Make money make sense

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

Two fake Halifax websites have been shut down this week – after being reported by Which? – but we're warning customers to be on high alert for texts, emails and calls claiming to be from the bank.

An uptick in online searches related to 'Halifax text scams' prompted us to do a little digging and we spotted two copycat websites within hours, both clearly aimed at tricking Halifax customers into sharing their online banking details.

No business is immune to fraud, so scammers may impersonate any bank, but it's common for certain banks to be hit harder than others at different times.

Here, we show you recent examples of Halifax bank scams and explain how to report phishing to protect others.

Our emails will alert you to scams doing the rounds, and provide practical advice to keep you one step ahead of fraudsters.

Sign up for scam alerts

Some of the most convincing scams feature domains (the unique, easy to remember 'address' for a website on the internet, such as which.co.uk) that seem connected to genuine companies.

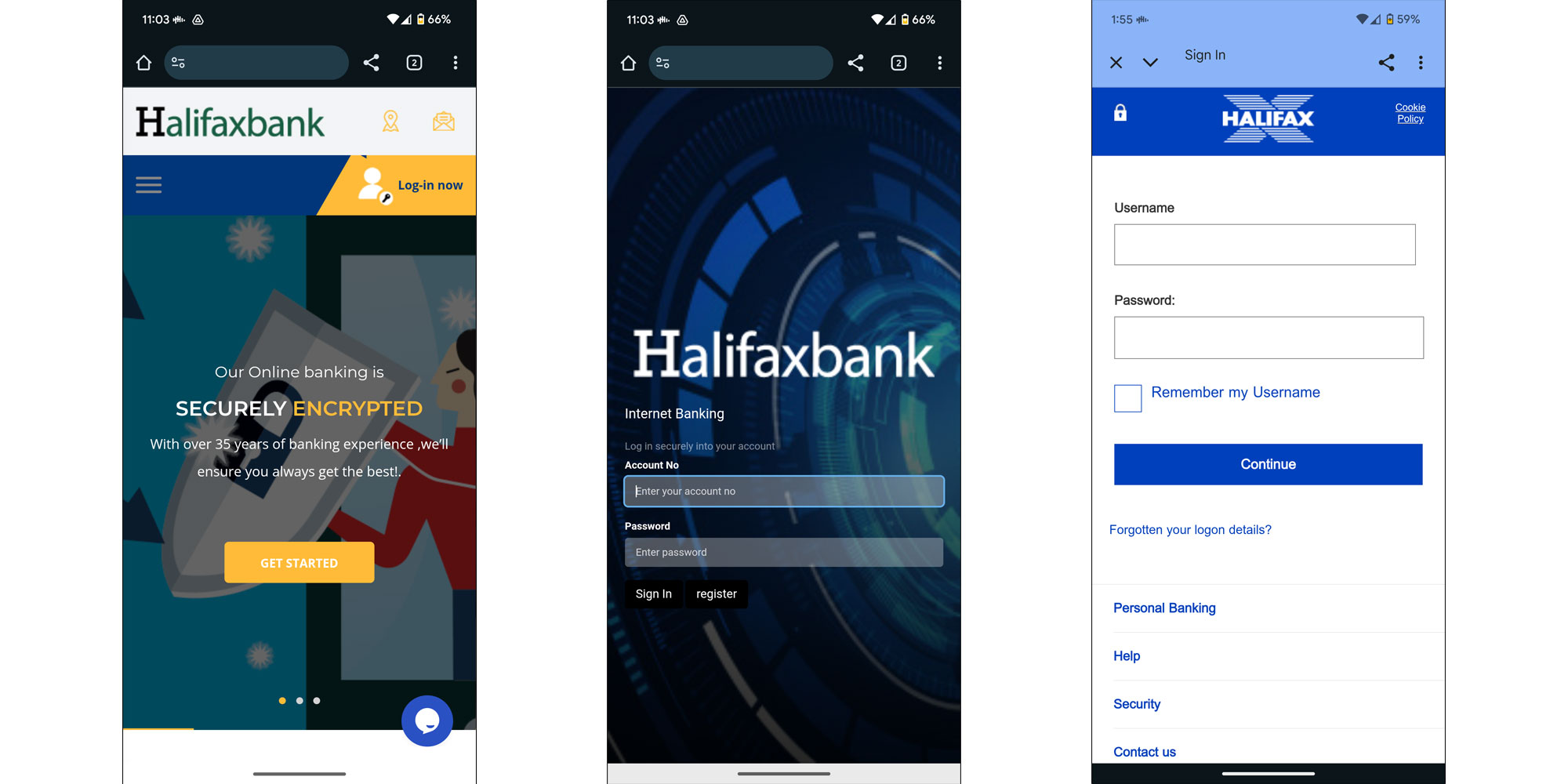

We searched for likely permutations until we found one that was clearly aimed at impersonating Halifax, as it referred to 'halifaxbankuk' (the real Halifax online banking domain is halifax-online.co.uk). We found another fake website that was still live thanks to a report sent to our Scam Sharer Tool, which used Halifax branding in an attempt to steal login details, as you can see from the screenshot below.

We immediately reported these to Halifax and both were taken down later that same day.

Which? also regularly shares details of suspicious websites reported to us with the National Cyber Security Centre (NCSC), helping to get many more shut down.

Other examples of Halifax phishing attempts shared with us in recent weeks include:

Halifax told Which?: 'Protecting our customers from fraud is our priority, and we actively search for fake websites which try to impersonate our brands. We have taken the appropriate steps to have these websites removed, however this also requires prompt action from the registrar hosting the domain itself. Fraudsters relentlessly target the customers of large companies, which shows why it is vital that tech firms do more to crack down on the criminals using their platforms to impersonate major brands.'

Your best defence against any fake you might come across is time, so don't rush or panic when you're contacted by someone claiming to be from your bank or any other business – take a minute before you act.

The safest thing to do is contact that business using a trusted source (such as the number on the back of your debit card or on its official website) to ensure the message or phone call was genuine. Barclays, Monzo and Starling even let customers quickly confirm if a call is genuine via their apps.

You can also make some checks yourself.

Remember that you can't always trust the phone number or sender ID displayed on your phone when you receive a call or text message, as these can be spoofed. But, if a message is directing you to click a link, does the web address look right? Is that the usual email address your bank uses?

You can also discover information about a website, including details of the registrar and the date it was created, using a tool such as ICANN.

If a website was only recently created, it doesn't belong to your bank.

Make every penny count with expert, impartial advice for just £49 a year – plus, get a £10 M&S voucher.

Join Which? MoneyJoin by midnight on 15 February 2026 and receive a £10 M&S gift card.

Banks and the registrars who inadvertently sell domains to scammers must work together to remove malicious websites quickly, to limit the damage and spread.

You can do your bit too.

If you come across a suspicious website, report this to the National Cyber Security Centre (NCSC). Google also offers a 'Safe Browsing' tool in a bid to remove malicious content from its search results.

You can forward suspicious emails to the NCSC at report@phishing.gov.uk and flag fake messages as 'phishing' to your email provider to help stop scams in their tracks.

For fake text messages, forward the text to 7726 so that your network can investigate the message and block the sender.