By clicking a retailer link you consent to third-party cookies that track your onward journey. This enables W? to receive an affiliate commission if you make a purchase, which supports our mission to be the UK's consumer champion.

Online banking outages: as NatWest's site goes down, how stable is your bank?

NatWest and RBS customers have been left stranded today, as the banks' websites went offline for at least six hours. The sites were still down at time of publication.

Website outage monitor Downdetector began receiving reports from users at 9:25am, suggesting the problem began around this time at the very latest.

This comes after Barclays topped a BBC list of banks with the most IT outages, with NatWest coming second and RBS coming fourth.

Read on to find out how many IT failures and security breaches your bank has suffered.

What happened with the NatWest website?

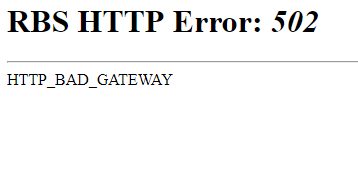

The websites for NatWest and RBS - both part of the RBS Group - have been showing a 502 Bad Gateway error today, which signals a general server problem.

This has shut down both sites completely, rendering them inaccessible to millions of customers.

NatWest did not respond to a request for comment, but both banks tweeted that the mobile app and online banking services were still available. Indeed, the banks each have separate online banking websites that are still accessible.

Which bank is the worst for IT glitches?

NatWest and RBS customers are by no means the only customers to experience outages like this.

Since 2018, all banks have been required to report major operational and security incidents that affect current account usage to the Financial Conduct Authority (FCA) and publish the data online.

BBC analysis of this data found Barclays to be the worst bank for breaches and outages. The bank suffered 33 glitches between 1 July 2018 and 30 June 2019. Which?'s own analysis of the data confirms this result.

We've compiled all the publicly available outage data from UK banks in the table below.

With 336 outages over the course of a year, that works out as almost one per day on average.

Nearly every single UK current account provider suffered at least one major IT or security glitch during this period.

The only exception was challenger bank Starling, which had no reported incidents.

In March, Which? carried out analysis of the same data for between April and December 2018. Barclays topped that table also, and Starling again reported no incidents.

Virgin Money, too, had no reported incidents during that period. But this time it reported five.

- Find out more:UK banks hit by major IT glitches every day

What does this mean for the cashless society?

When online banking is unavailable, cash might be your only backup.

Unfortunately, these glitches, along with major incidents like the Visa payment outage last year, paint a picture of a financial system that's not ready to support a fully cashless society.

The independent Access to Cash review found that 25 million people would struggle if they couldn't make cash payments. The report warned that we could be 'sleepwalking' into a cashless society that would pose huge risks.

Despite this, Which? research found that at least 3,318 UK bank branches have been shut down since 2015.

High street ATMs are also closing at an alarming rate, with some 3,000 disappearing in the last six months of 2018.

ATMs are getting more expensive, too. We found that 1,250 formerly free ATMs started charging fees in March alone.

- Find out more:is your local bank closing?

Which? wants Freedom to Pay. Our way.

As the country embraces digital payments, Which? is campaigning to protect access to cash as a payment option.

In May, the government appointed a committee to oversee cash after more than a year of Which? campaigning.

While Which? welcomed the appointment, we urged the new body to address rapid changes to the cash landscape urgently.

You can sign our petition to support our 'Freedom to Pay. Our Way' campaign.