounts in one place

- Fee: Free

- OS: Android, iOS, Web

Edinburgh-based app, Money Dashboard, lets you view all of your accounts and assets in one place. This includes current accounts, savings accounts and credit cards. It allows you to analyse your incomeand outgoings to see where your money is being spent and understand how much progress you've made towards your goals.

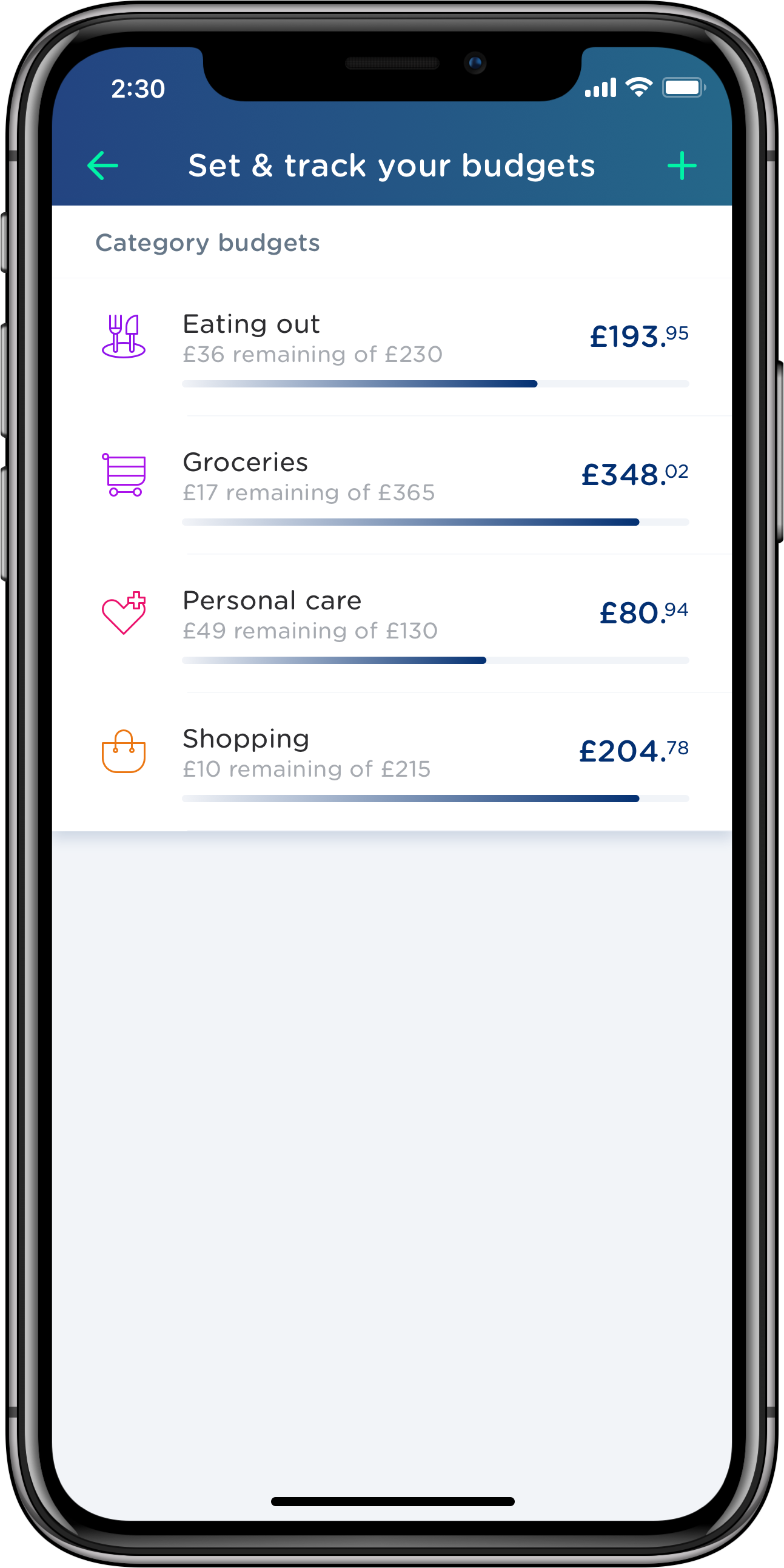

Each month, you can use the budget planner feature to set your limits, based on your previous months' spending.

The platform currently supports 60 financial providers including major high-street banks like Lloyds, HSBC, Halifax and Santander.

