By clicking a retailer link you consent to third-party cookies that track your onward journey. This enables W? to receive an affiliate commission if you make a purchase, which supports our mission to be the UK's consumer champion.

Six banking app features that can help you keep on top of your bills and subscriptions

With rising living costs proving a concern for many households, turning to technology to take care of your essential household bills could help to reduce the stress of stretching your budget.

As well as checking in with our 17 ways to save money on your household bills, innovation from banks and clever finance apps means there are lots of things you can do to prevent your spending from getting out of control.

Here, Which? reveals six banking and finance features and apps that offer clever ways that make sure no household bills come as a nasty surprise.

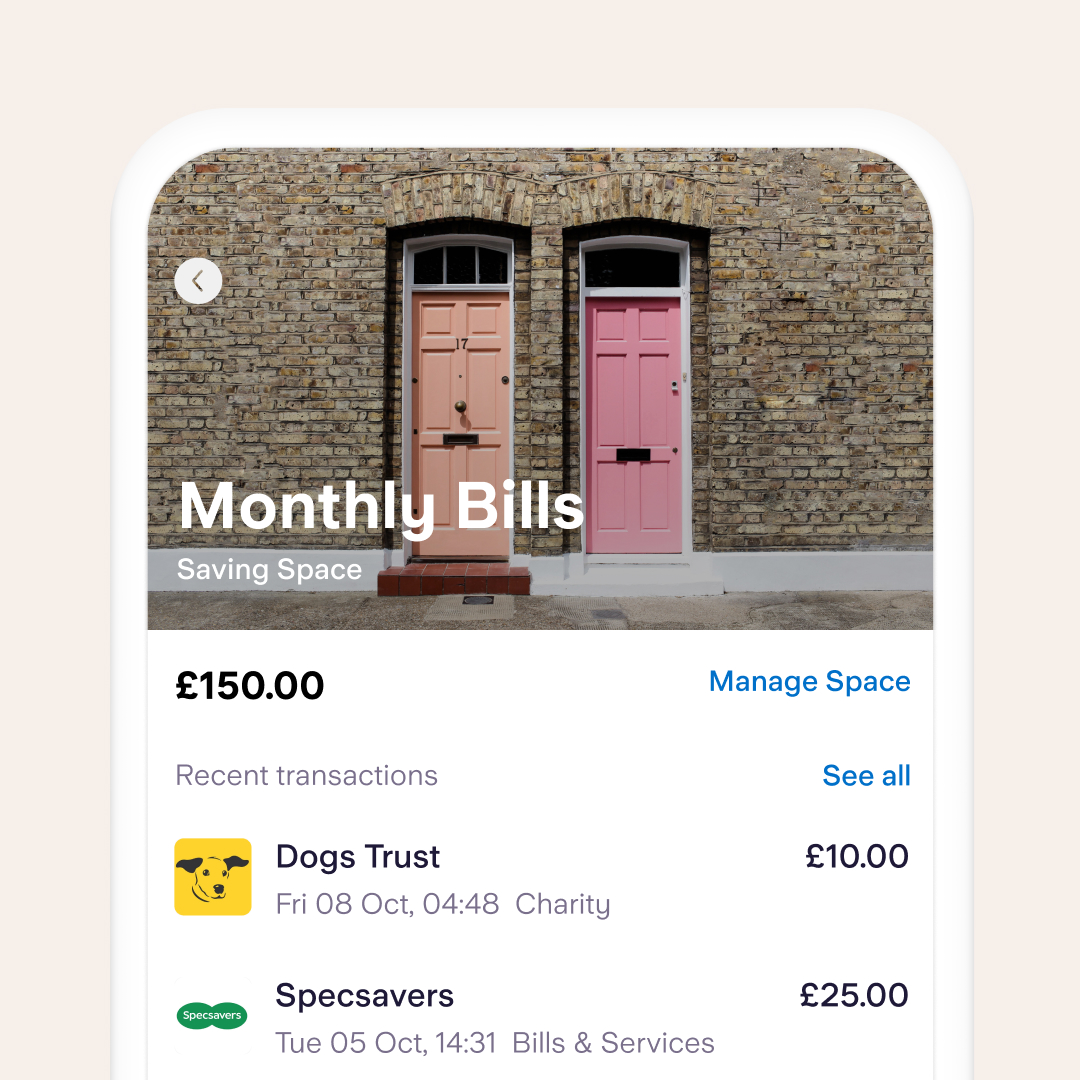

1. Starling Bank's Bills Manager

Starling Bank launched its Bills Manager feature at the beginning of this month; 'one of the most requested' features from the bank's existing customers.