Money Dashboard is free to use and available for download on Android, iOS and desktop.

2) Moneyhub

- USP:Get professional advice over the phone

- Fee: Monthly: £0.99, Annual: £9.99 (Android users) or £14.99 (Apple users)

- OS: Android, iOS, Web

Similarto Money Dashboard, Moneyhub brings all of your financial accounts together in one place including bank accounts, credit cards, savings and borrowings. It also allows you to add investment funds too.

The app lets you set spending goals and analyses your purchasing habits to help you see where your money goes. If you have any regular payments or subscriptions, for example, a monthly direct debit for home insurance, Moneyhub will send you an alert if there are any better deals available on the market.

One of Moneyhub's standout features is the 'Find Adviser' option which puts you in touch with professional advisers over the phone. If you consent, MoneyHub will automatically share allof the data you've connected to the app with them too.

Moneyhub is a subscription service and you can choose to pay a monthly fee of £0.99 or an annual fee of £9.99 (£14.99 from the App Store).

3) Squirrel

- USP:Helping you stretch to payday

- Fee: Free for 8 weeks, £9.99 a month thereafter

- OS: Android, iOS, Web

If you struggle to make your money stretch to payday, app-based budgeting account, Squirrel, could be for you.

Squirrel separates your bill money from your spending money, so you can budget effectively and set clear savings goals.

All you have to do is add your monthly expenses and savings goals and using this information, the app will release the money you need for bills when they're due as well as spending money for the week.

You can sign up for a free 8 week trial of Squirrel but after that, you'll have to pay a monthly subscription of £9.99.

4) Yolt

- USP:Helping you get a better deal

- Fee: Free

- OS: Android, iOS, Web

Yolt allows you to view your current account, savings accounts and credit cards in one place. It sends you insights into your spending habits and identifies what your major expenses are.

You can manage your bills and subscriptions through the app and it also offers a comparisonservice to help you find a better deal.

5) Bud and First Direct

- USP:Budgeting with a high street bank

- Fee:Free

- OS: iOS

Bud is an ambitious financial services platform that connects your accounts and credit cards.

It also allows you to add rewards schemes, investment funds, insurance policies, currency exchange services and a digital mortgage broker.

The company announced it was partnering with First Direct to produce a financial management app. Around 2,000 First Direct customers participated in the initial trial from December through to mid-2018.

Open Banking: where are we now?

The way we bank and manage our finances is becoming increasingly digital. Around 4.5 million people are estimated to already have a digital-only bank and 8.5 million intend to get one over the next five years, according to new data from Finder.

Open Banking was introduced by the CMA to help make the traditional banking ecosystem become more agile and convenient for us to use.

Under the new rules, banks have to make your financial data available to approved third parties in a standardised format (known as an 'open API') - but must get your permission before sharing.

Apps that want to access your data through an Open Banking API must be registered with the Financial Conduct Authority (FCA) and join the Open Banking Directory.

You can use Open Banking for payment accounts that you access online or by mobile, such as personal current accounts, business current accounts and credit cards.

As of now, all of the big nine UK banks have signed up to Open Banking.

Interestingly, some smaller challenger banks have also taken up the new initiative - even though they weren't required to by the regulator.

Starling Bank and Monzo Bank, which only received their banking licenses in 2016 and 2017 respectively, have made API's available for authorised companies to use.

Overall there are 100 regulated Open Banking providers; made up of third-party providers like apps and account providers like banks. This number is set to increase as time goes on which, in theory, should make accessing relevant financial products easier for us in the long term.

- Find out more: Open Banking launches: what's it all about

Open Banking vs screen-scraping

'Screen-scraping' is a process of handing over your bank login details to an app so it can access your transactional data directly from your account.

A few money apps like Plum and even budgeting apps like HSBC Connected, use this technique to help you save cash.

This process could open you up to liability if any of your money goes missing and may even violate your bank's terms of service. Banks are not obliged to return any money if you've given a third party provider your login details either.

One key benefit of Open Banking is that you'll be able to let apps access your data without actually having to hand over your login details to anyone.

Sharing APIs is much more secure than screen-scraping because you know exactly what information is being shared with each company and can revoke access easily.

Screen-scraping is being phased out and should eventually be banned under regulations coming into force from September 2019.

If you decide to use a third-party app that uses screen-scrapers instead of API's it's really important that you trust them to have access to your accounts.

For more information, check out our guide on Open Banking.