Bills Manager is free to use, available to all personal and joint current account holders, and aims to make it easier to manage your money by matching specific bills against savings you've allotted to pay it.

For this, bills are paid from the 'savings space', rather than the main account balance. Previously, the savings space was used to siphon money off from the main balance to save towards specific goals, but now you can select the option to 'pay bills from this space' as well. It's possible to set up several savings spaces, and then choose which direct debits or standing orders you'd like to pay from each one.

You'll also receive a notification when the bill has been paid.

However, you'll need to make sure there's enough money in the chosen savings space to cover the bill. If the balance doesn't cover the outgoing, Starling says it will send three notifications the day before the payment is due, and then another two on the payment due date. If the funds aren't topped up, the bill will not be paid. This could result in you having a default payment, which will be recorded on your credit report and may reduce your credit score.

- Find out more:credit reports - all you need to know

2. Pay from Monzo Pots

It's also possible to pay bills from your savings pots with Monzo. The balance in your main account can be kept for other spending, and direct debits and standing orders can be set up directly from a pot. You just need to select the option to 'pay from this pot' and pick which payment you'd like to make. You'll need to have set up the direct debit or standing order beforehand.

If you have Monzo Plus, Monzo's packaged current account which costs £5 a month, you can also link your virtual cards to a savings pot to pay for online subscriptions. The virtual cards can be beneficial for security as well as ease, as you won't run the risk of messing up any subscriptions should you lose your main payment card.

These payment features can be combined with Monzo's salary sorter feature. This divvies up your salary as soon as it arrives in your account, so it's automatically split into spending money, savings and bills. You can choose to sort any amount over £100.

- Find out more:Monzo Plus - is it any good?

3. Revolut's Pockets feature

Revolut's Pockets feature is where you can set aside money for your bills, and where all bills are automatically paid from.

You can also see an overview of all of the bills you're signed up to pay, including what the bill is for, how much it is, and when it's due to be taken from your account.

Pockets is separate from other spending or savings sections, so you don't need to worry about overspending or dipping into your savings.

Revolut also has a 'Subscriptions' feature, which allows you to block any outdated payments that are still due to be taken from your account.

4. Snoop's bill checker

Snoop is a finance app that uses open banking technology to link your chosen accounts all in one place.

As well as giving you an overview of your spending, the app has a particular focus on bills, as it scours the market to see whether you're paying over the odds. It provides online comparisons for things like broadband, mobile and energy bills, and suggests cheaper deals you can compare.

Snoop also has a relationship with third-party companies that provide mortgages, home and car insurance, and gadget insurance, which could help you find a cheaper deal. Bear in mind that we usually advise checking more than one comparison site before going ahead with these kinds of purchases, as well as checking directly with companies that don't appear on these sites.

- Find out more:best budgeting apps

5. HSBC's Balance After Bills calculator

HSBC also offers an easy way to keep your budgeting on track.

It calculates the total amount that's due to leave your account from any standing orders or direct debits you've got set up, and leaves you with the remaining balance until your next payday. This updates throughout the month, so you can see how many bills have already been paid, and how many are still to come.

In its mobile banking app, simply go to the current account you want to use (it must already have at least one direct debit set up), go to 'account features', and select 'Balance After Bills'. You'll be shown an overview of how the feature works, and if you want to go ahead, you can select 'Activate Balance After Bills'.

The Balance After Bills cycle is automatically set to the first of the month, but this can be changed to coincide with whenever you get paid.

- Find out more:best bank accounts

6. See bills from all accounts with Money Dashboard

If you have a more complicated financial set-up and pay bills from several accounts - for instance, paying some shared bills from a joint account, and others from a separate personal account - Money Dashboard's open banking technology means you can see a complete overview of all bill spending in one place.

These bills are split into 'upcoming' and 'paid' lists, so you can see how many are left for the month. However, it's up to you to make sure you have enough balance left in each account to pay them.

- Find out more:how to save on your household bills this winter